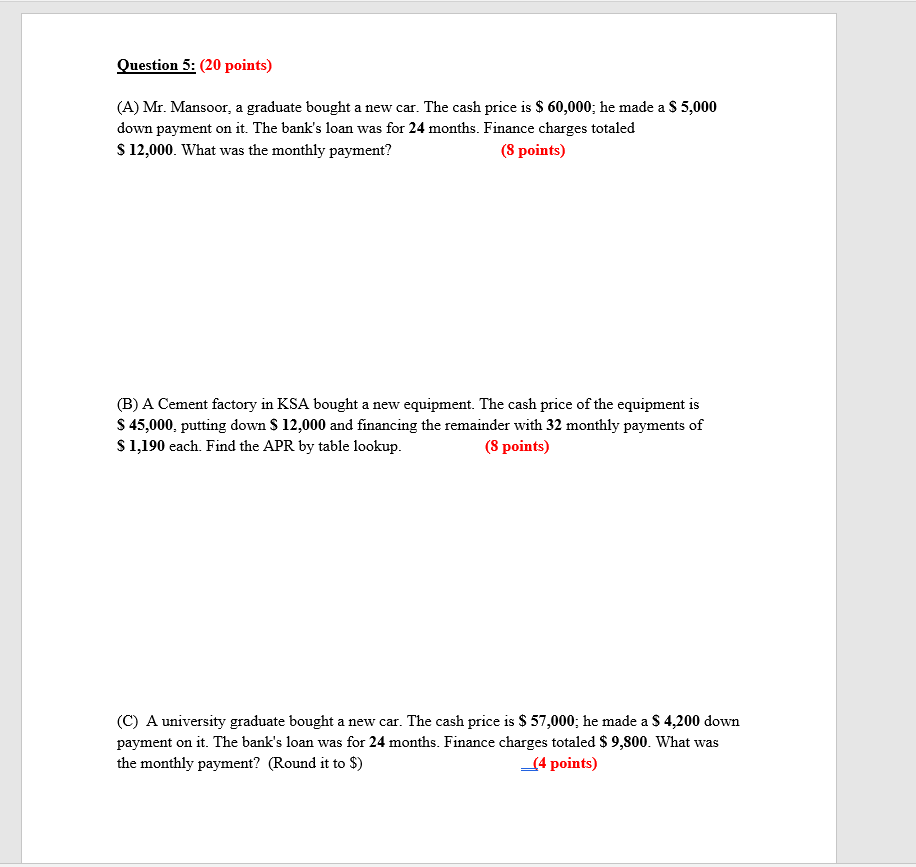

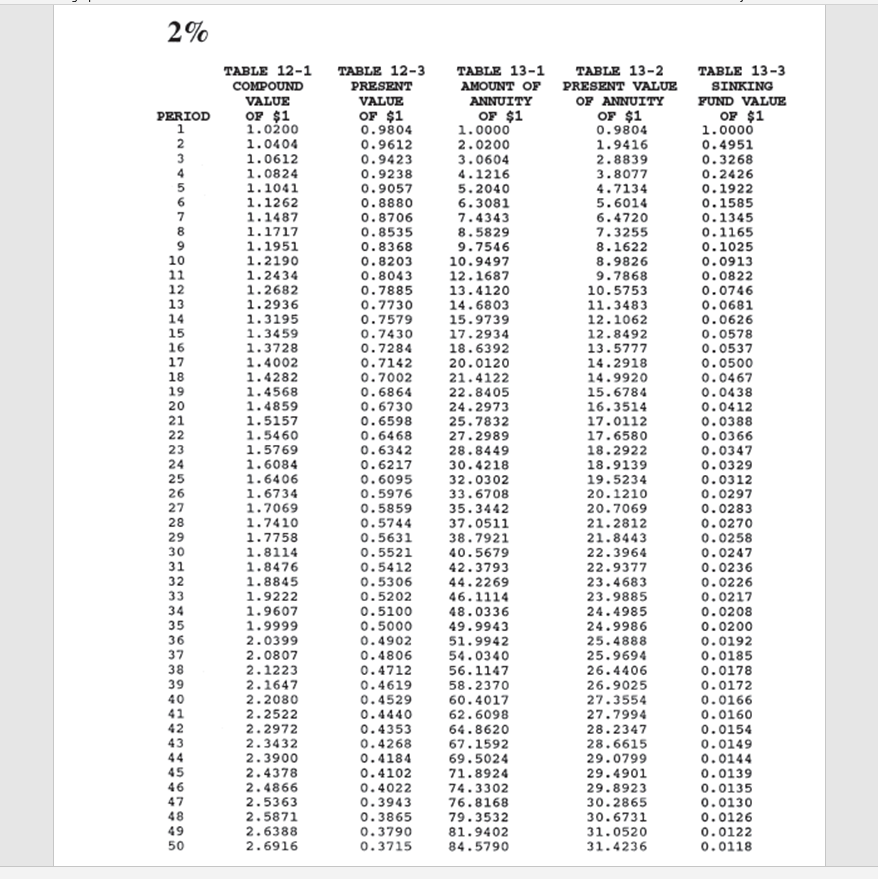

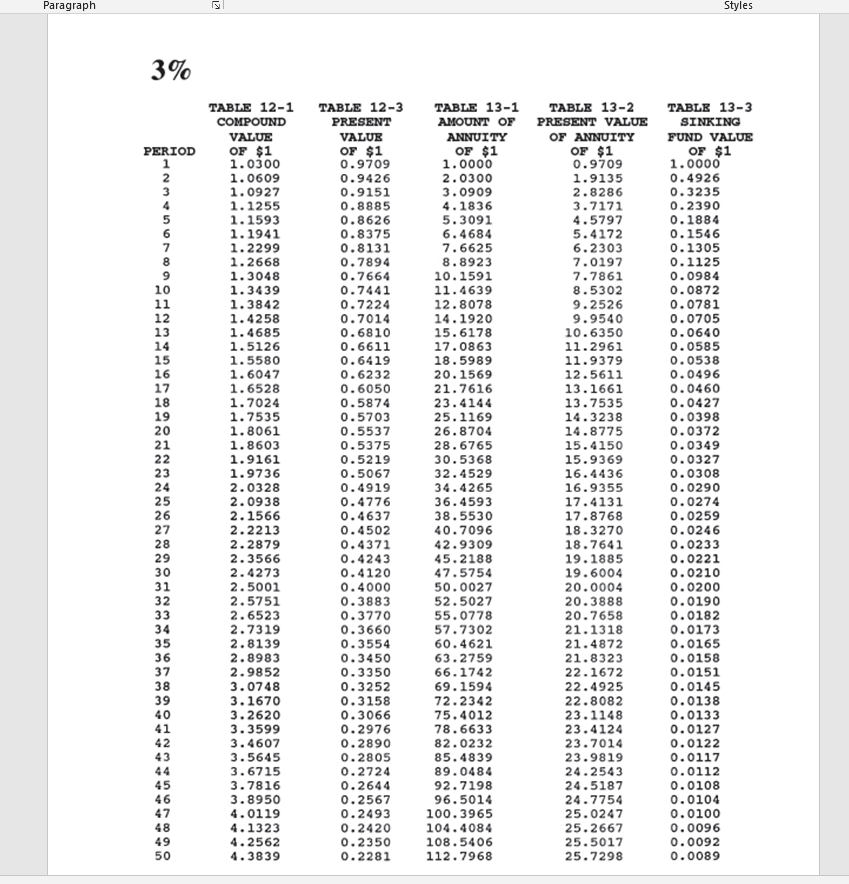

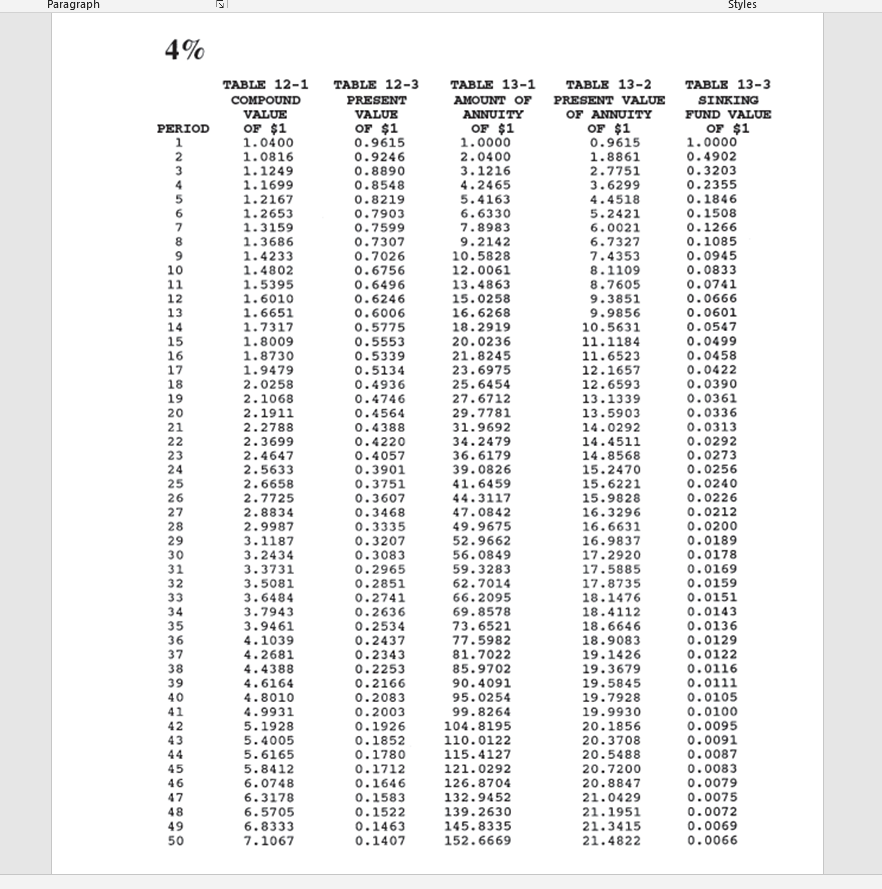

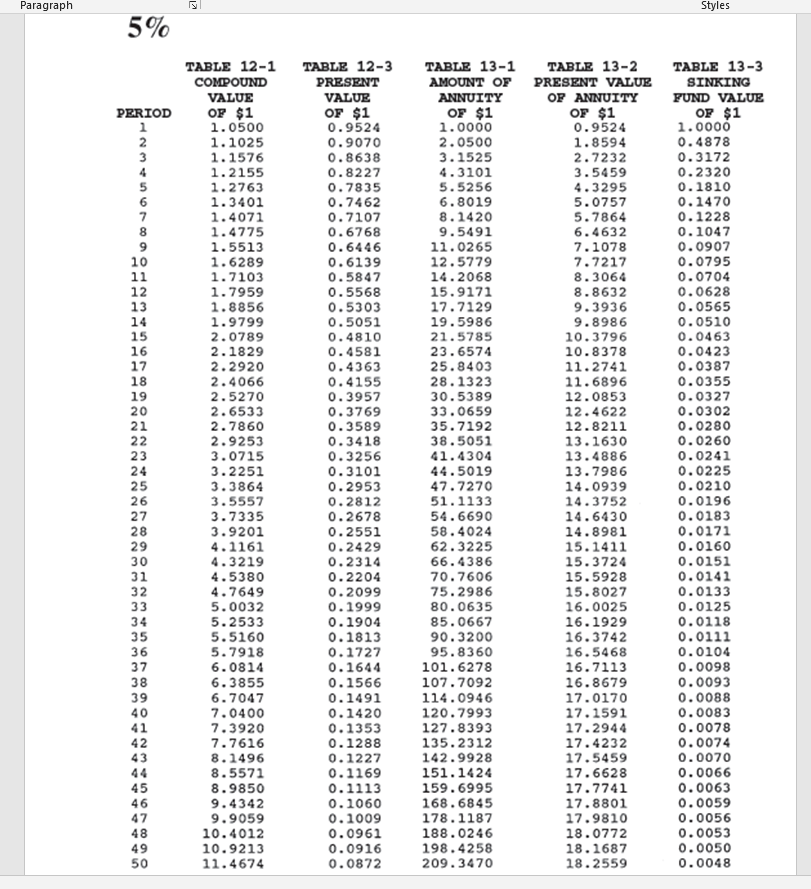

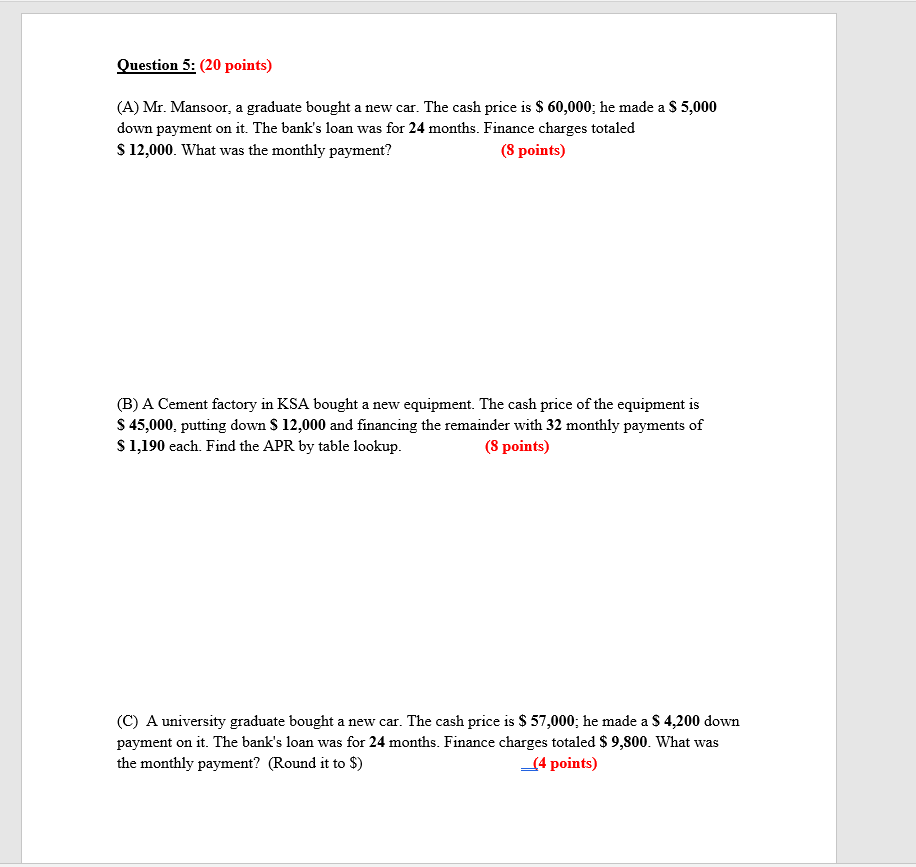

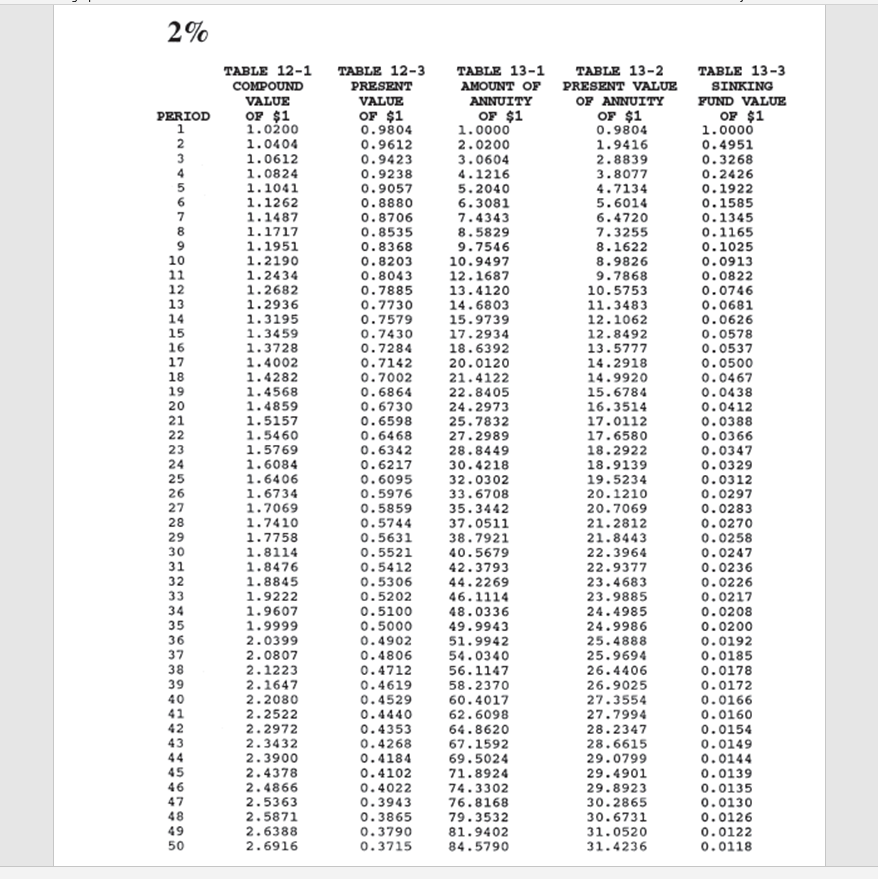

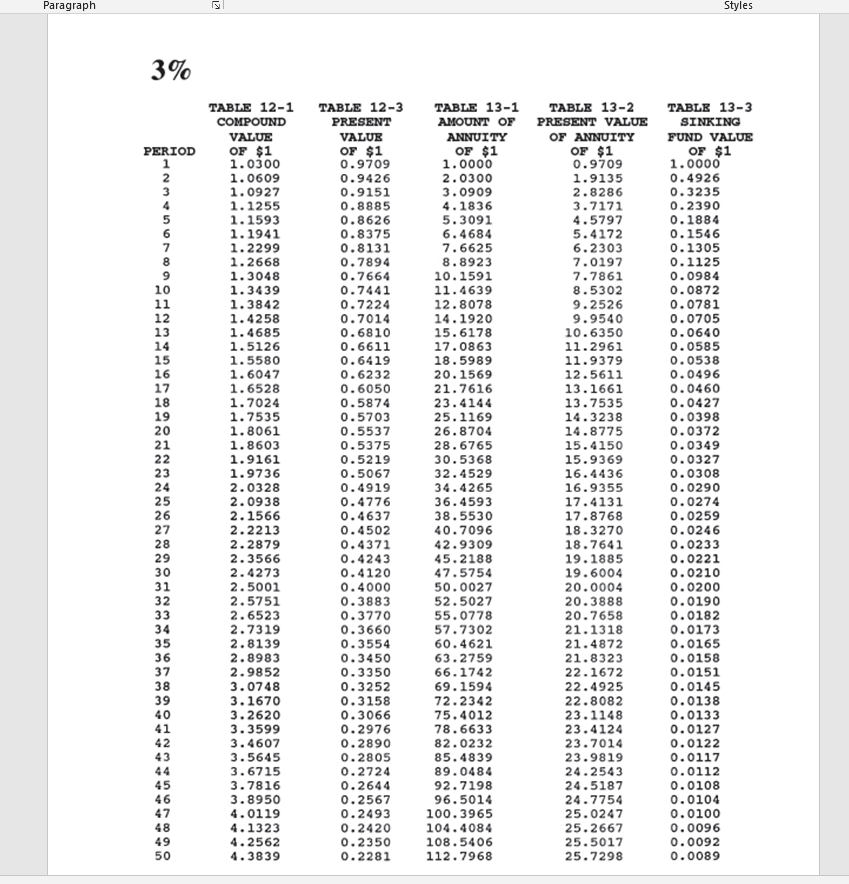

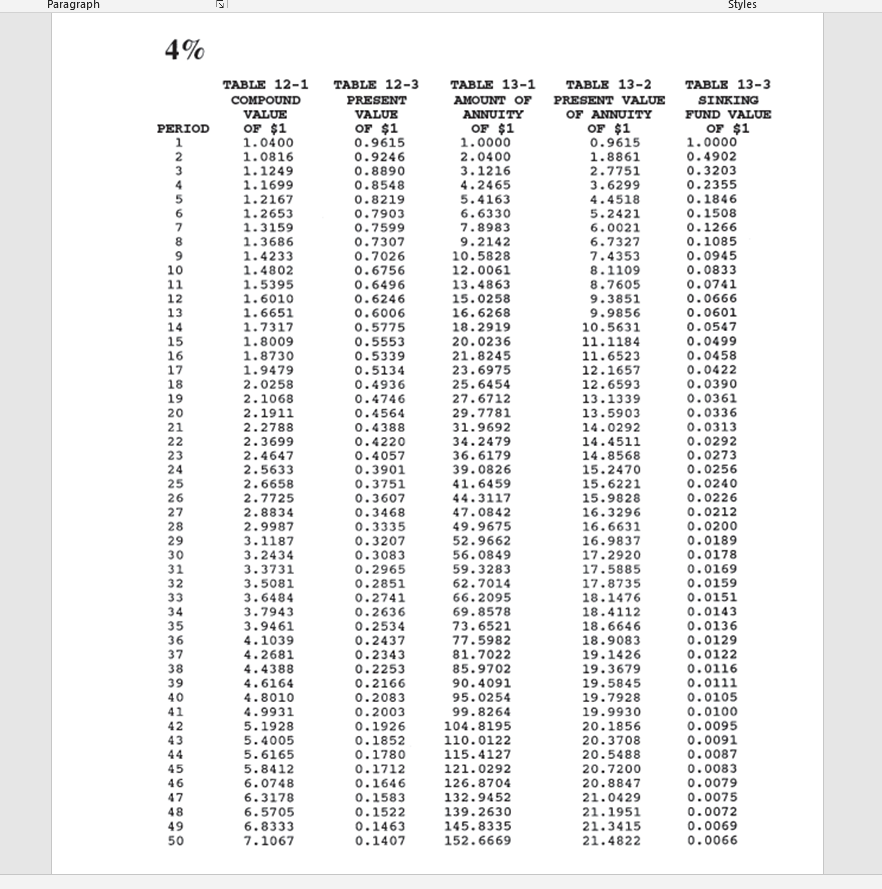

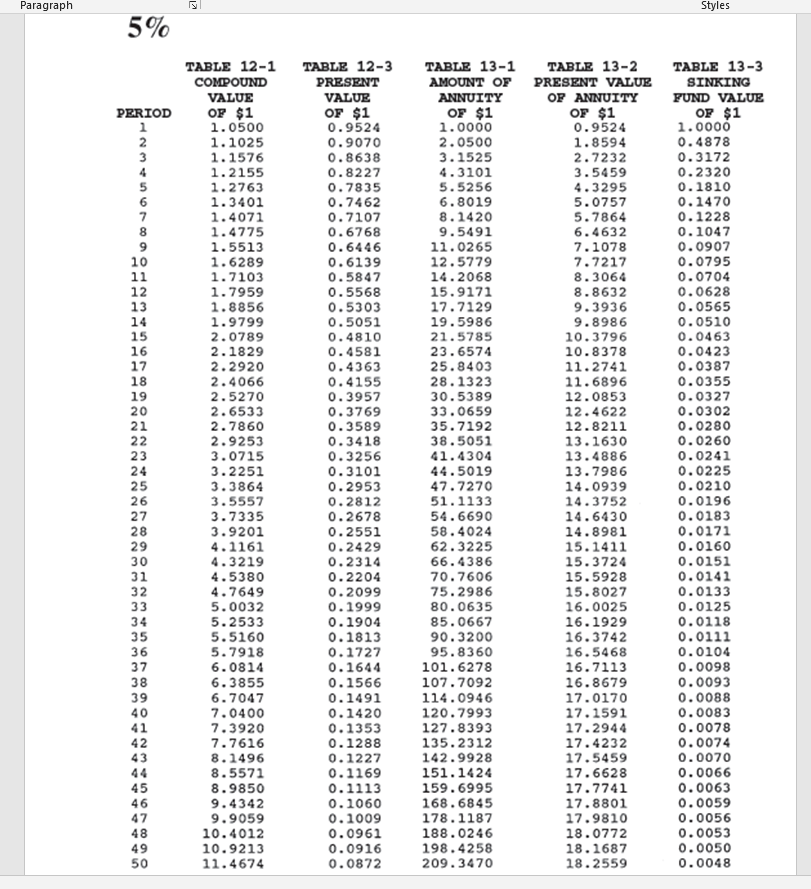

Question 5: (20 points) (A) Mr. Mansoor, a graduate bought a new car. The cash price is $ 60,000; he made a $ 5,000 down payment on it. The bank's loan was for 24 months. Finance charges totaled $ 12,000. What was the monthly payment? (8 points) (B) A Cement factory in KSA bought a new equipment. The cash price of the equipment is $ 45,000, putting down $ 12,000 and financing the remainder with 32 monthly payments of $ 1,190 each. Find the APR by table lookup. (8 points) (C) A university graduate bought a new car. The cash price is $ 57,000; he made a $4,200 down payment on it. The bank's loan was for 24 months. Finance charges totaled $ 9,800. What was the monthly payment? (Round it to $) 4 points) 2% PERIOD 1 2 3 2 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 TABLE 12-1 COMPOUND VALUE OF $1 1.0200 1.0404 1.0612 1.0824 1.1041 1.1262 1.1487 1.1717 1.1951 1.2190 1.2434 1.2682 1.2936 1.3195 1.3459 1.3728 1.4002 1.4282 1.4568 1.4859 1.5157 1.5460 1.5769 1.6084 1.6406 1.6734 1.7069 1.7410 1.7758 1.8114 1.8476 1.8845 1.9222 1.9607 1.9999 2.0399 2.0807 2.1223 2.1647 2.2080 2.2522 2.2972 2.3432 2.3900 2.4378 2.4866 2.5363 2.5871 2.6388 2.6916 TABLE 12-3 PRESENT VALUE OF $1 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.8043 0.7885 0.7730 0.7579 0.7430 0.7284 0.7142 0.7002 0.6864 0.6730 0.6598 0.6468 0.6342 0.6217 0.6095 0.5976 0.5859 0.5744 0.5631 0.5521 0.5412 0.5306 0.5202 0.5100 0.5000 0.4902 0.4806 0.4712 0.4619 0.4529 0.4440 0.4353 0.4268 0.4184 0.4102 0.4022 0.3943 0.3865 0.3790 0.3715 TABLE 13-1 TABLE 13-2 AMOUNT OF PRESENT VALUE ANNUITY OF ANNUITY OF $1 OF $1 1.0000 0.9804 2.0200 1.9416 3.0604 2.8839 4.1216 3.8077 5.2040 4.7134 6.3081 5.6014 7.4343 6.4720 8.5829 7.3255 9.7546 8.1622 10.9497 8.9826 12.1687 9.7868 13.4120 10.5753 14.6803 11.3483 15.9739 12.1062 17.2934 12.8492 18.6392 13.5777 20.0120 14.2918 21.4122 14.9920 22.8405 15.6784 24.2973 16.3514 25.7832 17.0112 27.2989 17.6580 28.8449 18.2922 30.4218 18.9139 32.0302 19.5234 33.6708 20.1210 35.3442 20.7069 37.0511 21.2812 38.7921 21.8443 40.5679 22.3964 42.3793 22.9377 44.2269 23.4683 46.1114 23.9885 48.0336 24.4985 49.9943 24.9986 51.9942 25.4888 54.0340 25.9694 56.1147 26.4406 58.2370 26.9025 60.4017 27.3554 62.6098 27.7994 64.8620 28.2347 67.1592 28.6615 69.5024 29.0799 71.8924 29.4901 74.3302 29.8923 76.8168 30.2865 79.3532 30.6731 81.9402 31.0520 84.5790 31.4236 TABLE 13-3 SINKING FUND VALUE OF $1 1.0000 0.4951 0.3268 0.2426 0.1922 0.1585 0.1345 0.1165 0.1025 0.0913 0.0822 0.0746 0.0681 0.0626 0.0578 0.0537 0.0500 0.0467 0.0438 0.0412 0.0388 0.0366 0.0347 0.0329 0.0312 0.0297 0.0283 0.0270 0.0258 0.0247 0.0236 0.0226 0.0217 0.0208 0.0200 0.0192 0.0185 0.0178 0.0172 0.0166 0.0160 0.0154 0.0149 0.0144 0.0139 0.0135 0.0130 0.0126 0.0122 0.0118 28 29 30 31 32 33 34 35 36 w 37 38 39 40 41 42 43 45 46 47 48 49 50 Paragraph KI Styles 3% PERIOD 9 10 11 12 13 14 15 16 17 18 NN 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 TABLE 12-1 COMPOUND VALUE OF $1 1.0300 1.0609 1.0927 1.1255 1.1593 1.1941 1.2299 1.2668 1.3048 1.3439 1.3842 1.4258 1.4685 1.5126 1.5580 1.6047 1.6528 1.7024 1.7535 1.8061 1.8603 1.9161 1.9736 2.0328 2.0938 2.1566 2.2213 2.2879 2.3566 2.4273 2.5001 2.5751 2.6523 2.7319 2.8139 2.8983 2.9852 3.0748 3.1670 3.2620 3.3599 3.4607 3.5645 3.6715 3.7816 3.8950 4.0119 4.1323 4.2562 4.3839 TABLE 12-3 PRESENT VALUE OF $1 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6611 0.6419 0.6232 0.6050 0.5874 0.5703 0.5537 0.5375 0.5219 0.5067 0.4919 0.4776 0.4637 0.4502 0.4371 0.4243 0.4120 0.4000 0.3883 0.3770 0.3660 0.3554 0.3450 0.3350 0.3252 0.3158 0.3066 0.2976 0.2890 0.2805 0.2724 0.2644 0.2567 0.2493 0.2420 0.2350 0.2281 TABLE 13-1 TABLE 13-2 AMOUNT OF PRESENT VALUE ANNUITY OF ANNUITY OF $1 OF $1 1.0000 0.9709 2.0300 1.9135 3.0909 2.8286 4.1836 3.7171 5.3091 4.5797 6.4684 5.4172 7.6625 6.2303 8.8923 7.0197 10.1591 7.7861 11.4639 8.5302 12.8078 9.2526 14.1920 9.9540 15.6178 10.6350 17.0863 11.2961 18.5989 11.9379 20.1569 12.5611 21.7616 13.1661 23.4144 13.7535 25.1169 14.3238 26.8704 14.8775 28.6765 15.4150 30.5368 15.9369 32.4529 16.4436 34.4265 16.9355 36.4593 17.4131 38.5530 17.8768 40.7096 18.3270 42.9309 18.7641 45.2188 19.1885 47.5754 19.6004 50.0027 20.0004 52.5027 20.3888 55.0778 20.7658 57.7302 21.1318 60.4621 21.4872 63.2759 21.8323 66.1742 22.1672 69.1594 22.4925 72.2342 22.8082 75.4012 23.1148 78.6633 23.4124 82.0232 23.7014 85.4839 23.9819 89.0484 24.2543 92.7198 24.5187 96.5014 24.7754 100.3965 25.0247 104.4084 25.2667 108.5406 25.5017 112.7968 25.7298 TABLE 13-3 SINKING FUND VALUE OF $1 1.0000 0.4926 0.3235 0.2390 0.1884 0.1546 0.1305 0.1125 0.0984 0.0872 0.0781 0.0705 0.0640 0.0585 0.0538 0.0496 0.0460 0.0427 0.0398 0.0372 0.0349 0.0327 0.0308 0.0290 0.0274 0.0259 0.0246 0.0233 0.0221 0.0210 0.0200 0.0190 0.0182 0.0173 0.0165 0.0158 0.0151 0.0145 0.0138 0.0133 0.0127 0.0122 0.0117 0.0112 0.0108 0.0104 0.0100 0.0096 0.0092 0.0089 NH 36 37 38 39 40 41 42 43 44 45 46 47 48 Paragraph Styles 4% PERIOD 1 2 3 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 TABLE 12-1 COMPOUND VALUE OF $1 1.0400 1.0816 1.1249 1.1699 1.2167 1.2653 1.3159 1.3686 1.4233 1.4802 1.5395 1.6010 1.6651 1.7317 1.8009 1.8730 1.9479 2.0258 2.1068 2.1911 2.2788 2.3699 2.4647 2.5633 2.6658 2.7725 2.8834 2.9987 3.1187 3.2434 3.3731 3.5081 3.6484 3.7943 3.9461 4.1039 4.2681 4.4388 4.6164 4.8010 4.9931 5.1928 5.4005 5.6165 5.8412 6.0748 6.3178 6.5705 6.8333 7.1067 TABLE 12-3 PRESENT VALUE OF $1 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.4388 0.4220 0.4057 0.3901 0.3751 0.3607 0.3468 0.3335 0.3207 0.3083 0.2965 0.2851 0.2741 0.2636 0.2534 0.2437 0.2343 0.2253 0.2166 0.2083 0.2003 0.1926 0.1852 0.1780 0.1712 0.1646 0.1583 0.1522 0.1463 0.1407 TABLE 13-1 AMOUNT OF ANNUITY OF $1 1.0000 2.0400 3.1216 4.2465 5.4163 6.6330 7.8983 9.2142 10.5828 12.0061 13.4863 15.0258 16.6268 18.2919 20.0236 21.8245 23.6975 25.6454 27.6712 29.7781 31.9692 34.2479 36.6179 39.0826 41.6459 44.3117 47.0842 49.9675 52.9662 56.0849 59.3283 62.7014 66.2095 69.8578 73.6521 77.5982 81.7022 85.9702 90.4091 95.0254 99.8264 104.8195 110.0122 115.4127 121.0292 126.8704 132.9452 139.2630 145.8335 152.6669 TABLE 13-2 PRESENT VALUE OF ANNUITY OF $1 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 8.1109 8.7605 9.3851 9.9856 10.5631 11.1184 11.6523 12.1657 12.6593 13.1339 13.5903 14.0292 14.4511 14.8568 15.2470 15.6221 15.9828 16.3296 16.6631 16.9837 17.2920 17.5885 17.8735 18.1476 18.4112 18.6646 18.9083 19.1426 19.3679 19.5845 19.7928 19.9930 20.1856 20.3708 20.5488 20.7200 20.8847 21.0429 21.1951 21.3415 21.4822 TABLE 13-3 SINKING FUND VALUE OF $1 1.0000 0.4902 0.3203 0.2355 0.1846 0.1508 0.1266 0.1085 0.0945 0.0833 0.0741 0.0666 0.0601 0.0547 0.0499 0.0458 0.0422 0.0390 0.0361 0.0336 0.0313 0.0292 0.0273 0.0256 0.0240 0.0226 0.0212 0.0200 0.0189 0.0178 0.0169 0.0159 0.0151 0.0143 0.0136 0.0129 0.0122 0.0116 0.0111 0.0105 0.0100 0.0095 0.0091 0.0087 0.0083 0.0079 0.0075 0.0072 0.0069 0.0066 29 30 31 32 33 34 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Paragraph Styles 5% PERIOD 1 2 3 6 7 8 9 10 11 12 14 15 16 TABLE 12-1 COMPOUND VALUE OF $1 1.0500 1.1025 1.1576 1.2155 1.2763 1.3401 1.4071 1.4775 1.5513 1.6289 1.7103 1.7959 1.8856 1.9799 2.0789 2.1829 2.2920 2.4066 2.5270 2.6533 2.7860 2.9253 3.0715 3.2251 3.3864 3.5557 3.7335 3.9201 4.1161 4.3219 4.5380 4.7649 5.0032 5.2533 5.5160 5.7918 6.0814 6.3855 6.7047 7.0400 7.3920 7.7616 8.1496 8.5571 8.9850 9.4342 9.9059 10.4012 10.9213 11.4674 TABLE 12-3 PRESENT VALUE OF $1 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5847 0.5568 0.5303 0.5051 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.3589 0.3418 0.3256 0.3101 0.2953 0.2812 0.2678 0.2551 0.2429 0.2314 0.2204 0.2099 0.1999 0.1904 0.1813 0.1727 0.1644 0.1566 0.1491 0.1420 0.1353 0.1288 0.1227 0.1169 0.1113 0.1060 0.1009 0.0961 0.0916 0.0872 TABLE 13-1 AMOUNT OF ANNUITY OF $1 1.0000 2.0500 3.1525 4.3101 5.5256 6.8019 8.1420 9.5491 11.0265 12.5779 14.2068 15.9171 17.7129 19.5986 21.5785 23.6574 25.8403 28.1323 30.5389 33.0659 35.7192 38.5051 41.4304 44.5019 47.7270 51.1133 54.6690 58.4024 62.3225 66.4386 70.7606 75.2986 80.0635 85.0667 90.3200 95.8360 101.6278 107.7092 114.0946 120.7993 127.8393 135.2312 142.9928 151.1424 159.6995 168.6845 178.1187 188.0246 198.4258 209.3470 TABLE 13-2 PRESENT VALUE OF ANNUITY OF $1 0.9524 1.8594 2.7232 3.5459 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 8.3064 8.8632 9.3936 9.8986 10.3796 10.8378 11.2741 11.6896 12.0853 12.4622 12.8211 13.1630 13.4886 13.7986 14.0939 14.3752 14.6430 14.8981 15.1411 15.3724 15.5928 15.8027 16.0025 16.1929 16.3742 16.5468 16.7113 16.8679 17.0170 17.1591 17.2944 17.4232 17.5459 17.6628 17.7741 17.8801 17.9810 18.0772 18.1687 18.2559 TABLE 13-3 SINKING FUND VALUE OF $1 1.0000 0.4878 0.3172 0.2320 0.1810 0.1470 0.1228 0.1047 0.0907 0.0795 0.0704 0.0628 0.0565 0.0510 0.0463 0.0423 0.0387 0.0355 0.0327 0.0302 0.0280 0.0260 0.0241 0.0225 0.0210 0.0196 0.0183 0.0171 0.0160 0.0151 0.0141 0.0133 0.0125 0.0118 0.0111 0.0104 0.0098 0.0093 0.0088 0.0083 0.0078 0.0074 0.0070 0.0066 0.0063 0.0059 0.0056 0.0053 0.0050 0.0048 40 41 42 43 45 46 47 48 49 50