Answered step by step

Verified Expert Solution

Question

1 Approved Answer

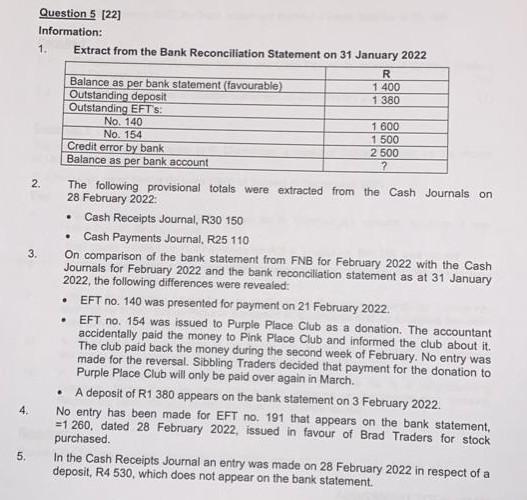

Question 5 [22] Information: 1. Extract from the Bank Reconciliation Statement on 31 January 2022 2. The following provisional totals were extracted from the Cash

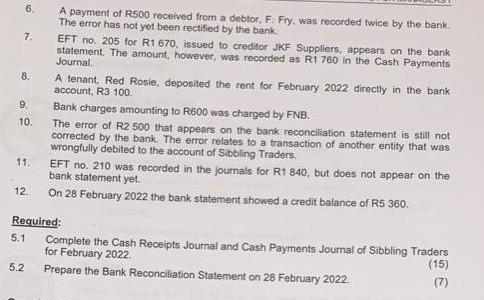

Question 5 [22] Information: 1. Extract from the Bank Reconciliation Statement on 31 January 2022 2. The following provisional totals were extracted from the Cash Journais on 28 February 2022: - Cash Receipts Journal, R30 150 - Cash Payments Journal, R25 110 3. On comparison of the bank statement from. FNB for February 2022 with the Cash Journals for February 2022 and the bank reconcliation statement as at 31 January 2022, the following differences were revealed: - EFT no. 140 was presented for payment on 21 February 2022. - EFT no. 154 was issued to Purple Place Club as a donation. The accountant accidentally paid the money to Pink Place Club and informed the club about it. The club paid back the money during the second week of February. No entry was made for the reversal. Sibbling Traders decided that payment for the donation to Purple Place Club will only be paid over again in March. - A deposit of R1 380 appears on the bank statement on 3 February 2022 . 4. No entry has been made for EFT no. 191 that appears on the bank statement, =1260, dated 28 February 2022, issued in favour of Brad Traders for stock purchased. 6. A payment of R500 received from a deblor, F. Fry, was recorded twice by the bank. The error has not yet been rectified by the bank. 7. EFT no. 205 for R1 670 , issued to creditor JKF Suppliers, appears on the bank statement. The amount, however, was recorded as R1760 in the Cash Payments Journal, 8. A tenant, Red Rosie, deposited the rent for February 2022 directly in the bank account, R3:100. 9. Bank charges amounting to R600 was charged by FNB. 10. The error of R2 500 that appears on the bank reconciliation statement is still not corrected by the bank. The error relates to a transaction of another entity that was wrongfully debited to the account of Sibbling Traders. 11. EFT no. 210 was recorded in the joumals for R1 840, but does not appear on the bank statement yet. 12. On 28 February 2022 the bank statement showed a credit balance of R5 360 . Required: 5.1 Complete the Cash Receipts Journal and Cash Payments Joumal of Sibbling Traders for February 2022. 5.2 Prepare the Bank Reconciliation Statement on 28 February 2022 Question 5 [22] Information: 1. Extract from the Bank Reconciliation Statement on 31 January 2022 2. The following provisional totals were extracted from the Cash Journais on 28 February 2022: - Cash Receipts Journal, R30 150 - Cash Payments Journal, R25 110 3. On comparison of the bank statement from. FNB for February 2022 with the Cash Journals for February 2022 and the bank reconcliation statement as at 31 January 2022, the following differences were revealed: - EFT no. 140 was presented for payment on 21 February 2022. - EFT no. 154 was issued to Purple Place Club as a donation. The accountant accidentally paid the money to Pink Place Club and informed the club about it. The club paid back the money during the second week of February. No entry was made for the reversal. Sibbling Traders decided that payment for the donation to Purple Place Club will only be paid over again in March. - A deposit of R1 380 appears on the bank statement on 3 February 2022 . 4. No entry has been made for EFT no. 191 that appears on the bank statement, =1260, dated 28 February 2022, issued in favour of Brad Traders for stock purchased. 6. A payment of R500 received from a deblor, F. Fry, was recorded twice by the bank. The error has not yet been rectified by the bank. 7. EFT no. 205 for R1 670 , issued to creditor JKF Suppliers, appears on the bank statement. The amount, however, was recorded as R1760 in the Cash Payments Journal, 8. A tenant, Red Rosie, deposited the rent for February 2022 directly in the bank account, R3:100. 9. Bank charges amounting to R600 was charged by FNB. 10. The error of R2 500 that appears on the bank reconciliation statement is still not corrected by the bank. The error relates to a transaction of another entity that was wrongfully debited to the account of Sibbling Traders. 11. EFT no. 210 was recorded in the joumals for R1 840, but does not appear on the bank statement yet. 12. On 28 February 2022 the bank statement showed a credit balance of R5 360 . Required: 5.1 Complete the Cash Receipts Journal and Cash Payments Joumal of Sibbling Traders for February 2022. 5.2 Prepare the Bank Reconciliation Statement on 28 February 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started