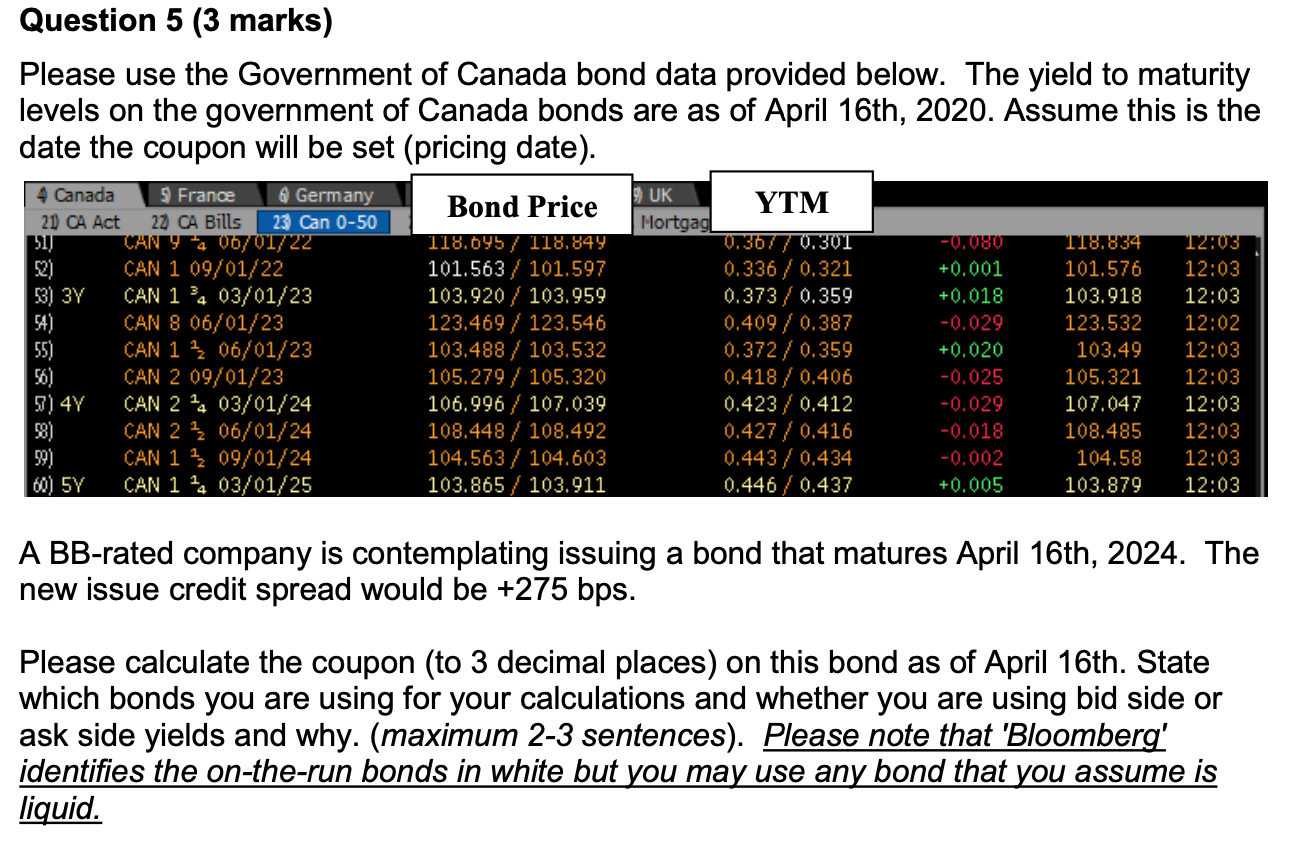

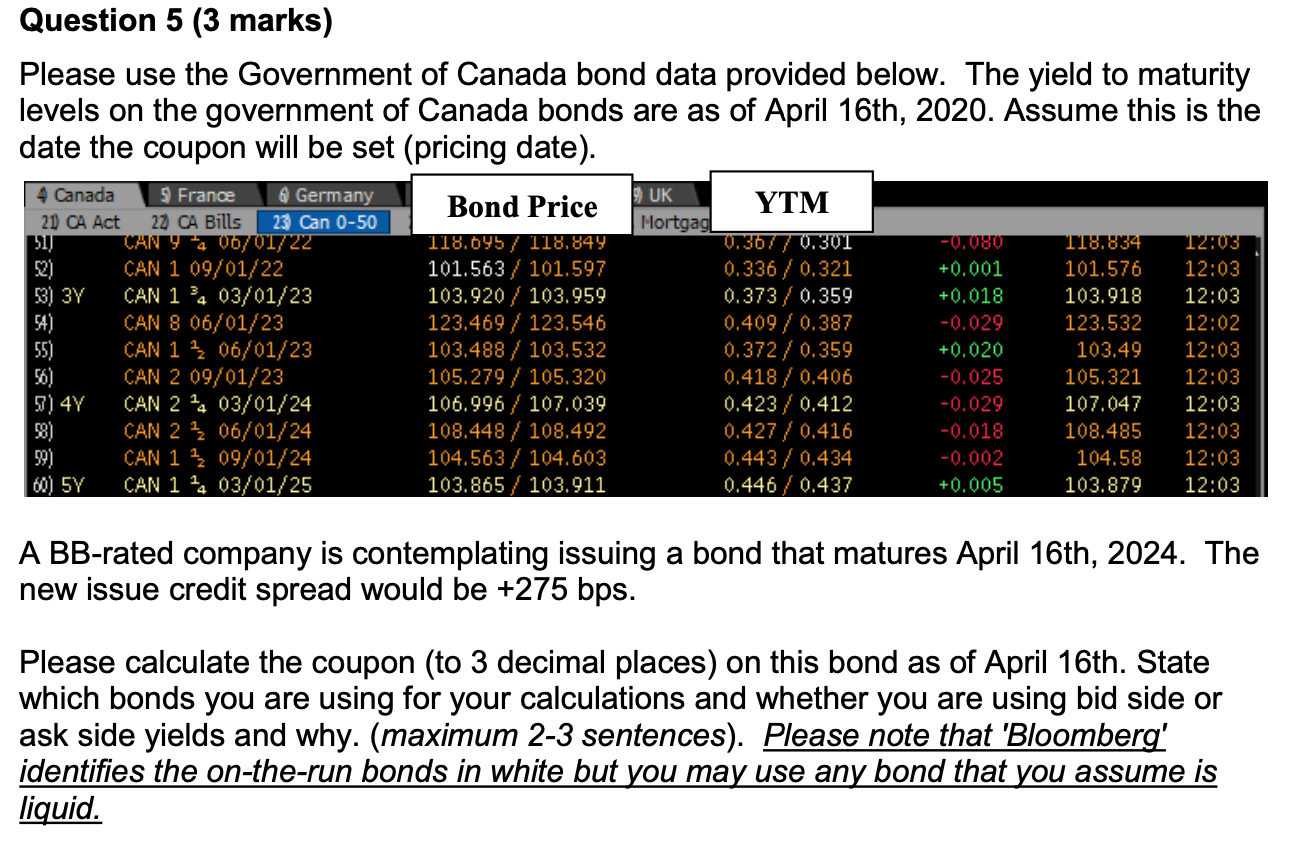

Question 5 (3 marks) Please use the Government of Canada bond data provided below. The yield to maturity levels on the government of Canada bonds are as of April 16th, 2020. Assume this is the date the coupon will be set (pricing date). 9 UK Mortgag YTM 4 Canada France Germany 20 CA Act 27 CA Bills 23 Can 0-50 311 CAN Y 4 VO/ 01/ 22 CAN 1 09/01/22 CAN 1 34 03/01/23 CAN 8 06/01/23 CAN 1 ? 06/01/23 CAN 2 09/01/23 CAN 2 03/01/24 8) CAN 2 06/01/24 CAN 1 09/01/24 6) 5YCAN 1 % 03/01/25 Bond Price 118.095/ 118.844 101.563 / 101.597 103.920 / 103.959 123.469 / 123.546 103.488 / 103.532 105.279 / 105.320 106.996 / 107.039 108.448 / 108.492 104.563 / 104.603 103.865 / 103.911 0.3677 0.301 0.336 / 0.321 0.373 / 0.359 0.409 / 0.387 0.372 / 0.359 0.418 / 0.406 0.423 / 0.412 0.427 / 0.416 0.443 / 0.434 0.446 / 0.437 -0.080 +0.001 +0.018 -0.029 +0.020 -0.025 -0.029 -0.018 -0.002 +0.005 118.834 101.576 103.918 123.532 103.49 105.321 107.047 108.485 104.58 103.879 12:03 12:03 12:03 12:02 12:03 12:03 12:03 12:03 12:03 12:03 4Y 50) A BB-rated company is contemplating issuing a bond that matures April 16th, 2024. The new issue credit spread would be +275 bps. Please calculate the coupon (to 3 decimal places) on this bond as of April 16th. State which bonds you are using for your calculations and whether you are using bid side or ask side yields and why. (maximum 2-3 sentences). Please note that 'Bloomberg' identifies the on-the-run bonds in white but you may use any bond that you assume is liquid. Question 5 (3 marks) Please use the Government of Canada bond data provided below. The yield to maturity levels on the government of Canada bonds are as of April 16th, 2020. Assume this is the date the coupon will be set (pricing date). 9 UK Mortgag YTM 4 Canada France Germany 20 CA Act 27 CA Bills 23 Can 0-50 311 CAN Y 4 VO/ 01/ 22 CAN 1 09/01/22 CAN 1 34 03/01/23 CAN 8 06/01/23 CAN 1 ? 06/01/23 CAN 2 09/01/23 CAN 2 03/01/24 8) CAN 2 06/01/24 CAN 1 09/01/24 6) 5YCAN 1 % 03/01/25 Bond Price 118.095/ 118.844 101.563 / 101.597 103.920 / 103.959 123.469 / 123.546 103.488 / 103.532 105.279 / 105.320 106.996 / 107.039 108.448 / 108.492 104.563 / 104.603 103.865 / 103.911 0.3677 0.301 0.336 / 0.321 0.373 / 0.359 0.409 / 0.387 0.372 / 0.359 0.418 / 0.406 0.423 / 0.412 0.427 / 0.416 0.443 / 0.434 0.446 / 0.437 -0.080 +0.001 +0.018 -0.029 +0.020 -0.025 -0.029 -0.018 -0.002 +0.005 118.834 101.576 103.918 123.532 103.49 105.321 107.047 108.485 104.58 103.879 12:03 12:03 12:03 12:02 12:03 12:03 12:03 12:03 12:03 12:03 4Y 50) A BB-rated company is contemplating issuing a bond that matures April 16th, 2024. The new issue credit spread would be +275 bps. Please calculate the coupon (to 3 decimal places) on this bond as of April 16th. State which bonds you are using for your calculations and whether you are using bid side or ask side yields and why. (maximum 2-3 sentences). Please note that 'Bloomberg' identifies the on-the-run bonds in white but you may use any bond that you assume is liquid