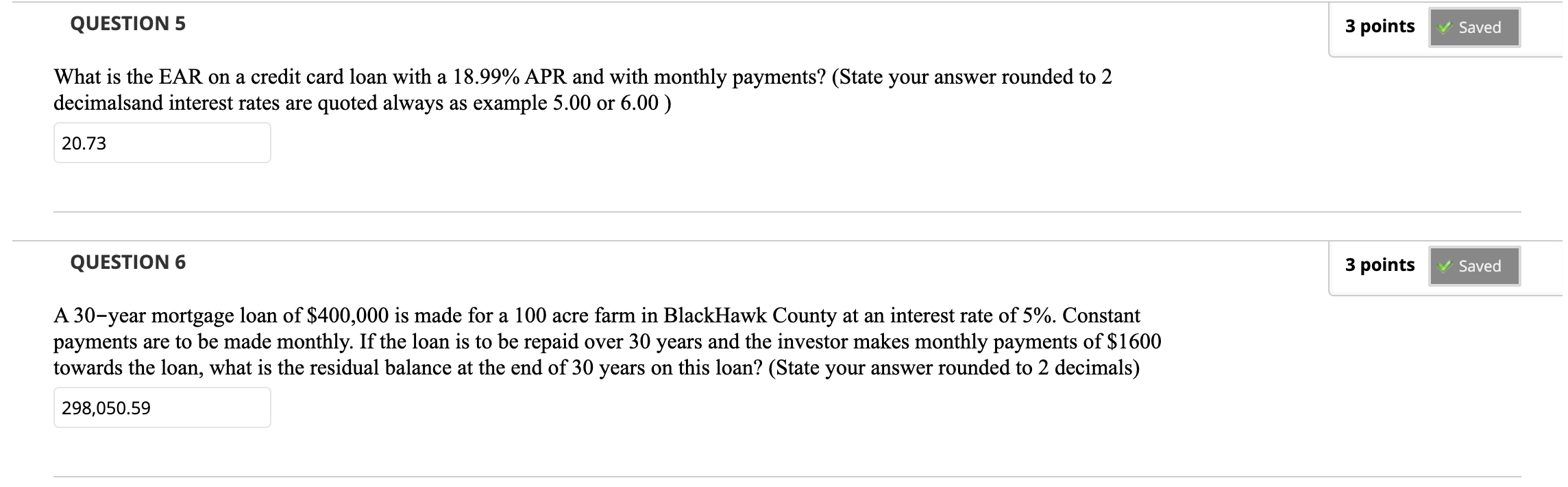

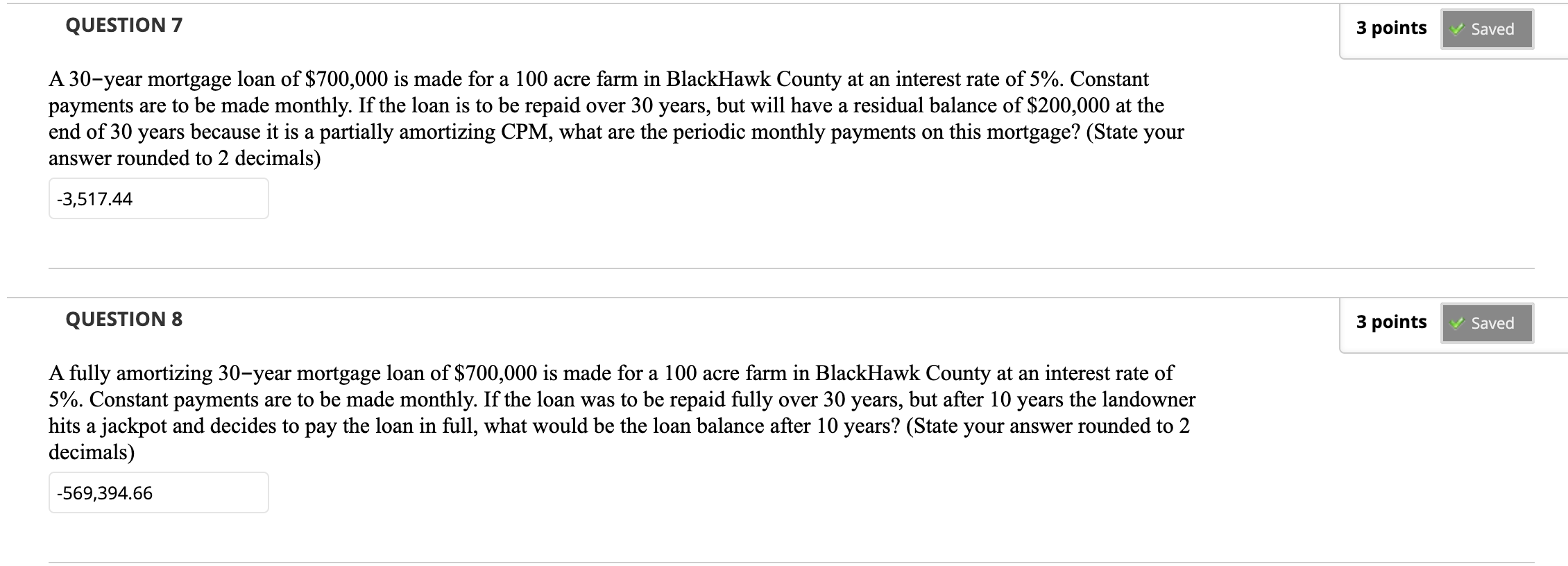

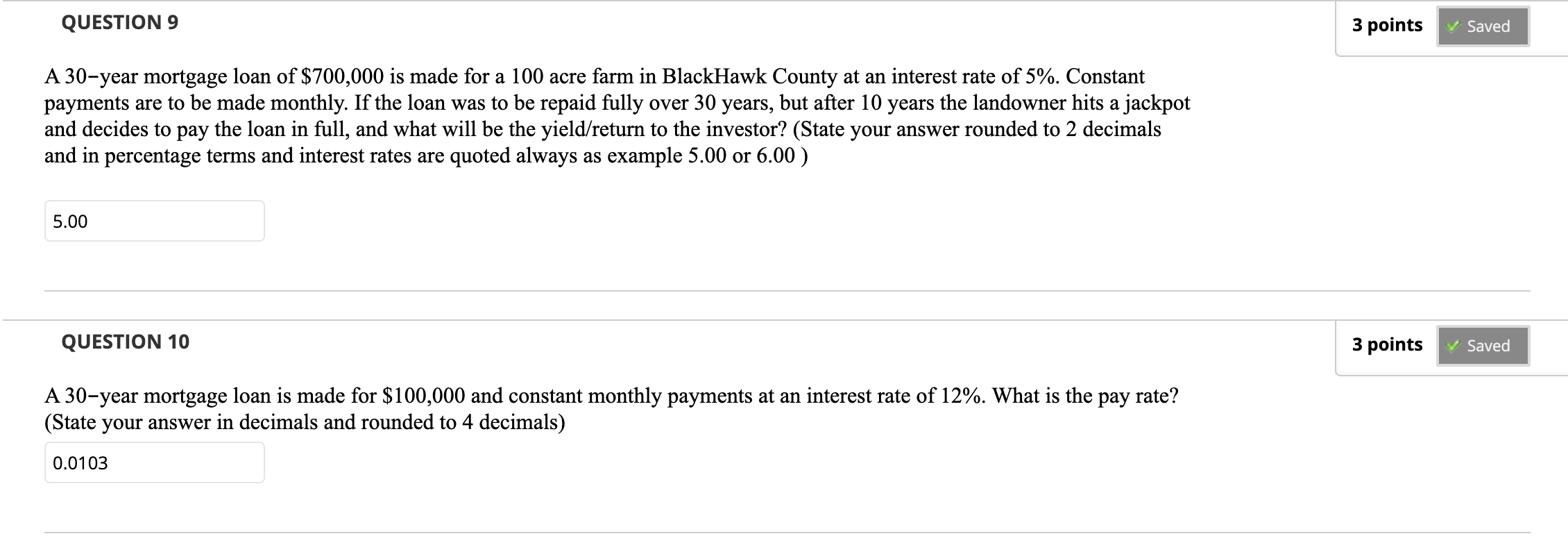

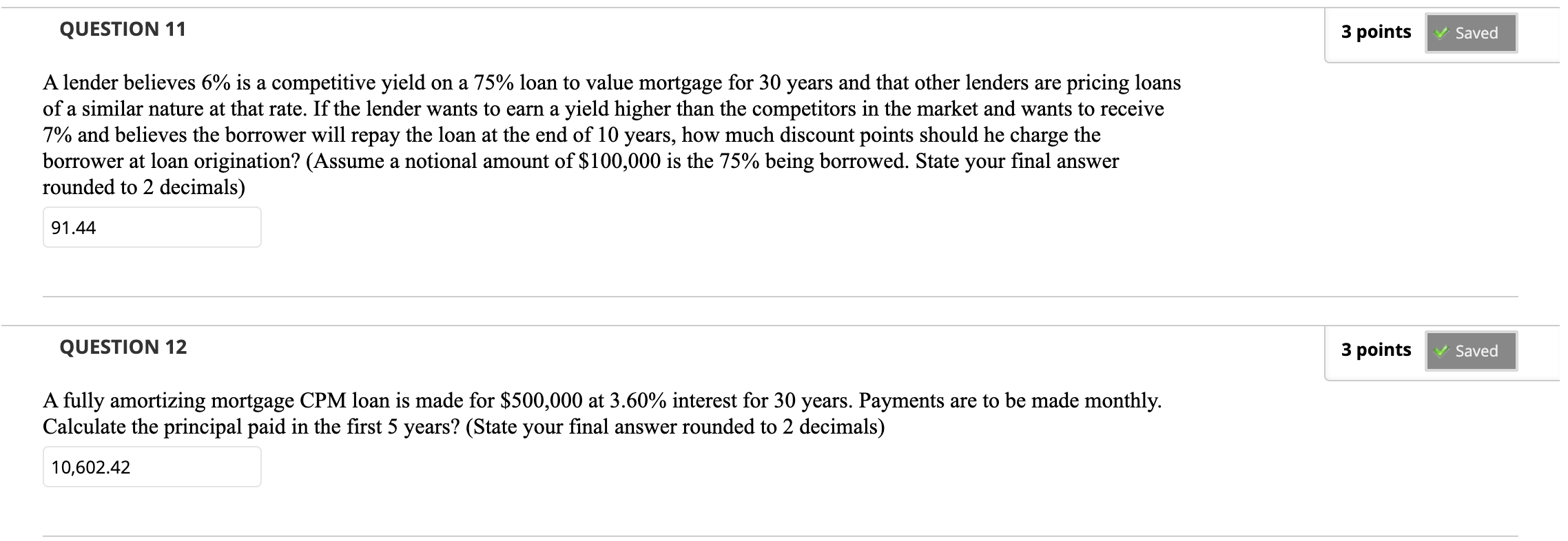

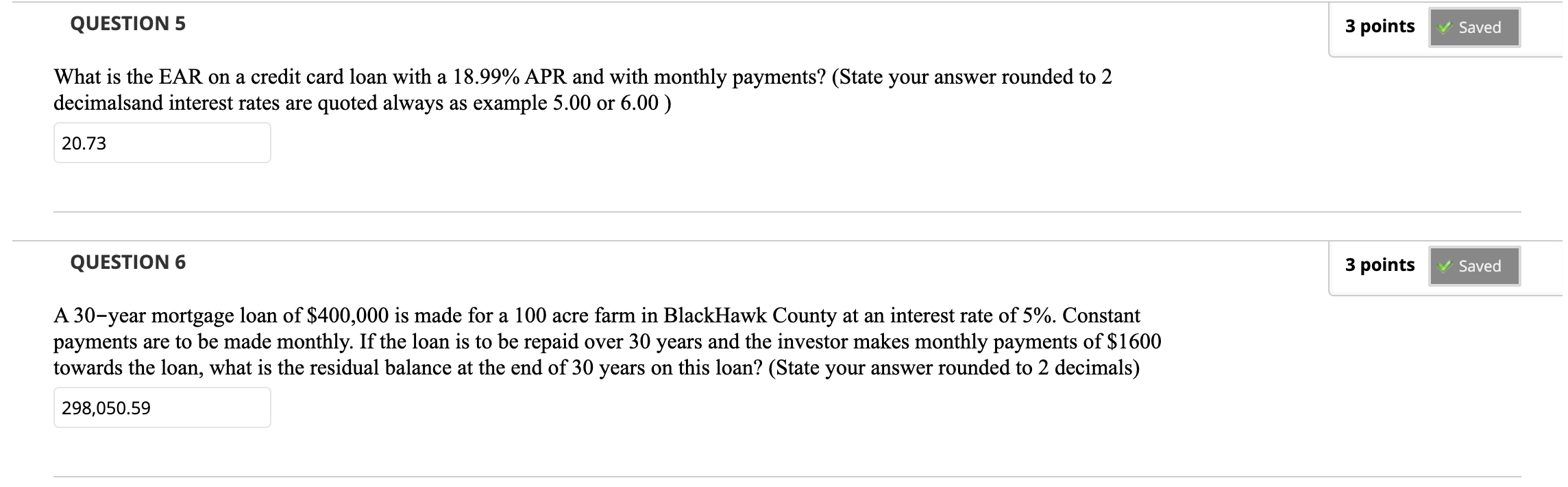

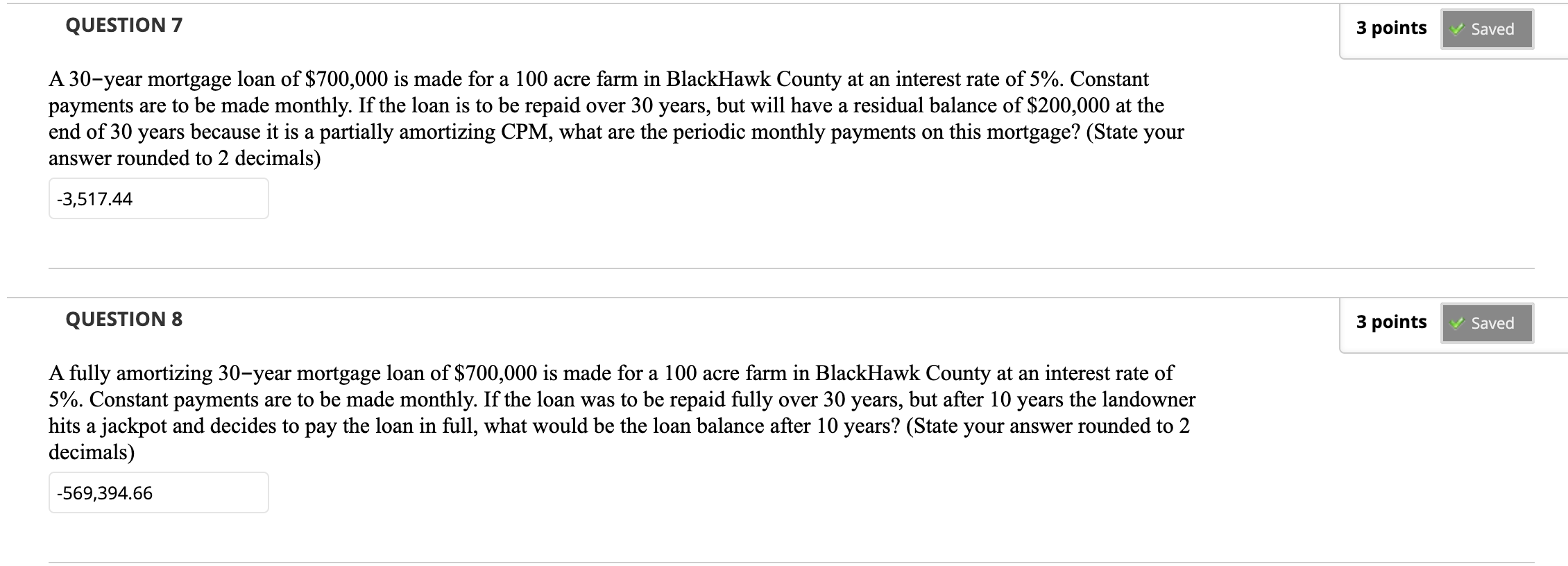

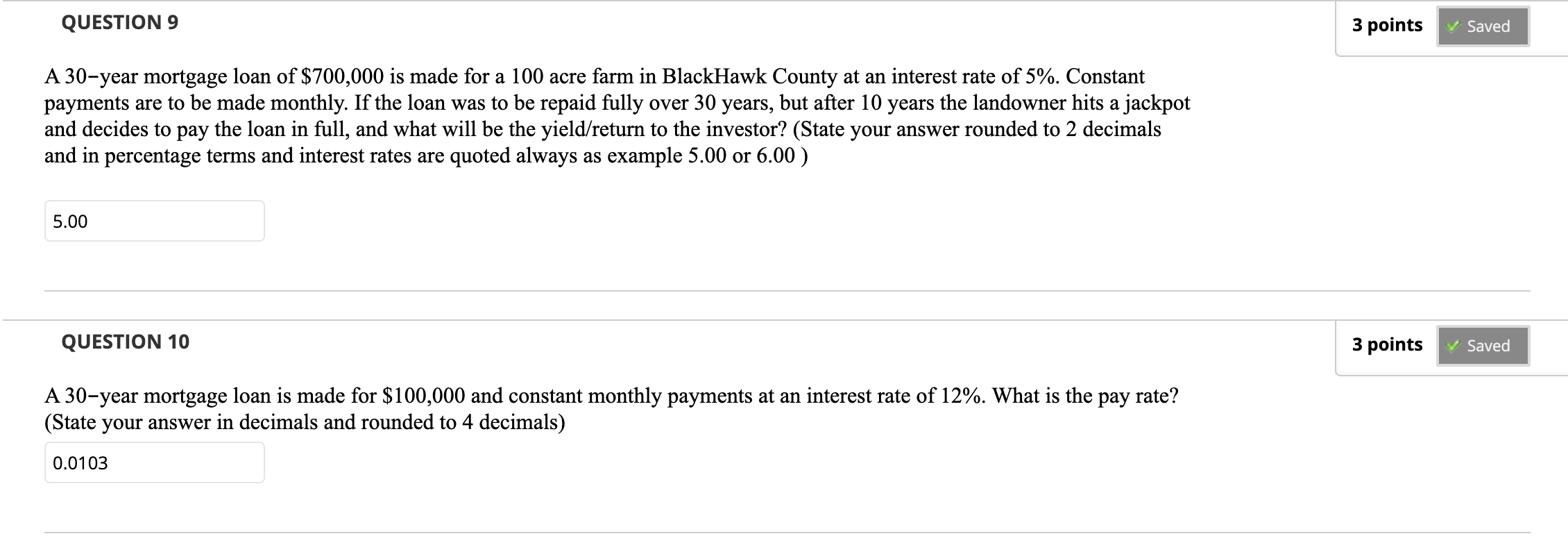

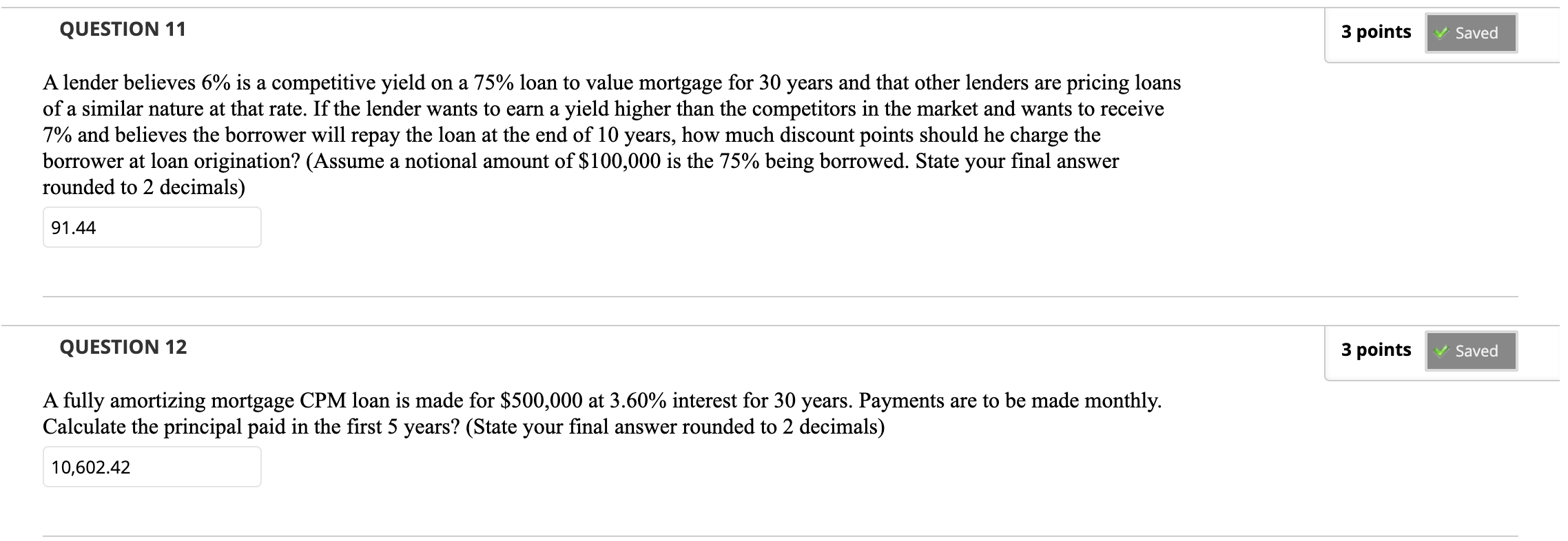

QUESTION 5 3 points Saved What is the EAR on a credit card loan with a 18.99% APR and with monthly payments? (State your answer rounded to 2 decimalsand interest rates are quoted always as example 5.00 or 6.00 ) 20.73 QUESTION 6 3 points Saved A 30-year mortgage loan of $400,000 is made for a 100 farm in BlackHawk County at an interest rate of 5%. Constant payments are to be made monthly. If the loan is to be repaid over 30 years and the investor makes monthly payments of $1600 towards the loan, what is the residual balance at the end of 30 years on this loan? (State your answer rounded to 2 decimals) 298,050.59 QUESTION 7 3 points Saved A 30-year mortgage loan of $700,000 is made for a 100 acre farm in BlackHawk County at an interest rate of 5%. Constant payments are to be made monthly. If the loan is to be repaid over 30 years, but will have a residual balance of $200,000 at the end of 30 years because it is a partially amortizing CPM, what are the periodic monthly payments on this mortgage? (State your answer rounded to 2 decimals) -3,517.44 TION 8 3 points Saved A fully amortizing 30-year mortgage loan of $700,000 is made for a 100 acre farm in BlackHawk County at an interest rate of 5%. Constant payments are to be made monthly. If the loan was to be repaid fully over 30 years, but after 10 years the landowner hits a jackpot and decides to pay the loan in full, what would be the loan balance after 10 years? (State your answer rounded to 2 decimals) -569,394.66 QUESTION 9 3 points Saved A 30-year mortgage loan of $700,000 is made for a 100 acre farm in BlackHawk County at an interest rate of 5%. Constant payments are to be made monthly. If the loan was to be repaid fully over 30 years, but after 10 years the landowner hits a jackpot and decides to pay the loan in full, and what will be the yield/return to the investor? (State your answer rounded to 2 decimals and in percentage terms and interest rates are quoted always as example 5.00 or 6.00 ) 5.00 QUESTION 10 3 points Saved A 30-year mortgage loan is made for $100,000 and constant monthly payments at an interest rate of 12%. What is the pay rate? (State your answer in decimals and rounded to 4 decimals) 0.0103 QUESTION 11 3 points Saved A lender believes 6% is a competitive yield on a 75% loan to value mortgage for 30 years and that other lenders are pricing loans of a similar nature at that rate. If the lender wants to earn a yield higher than the competitors in the market and wants to receive 7% and believes the borrower will repay the loan at the end of 10 years, how much discount points should he charge the borrower at loan origination? (Assume a notional amount of $100,000 is the 75% being borrowed. State your final answer rounded to 2 decimals) 91.44 QUESTION 12 3 points Saved A fully amortizing mortgage CPM loan is made for $500,000 at 3.60% interest for 30 years. Payments are to be made monthly. Calculate the principal paid in the first 5 years? (State your final answer rounded to 2 decimals) 10,602.42