Answered step by step

Verified Expert Solution

Question

1 Approved Answer

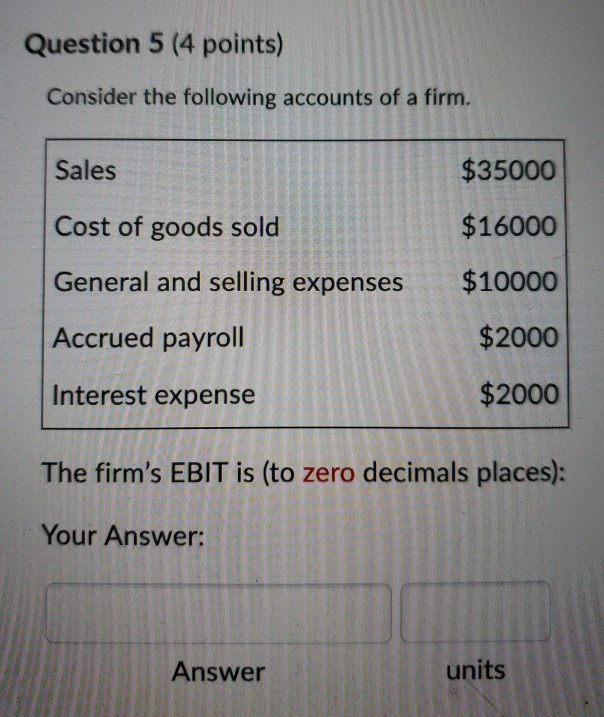

Question 5 (4 points) Consider the following accounts of a firm. Sales Cost of goods sold General and selling expenses $10000 Accrued payroll Interest expense

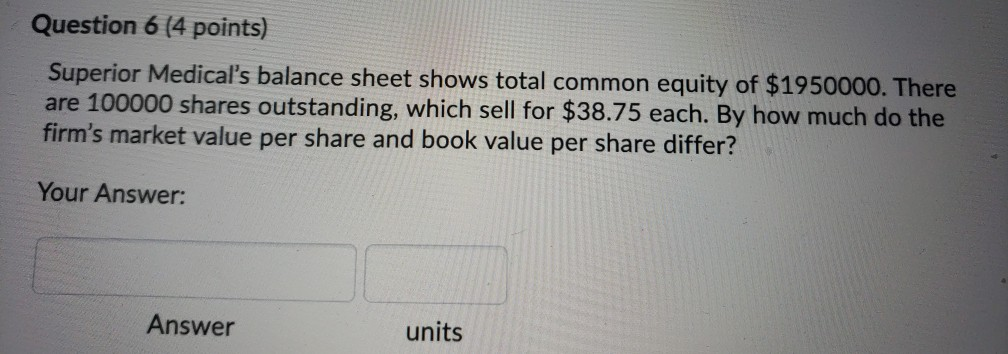

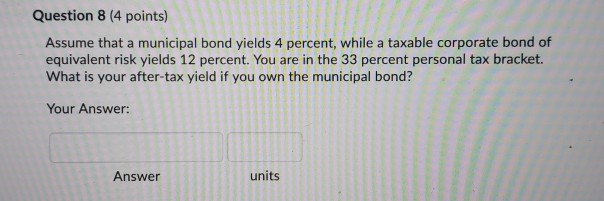

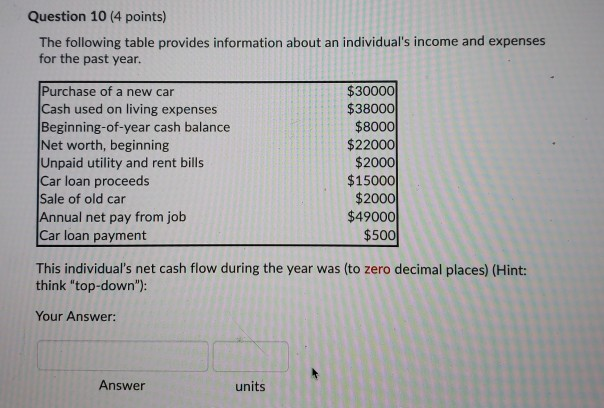

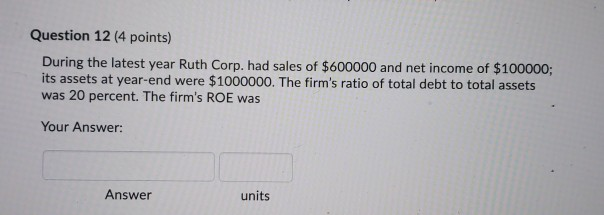

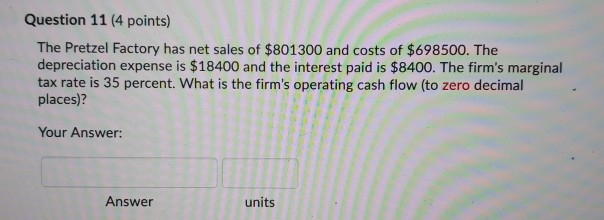

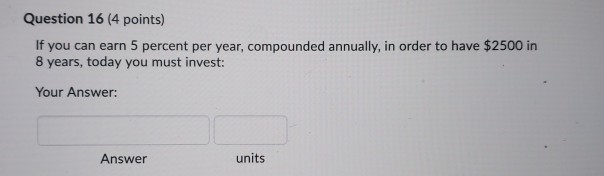

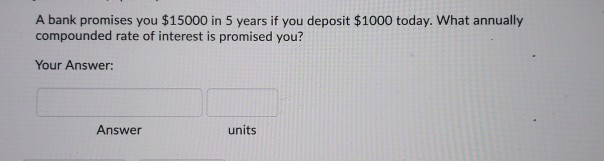

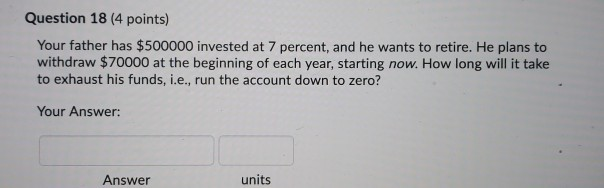

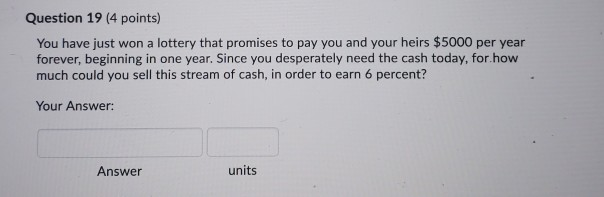

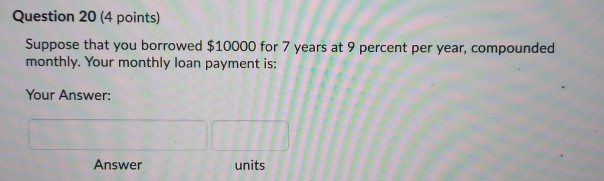

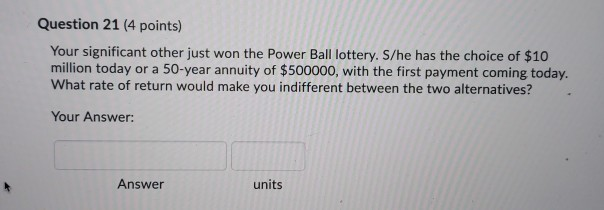

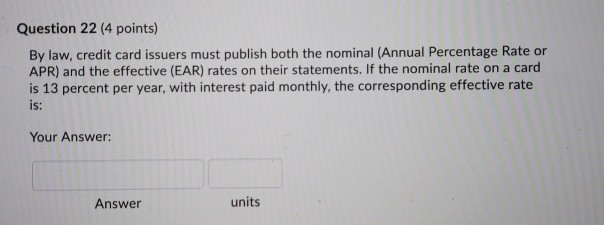

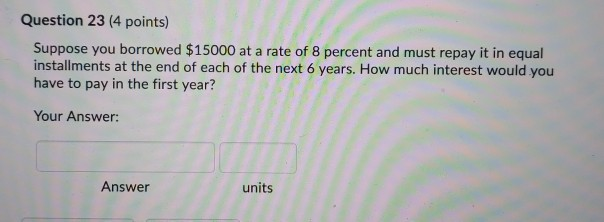

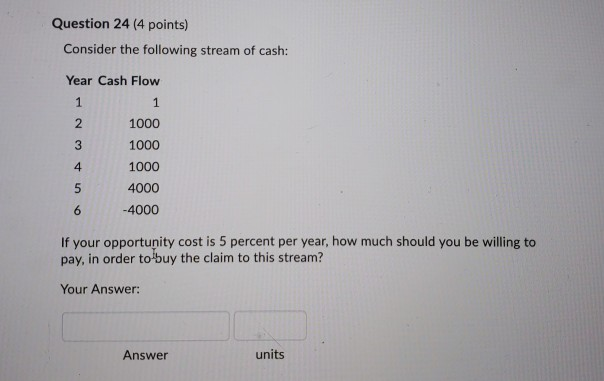

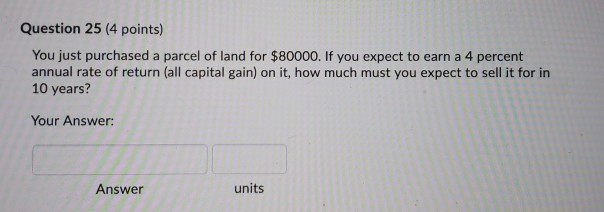

Question 5 (4 points) Consider the following accounts of a firm. Sales Cost of goods sold General and selling expenses $10000 Accrued payroll Interest expense $35000 $16000 $2000 $2000 The firm's EBIT is (to zero decimals places): Your Answer Answer units Question 6 (4 points) Superior Medical's balance sheet shows total common equity of $1950000. There are 100000 shares outstanding, which sell for $38.75 each. By how much do the firm's market value per share and book value per share differ? Your Answer: Answer units Question 8 (4 points) Assume that a municipal bond yields 4 percent, while a taxable corporate bond of equivalent risk yields 12 percent. You are in the 33 percent personal tax bracket. What is your after-tax yield if you own the municipal bond? Your Answer: Answer units Question 10 (4 points) The following table provides information about an individual's income and expenses for the past year. Purchase of a new car Cash used on living expenses Beginning-of-year cash balance Net worth, beginning Unpaid utility and rent bills $30000 $38000 $8000 $22000 $2000 $15000 $2000 $49000 $500 r loan proceeds Sale of old car Annual net pay from job Car loan payment This individual's net cash flow during the year was (to zero decimal places) (Hint: think "top-down"): Your Answer: Answer units Question 12 (4 points) During the latest year Ruth Corp. had sales of $600000 and net income of $100000; its assets at year-end were $1000000. The firm's ratio of total debt to total assets was 20 percent. The firm's ROE was Your Answer: Answer units Question 11 (4 points) The Pretzel Factory has net sales of $801300 and costs of $698500. The depreciation expense is $18400 and the interest paid is $8400. The firm's marginal tax rate is 35 percent. What is the firm's operating cash flow (to zero decimal places)? Your Answer: Answer units Question 16 (4 points) If you can earn 5 percent per year, compounded annually, in order to have $2500 in 8 years, today you must invest Your Answer: Answer units A bank promises you $15000 in 5 years if you deposit $1000 today. What annually compounded rate of interest is promised you? Your Answer: Answer units Question 18 (4 points) Your father has $500000 invested at 7 percent, and he wants to retire. He plans to withdraw $70000 at the beginning of each year, starting now. How long will it take to exhaust his funds, i.e., run the account down to zero? Your Answer: Answer units Question 19 (4 points) You have just won a lottery that promises to pay you and your heirs $5000 per year forever, beginning in one year. Since you desperately need the cash today, for.hovw much could you sell this stream of cash, in order to earn 6 percent? Your Answer: Answer units Question 20 (4 points) Suppose that you borrowed $10000 for 7 years at 9 percent per year, compounded monthly. Your monthly loan payment is: Your Answer: Answer units Question 22 (4 points) By law, credit card issuers must publish both the nominal (Annual Percentage Rate or APR) and the effective (EAR) rates on their statements. If the nominal rate on a card is 13 percent per year, with interest paid monthly, the corresponding effective rate is: Your Answer: Answer units Question 23 (4 points) Suppose you borrowed $15000 at a rate of 8 percent and must repay it in equal installments at the end of each of the next 6 years. How much interest would you have to pay in the first year? Your Answer: Answer units Question 24 (4 points) Consider the following stream of cash: Year Cash Flow 2 3 4 1000 1000 1000 4000 4000 If your opportunity cost is 5 percent per year, how much should you be willing to pay, in order to buy the claim to this stream? Your Answer: Answer units Question 25 (4 points) You just purchased a parcel of land for $80000. If you expect to earn a 4 percent annual rate of return (all capital gain) on it, how much must you expect to sell it for in 10 years? Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started