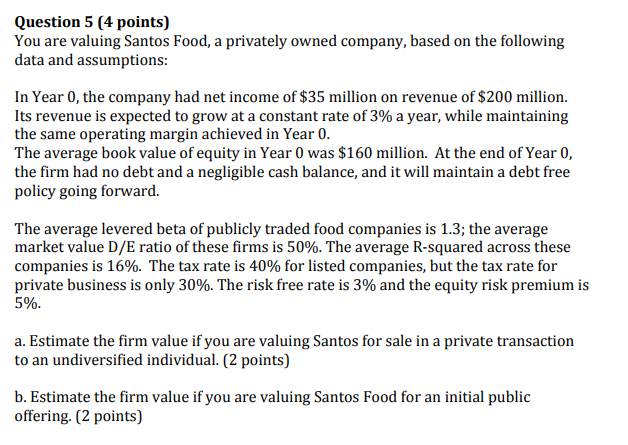

Question 5 (4 points) You are valuing Santos Food, a privately owned company, based on the following data and assumptions: In Year O, the company had net income of $35 million on revenue of $200 million. Its revenue is expected to grow at a constant rate of 3% a year, while maintaining the same operating margin achieved in Year 0. The average book value of equity in Year 0 was $160 million. At the end of Year 0, the firm had no debt and a negligible cash balance, and it will maintain a debt free policy going forward. The average levered beta of publicly traded food companies is 1.3; the average market value D/E ratio of these firms is 50%. The average R-squared across these companies is 16%. The tax rate is 40% for listed companies, but the tax rate for private business is only 30%. The risk free rate is 3% and the equity risk premium is 5%. a. Estimate the firm value if you are valuing Santos for sale in a private transaction to an undiversified individual. (2 points) b. Estimate the firm value if you are valuing Santos Food for an initial public offering. (2 points) Question 5 (4 points) You are valuing Santos Food, a privately owned company, based on the following data and assumptions: In Year O, the company had net income of $35 million on revenue of $200 million. Its revenue is expected to grow at a constant rate of 3% a year, while maintaining the same operating margin achieved in Year 0. The average book value of equity in Year 0 was $160 million. At the end of Year 0, the firm had no debt and a negligible cash balance, and it will maintain a debt free policy going forward. The average levered beta of publicly traded food companies is 1.3; the average market value D/E ratio of these firms is 50%. The average R-squared across these companies is 16%. The tax rate is 40% for listed companies, but the tax rate for private business is only 30%. The risk free rate is 3% and the equity risk premium is 5%. a. Estimate the firm value if you are valuing Santos for sale in a private transaction to an undiversified individual. (2 points) b. Estimate the firm value if you are valuing Santos Food for an initial public offering. (2 points)