Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 [40 Total Marks] With the separation of ownership and control, agency conflicts between managers and shareholders emerge. Corporate governance is key in alleviating

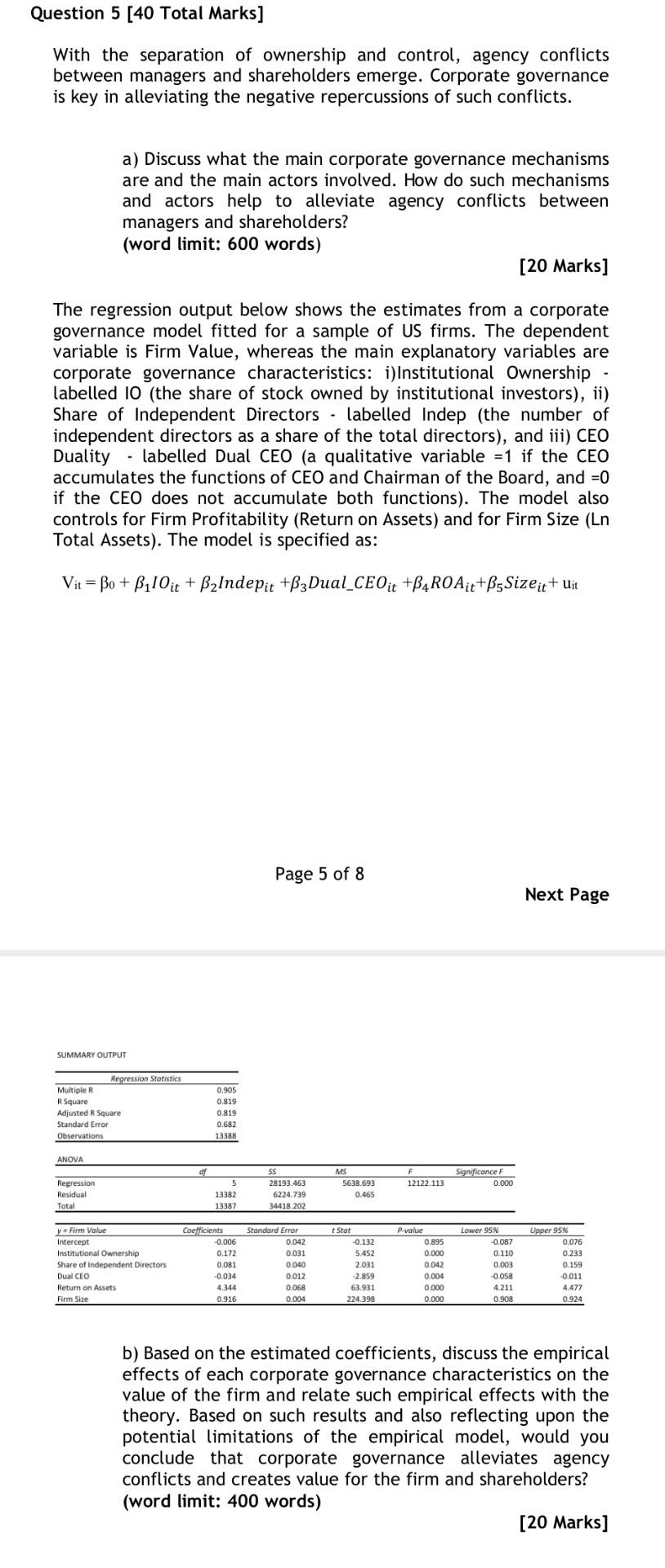

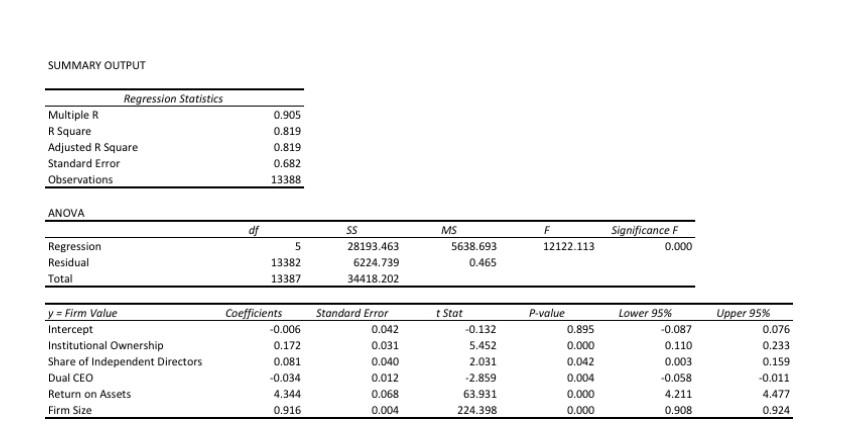

Question 5 [40 Total Marks] With the separation of ownership and control, agency conflicts between managers and shareholders emerge. Corporate governance is key in alleviating the negative repercussions of such conflicts. a) Discuss what the main corporate governance mechanisms are and the main actors involved. How do such mechanisms and actors help to alleviate agency conflicts between managers and shareholders? (word limit: 600 words) [20 Marks] The regression output below shows the estimates from a corporate governance model fitted for a sample of US firms. The dependent variable is Firm Value, whereas the main explanatory variables are corporate governance characteristics: i)Institutional Ownership- labelled 10 (the share of stock owned by institutional investors), ii) Share of Independent Directors - labelled Indep (the number of independent directors as a share of the total directors), and iii) CEO Duality - labelled Dual CEO (a qualitative variable = 1 if the CEO accumulates the functions of CEO and Chairman of the Board, and =0 if the CEO does not accumulate both functions). The model also controls for Firm Profitability (Return on Assets) and for Firm Size (Ln Total Assets). The model is specified as: Vit = Bo + B110 it + B2Indepit +B3Dual_CEO it +B4ROAit+B5Sizeit+ Uit Page 5 of 8 Next Page SUMMARY OUTPUT Regression Statistics Multiple R Square Adjusted R Square Standard Error Observations 0.905 0.819 0.819 0.682 13388 ANOVA df Significance F 0.000 Regression Residual Total 12122.113 MS 5638.693 0.465 5 13382 13387 ss 28193.463 6224.739 34418.202 Coefficients -0.006 0.172 y Firm Value Intercept Institutional Ownership Share of Independent Directors Dual CEO Return on Assets Firm Size 0.081 Standard Error 0.042 0.031 0.040 0.012 0.068 0.004 Stat -0.132 5.452 2.031 -2.859 63.931 224.398 P-value 0.895 0.000 0.042 0.004 0.000 0.000 Lower 95% -0.087 0.110 0.003 -0.058 4.211 0.908 Upper 95% 0.076 0.233 0.159 -0.011 4.477 0.924 -0.034 4,344 0.916 b) Based on the estimated coefficients, discuss the empirical effects of each corporate governance characteristics on the value of the firm and relate such empirical effects with the theory. Based on such results and also reflecting upon the potential limitations of the empirical model, would you conclude that corporate governance alleviates agency conflicts and creates value for the firm and shareholders? (word limit: 400 words) [20 Marks] SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.905 0.819 0.819 0.682 13388 ANOVA F 12122.113 Significance F 0.000 Regression Residual Total MS 5638.693 0.465 5 13382 13387 SS 28193.463 6224.739 34418.202 y = Firm Value Intercept Institutional Ownership Share of Independent Directors Dual CEO Return on Assets Firm Size Coefficients -0.006 0.172 0.081 -0.034 4.344 0.916 Standard Error 0.042 0.031 0.040 0.012 0.068 0.004 Stat -0.132 5.452 2.031 -2.859 63.931 224.398 P-value 0.895 0.000 0.042 0.004 0.000 0.000 Lower 95% -0.087 0.110 0.003 -0.058 4.211 0.908 Upper 95% 0.076 0.233 0.159 -0.011 4.477 0.924

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started