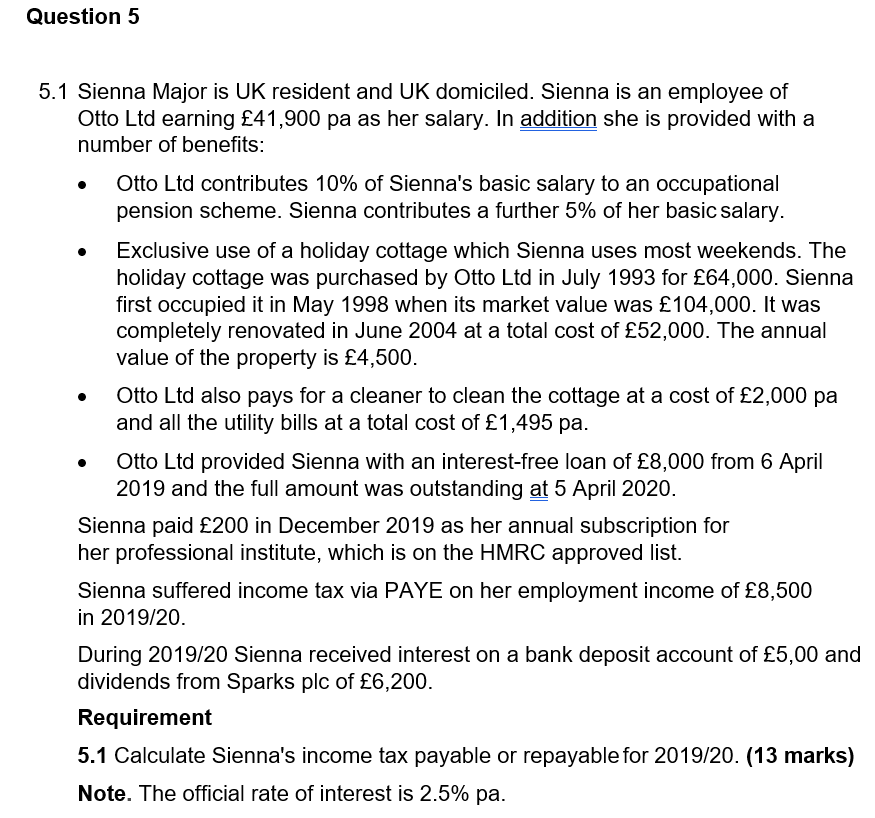

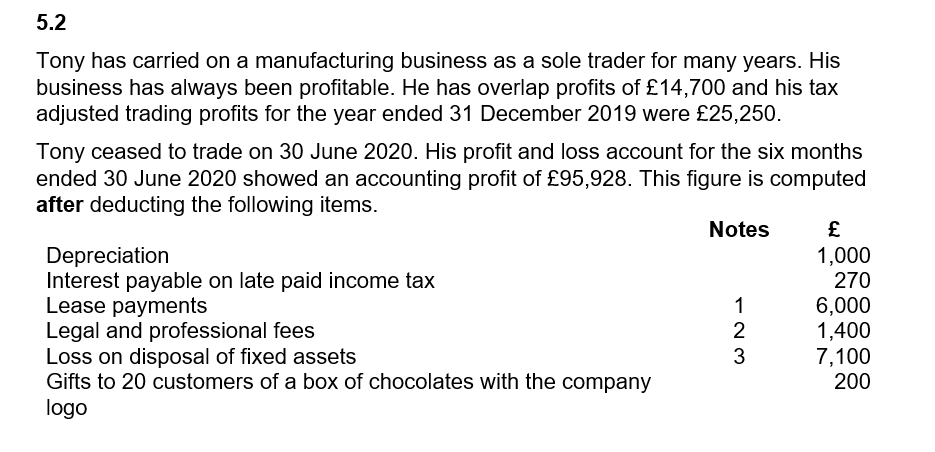

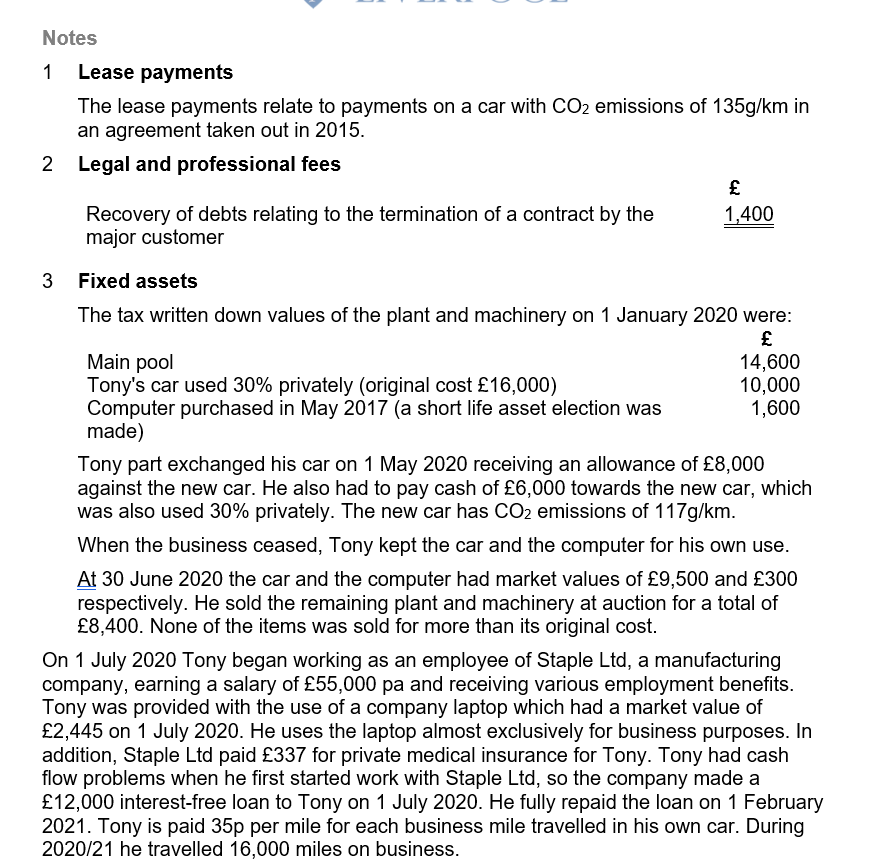

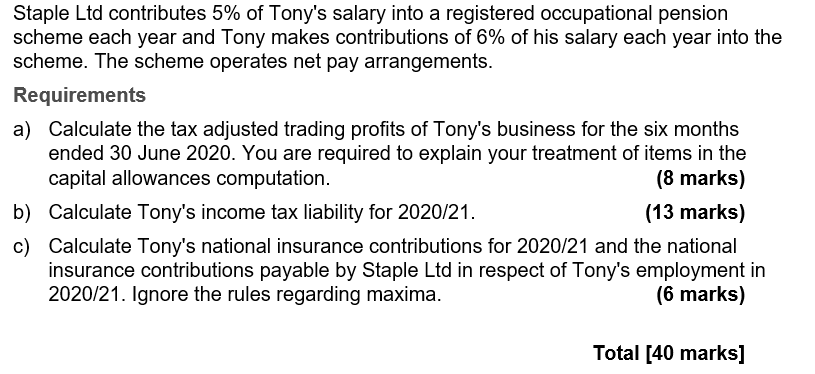

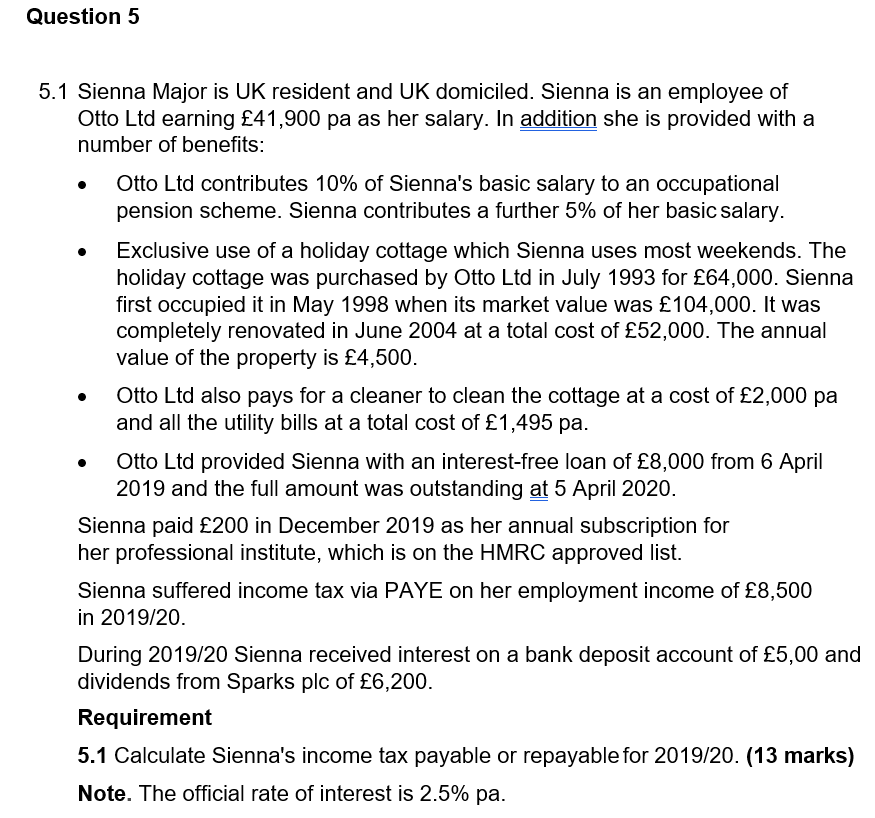

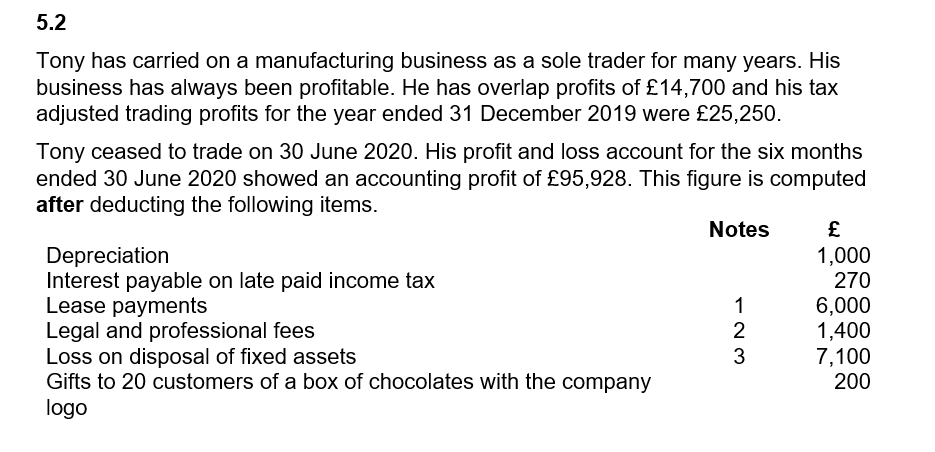

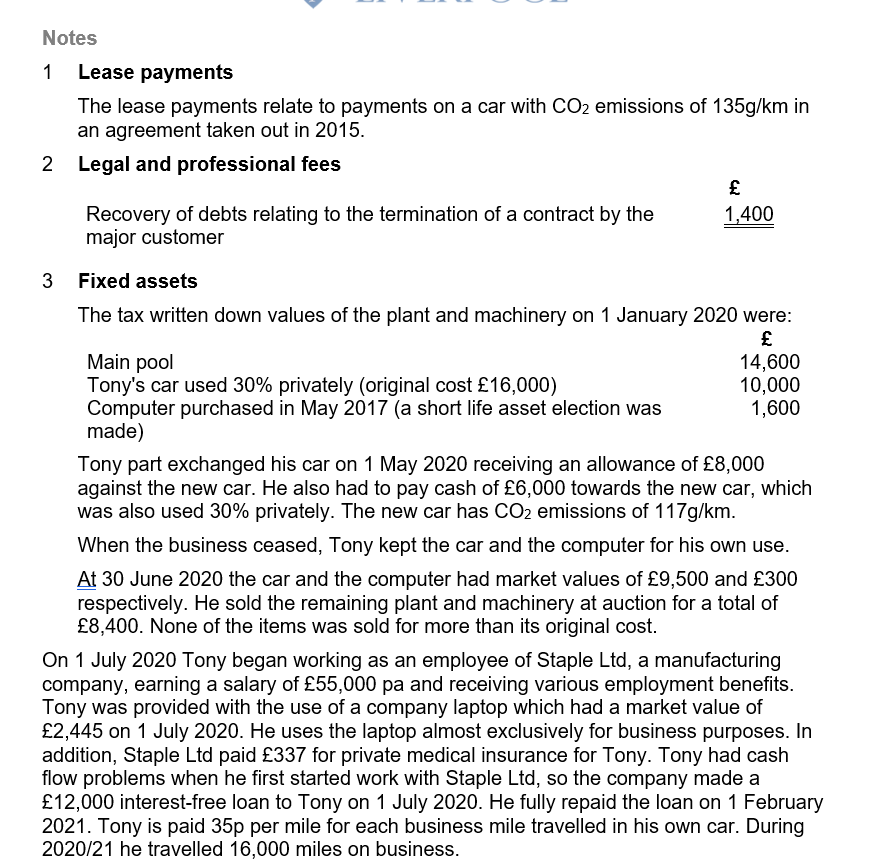

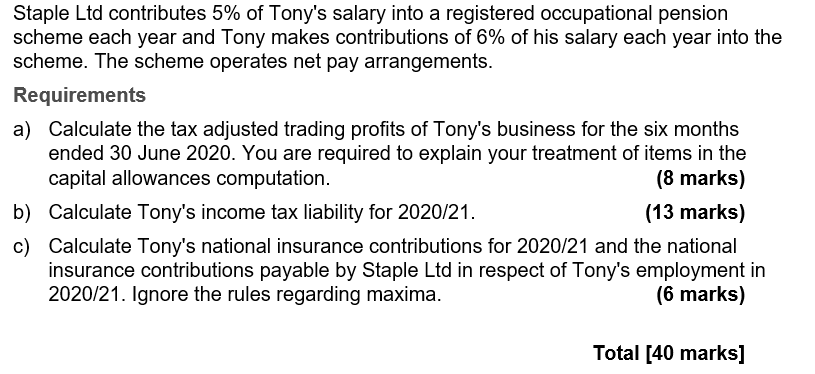

Question 5 . 5.1 Sienna Major is UK resident and UK domiciled. Sienna is an employee of Otto Ltd earning 41,900 pa as her salary. In addition she is provided with a number of benefits: Otto Ltd contributes 10% of Sienna's basic salary to an occupational pension scheme. Sienna contributes a further 5% of her basic salary. Exclusive use of a holiday cottage which Sienna uses most weekends. The holiday cottage was purchased by Otto Ltd in July 1993 for 64,000. Sienna first occupied it in May 1998 when its market value was 104,000. It was completely renovated in June 2004 at a total cost of 52,000. The annual value of the property is 4,500. Otto Ltd also pays for a cleaner to clean the cottage at a cost of 2,000 pa and all the utility bills at a total cost of 1,495 pa. Otto Ltd provided Sienna with an interest-free loan of 8,000 from 6 April 2019 and the full amount was outstanding at 5 April 2020. Sienna paid 200 in December 2019 as her annual subscription for her professional institute, which is on the HMRC approved list. Sienna suffered income tax via PAYE on her employment income of 8,500 in 2019/20. During 2019/20 Sienna received interest on a bank deposit account of 5,00 and dividends from Sparks plc of 6,200. Requirement 5.1 Calculate Sienna's income tax payable or repayable for 2019/20. (13 marks) Note. The official rate of interest is 2.5% pa. . 5.2 Tony has carried on a manufacturing business as a sole trader for many years. His business has always been profitable. He has overlap profits of 14,700 and his tax adjusted trading profits for the year ended 31 December 2019 were 25,250. Tony ceased to trade on 30 June 2020. His profit and loss account for the six months ended 30 June 2020 showed an accounting profit of 95,928. This figure is computed after deducting the following items. Notes Depreciation 1,000 Interest payable on late paid income tax 270 Lease payments 1 6,000 Legal and professional fees 2. 1,400 Loss on disposal of fixed assets 3 7,100 Gifts to 20 customers of a box of chocolates with the company 200 logo Notes 1 Lease payments The lease payments relate to payments on a car with CO2 emissions of 135g/km in an agreement taken out in 2015. 2 Legal and professional fees Recovery of debts relating to the termination of a contract by the 1,400 major customer 3 Fixed assets The tax written down values of the plant and machinery on 1 January 2020 were: Main pool 14,600 Tony's car used 30% privately (original cost 16,000) 10,000 Computer purchased in May 2017 (a short life asset election was 1,600 made) Tony part exchanged his car on 1 May 2020 receiving an allowance of 8,000 against the new car. He also had to pay cash of 6,000 towards the new car, which was also used 30% privately. The new car has CO2 emissions of 117g/km. When the business ceased, Tony kept the car and the computer for his own use. At 30 June 2020 the car and the computer had market values of 9,500 and 300 respectively. He sold the remaining plant and machinery at auction for a total of 8,400. None of the items was sold for more than its original cost. On 1 July 2020 Tony began working as an employee of Staple Ltd, a manufacturing company, earning a salary of 55,000 pa and receiving various employment benefits. Tony was provided with the use of a company laptop which had a market value of 2,445 on 1 July 2020. He uses the laptop almost exclusively for business purposes. In addition, Staple Ltd paid 337 for private medical insurance for Tony. Tony had cash flow problems when he first started work with Staple Ltd, so the company made a 12,000 interest-free loan to Tony on 1 July 2020. He fully repaid the loan on 1 February 2021. Tony is paid 35p per mile for each business mile travelled in his own car. During 2020/21 he travelled 16,000 miles on business. Staple Ltd contributes 5% of Tony's salary into a registered occupational pension scheme each year and Tony makes contributions of 6% of his salary each year into the scheme. The scheme operates net pay arrangements. Requirements a) Calculate the tax adjusted trading profits of Tony's business for the six months ended 30 June 2020. You are required to explain your treatment of items in the capital allowances computation. (8 marks) b) Calculate Tony's income tax liability for 2020/21. (13 marks) c) Calculate Tony's national insurance contributions for 2020/21 and the national insurance contributions payable by Staple Ltd in respect of Tony's employment in 2020/21. Ignore the rules regarding maxima. (6 marks) Total [40 marks] Question 5 . 5.1 Sienna Major is UK resident and UK domiciled. Sienna is an employee of Otto Ltd earning 41,900 pa as her salary. In addition she is provided with a number of benefits: Otto Ltd contributes 10% of Sienna's basic salary to an occupational pension scheme. Sienna contributes a further 5% of her basic salary. Exclusive use of a holiday cottage which Sienna uses most weekends. The holiday cottage was purchased by Otto Ltd in July 1993 for 64,000. Sienna first occupied it in May 1998 when its market value was 104,000. It was completely renovated in June 2004 at a total cost of 52,000. The annual value of the property is 4,500. Otto Ltd also pays for a cleaner to clean the cottage at a cost of 2,000 pa and all the utility bills at a total cost of 1,495 pa. Otto Ltd provided Sienna with an interest-free loan of 8,000 from 6 April 2019 and the full amount was outstanding at 5 April 2020. Sienna paid 200 in December 2019 as her annual subscription for her professional institute, which is on the HMRC approved list. Sienna suffered income tax via PAYE on her employment income of 8,500 in 2019/20. During 2019/20 Sienna received interest on a bank deposit account of 5,00 and dividends from Sparks plc of 6,200. Requirement 5.1 Calculate Sienna's income tax payable or repayable for 2019/20. (13 marks) Note. The official rate of interest is 2.5% pa. . 5.2 Tony has carried on a manufacturing business as a sole trader for many years. His business has always been profitable. He has overlap profits of 14,700 and his tax adjusted trading profits for the year ended 31 December 2019 were 25,250. Tony ceased to trade on 30 June 2020. His profit and loss account for the six months ended 30 June 2020 showed an accounting profit of 95,928. This figure is computed after deducting the following items. Notes Depreciation 1,000 Interest payable on late paid income tax 270 Lease payments 1 6,000 Legal and professional fees 2. 1,400 Loss on disposal of fixed assets 3 7,100 Gifts to 20 customers of a box of chocolates with the company 200 logo Notes 1 Lease payments The lease payments relate to payments on a car with CO2 emissions of 135g/km in an agreement taken out in 2015. 2 Legal and professional fees Recovery of debts relating to the termination of a contract by the 1,400 major customer 3 Fixed assets The tax written down values of the plant and machinery on 1 January 2020 were: Main pool 14,600 Tony's car used 30% privately (original cost 16,000) 10,000 Computer purchased in May 2017 (a short life asset election was 1,600 made) Tony part exchanged his car on 1 May 2020 receiving an allowance of 8,000 against the new car. He also had to pay cash of 6,000 towards the new car, which was also used 30% privately. The new car has CO2 emissions of 117g/km. When the business ceased, Tony kept the car and the computer for his own use. At 30 June 2020 the car and the computer had market values of 9,500 and 300 respectively. He sold the remaining plant and machinery at auction for a total of 8,400. None of the items was sold for more than its original cost. On 1 July 2020 Tony began working as an employee of Staple Ltd, a manufacturing company, earning a salary of 55,000 pa and receiving various employment benefits. Tony was provided with the use of a company laptop which had a market value of 2,445 on 1 July 2020. He uses the laptop almost exclusively for business purposes. In addition, Staple Ltd paid 337 for private medical insurance for Tony. Tony had cash flow problems when he first started work with Staple Ltd, so the company made a 12,000 interest-free loan to Tony on 1 July 2020. He fully repaid the loan on 1 February 2021. Tony is paid 35p per mile for each business mile travelled in his own car. During 2020/21 he travelled 16,000 miles on business. Staple Ltd contributes 5% of Tony's salary into a registered occupational pension scheme each year and Tony makes contributions of 6% of his salary each year into the scheme. The scheme operates net pay arrangements. Requirements a) Calculate the tax adjusted trading profits of Tony's business for the six months ended 30 June 2020. You are required to explain your treatment of items in the capital allowances computation. (8 marks) b) Calculate Tony's income tax liability for 2020/21. (13 marks) c) Calculate Tony's national insurance contributions for 2020/21 and the national insurance contributions payable by Staple Ltd in respect of Tony's employment in 2020/21. Ignore the rules regarding maxima. (6 marks) Total [40 marks]