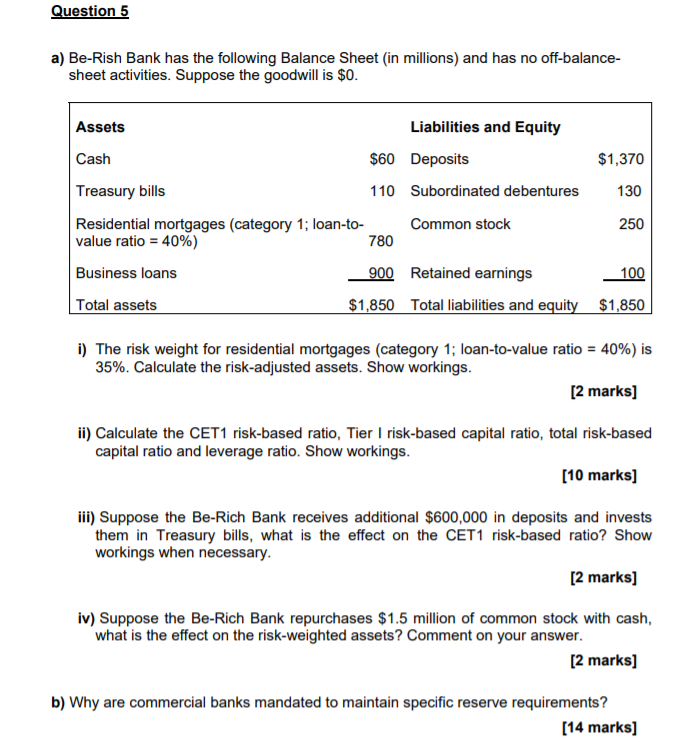

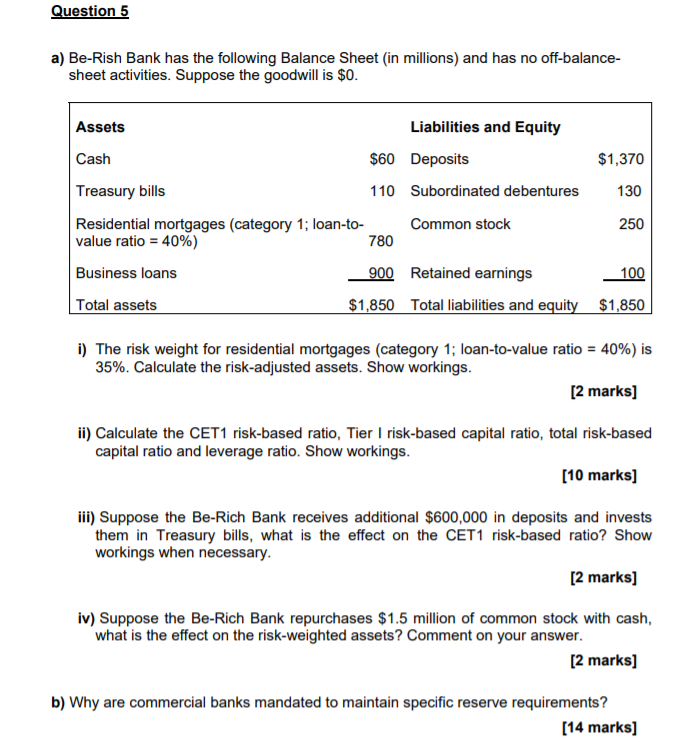

Question 5 a) Be-Rish Bank has the following Balance Sheet (in millions) and has no off-balance- sheet activities. Suppose the goodwill is $0. Assets Liabilities and Equity Cash $60 Deposits $1,370 Treasury bills 110 Subordinated debentures 130 Residential mortgages (category 1; loan-to- Common stock 250 value ratio = 40%) 780 Business loans 900 Retained earnings Total assets $1,850 Total liabilities and equity $1,850 100 i) The risk weight for residential mortgages (category 1; loan-to-value ratio = 40%) is 35%. Calculate the risk-adjusted assets. Show workings. [2 marks] ii) Calculate the CET1 risk-based ratio, Tier I risk-based capital ratio, total risk-based capital ratio and leverage ratio. Show workings. [10 marks] iii) Suppose the Be-Rich Bank receives additional $600,000 in deposits and invests them in Treasury bills, what is the effect on the CET1 risk-based ratio? Show workings when necessary. [2 marks] iv) Suppose the Be-Rich Bank repurchases $1.5 million of common stock with cash, what is the effect on the risk-weighted assets? Comment on your answer. [2 marks] b) Why are commercial banks mandated to maintain specific reserve requirements? [14 marks] Question 5 a) Be-Rish Bank has the following Balance Sheet (in millions) and has no off-balance- sheet activities. Suppose the goodwill is $0. Assets Liabilities and Equity Cash $60 Deposits $1,370 Treasury bills 110 Subordinated debentures 130 Residential mortgages (category 1; loan-to- Common stock 250 value ratio = 40%) 780 Business loans 900 Retained earnings Total assets $1,850 Total liabilities and equity $1,850 100 i) The risk weight for residential mortgages (category 1; loan-to-value ratio = 40%) is 35%. Calculate the risk-adjusted assets. Show workings. [2 marks] ii) Calculate the CET1 risk-based ratio, Tier I risk-based capital ratio, total risk-based capital ratio and leverage ratio. Show workings. [10 marks] iii) Suppose the Be-Rich Bank receives additional $600,000 in deposits and invests them in Treasury bills, what is the effect on the CET1 risk-based ratio? Show workings when necessary. [2 marks] iv) Suppose the Be-Rich Bank repurchases $1.5 million of common stock with cash, what is the effect on the risk-weighted assets? Comment on your answer. [2 marks] b) Why are commercial banks mandated to maintain specific reserve requirements? [14 marks]