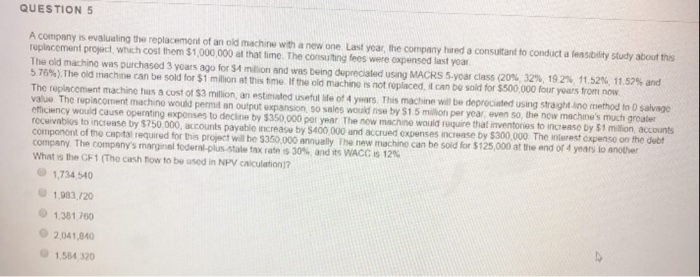

QUESTION 5 A company is evaluating the replacement of an old machine with a new one Last year the company hued a consultant to conduct a feasibility study about this Toplacement project which cost them $1,000,000 at that time. The consulting fees were expensed last year The old machine was purchased 3 years ago for $4 million and was being depreciated using MACRS 5-year class 20% 32% 1925 11.52% 11.52 and 5.76%). The old machine can be sold for $1 million at this time. If the old machine is not replaced. It can be sold for $500.000 four years from now. The replacement machine has a cost of $3 million, an estimated useful le of 4 years. This machine will be depreciated using straighting method to 0 salvage Value The rupiacoment machine would permitan output expansion so sales would rise by $15 milon per year even so, the now machine's much greater chiciency would cause operating exponses to decline by $350,000 per year. The new machine would require that inventories to increase by $1 million accounts receivabios to increase by $750,000, accounts payable increase by 5400 000 and accrued expenses increase by $300,000. The interest expense on the dubt component of the capital required for this project will be $350.000 annually The new machine can be sold for $125,000 at the end of 4 years to another company. The company's marginal fodern-plus stale tax rates 30% and its WACC IS 12% What is the CF1 (The cash flow to be used in NPV Ciculation? 1,734 540 1.983./20 1.381 760 2.041.340 1,584 320 QUESTION 5 A company is evaluating the replacement of an old machine with a new one Last year the company hued a consultant to conduct a feasibility study about this Toplacement project which cost them $1,000,000 at that time. The consulting fees were expensed last year The old machine was purchased 3 years ago for $4 million and was being depreciated using MACRS 5-year class 20% 32% 1925 11.52% 11.52 and 5.76%). The old machine can be sold for $1 million at this time. If the old machine is not replaced. It can be sold for $500.000 four years from now. The replacement machine has a cost of $3 million, an estimated useful le of 4 years. This machine will be depreciated using straighting method to 0 salvage Value The rupiacoment machine would permitan output expansion so sales would rise by $15 milon per year even so, the now machine's much greater chiciency would cause operating exponses to decline by $350,000 per year. The new machine would require that inventories to increase by $1 million accounts receivabios to increase by $750,000, accounts payable increase by 5400 000 and accrued expenses increase by $300,000. The interest expense on the dubt component of the capital required for this project will be $350.000 annually The new machine can be sold for $125,000 at the end of 4 years to another company. The company's marginal fodern-plus stale tax rates 30% and its WACC IS 12% What is the CF1 (The cash flow to be used in NPV Ciculation? 1,734 540 1.983./20 1.381 760 2.041.340 1,584 320