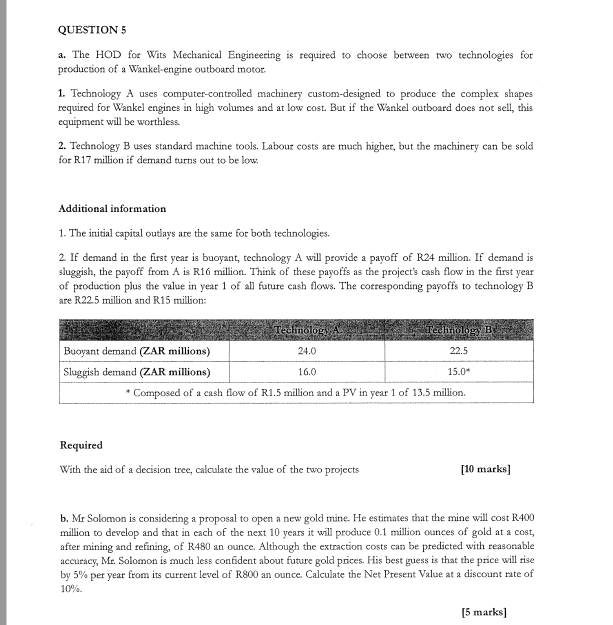

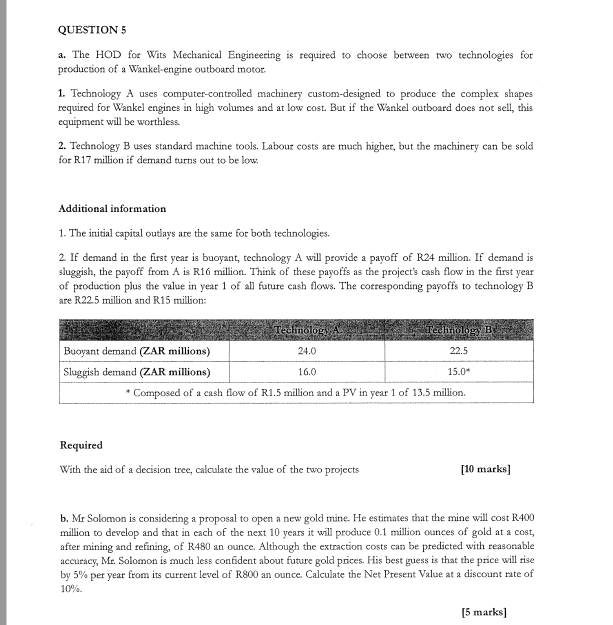

QUESTION 5 a. The HOD for Wits Mechanical Engineering is required to choose between two technologies for production of a Wankel engine outboard motor 1. Technology A uses computer-controlled machinery custom-designed to produce the complex shapes required for Wankel engines in high volumes and at low cost. But if the Wankel outboard does not sell, this equipment will be worthless 2. Technology B uses standard machine tools. Labour costs are much higher, but the machinery can be sold for R17 million if demand turns out to be low Additional information 1. The initial capital outlays are the same for both technologies, 2. If demand in the first year is buoyant, technology A will provide a payoff of R24 million. If demand is sluggish, the payoff from A is R16 million. Think of these payoffs as the project's cash flow in the first year of production plus the value in year 1 of all future cash flows. The corresponding payoffs to technology B are R22.5 million and R15 million Chinolog Buoyant demand (ZAR millions) 24.0 22.5 Sluggish demand (ZAR millions) 15.04 Composed of a cash flow of R1.5 million and a PV in year 1 of 13.5 million. 16.0 Required With the aid of a decision tree, calculate the value of the two projects [10 marks) b. Mr Solomon is considering a proposal to open a new gold mine. He estimates that the mine will cost R400 million to develop and that in each of the next 10 years it will produce 0.1 million ounces of gold at a cost, after mining and refining, of R480 an ounce. Although the extraction costs can be predicted with reasonable accuracy, Mr. Solomon is much less confident about future gold prices. His best guess is that the price will rise by 5% per year from its current level of R800 an ounce. Calculate the Net Present Value at a discount rate of 10%. [5 marks] QUESTION 5 a. The HOD for Wits Mechanical Engineering is required to choose between two technologies for production of a Wankel engine outboard motor 1. Technology A uses computer-controlled machinery custom-designed to produce the complex shapes required for Wankel engines in high volumes and at low cost. But if the Wankel outboard does not sell, this equipment will be worthless 2. Technology B uses standard machine tools. Labour costs are much higher, but the machinery can be sold for R17 million if demand turns out to be low Additional information 1. The initial capital outlays are the same for both technologies, 2. If demand in the first year is buoyant, technology A will provide a payoff of R24 million. If demand is sluggish, the payoff from A is R16 million. Think of these payoffs as the project's cash flow in the first year of production plus the value in year 1 of all future cash flows. The corresponding payoffs to technology B are R22.5 million and R15 million Chinolog Buoyant demand (ZAR millions) 24.0 22.5 Sluggish demand (ZAR millions) 15.04 Composed of a cash flow of R1.5 million and a PV in year 1 of 13.5 million. 16.0 Required With the aid of a decision tree, calculate the value of the two projects [10 marks) b. Mr Solomon is considering a proposal to open a new gold mine. He estimates that the mine will cost R400 million to develop and that in each of the next 10 years it will produce 0.1 million ounces of gold at a cost, after mining and refining, of R480 an ounce. Although the extraction costs can be predicted with reasonable accuracy, Mr. Solomon is much less confident about future gold prices. His best guess is that the price will rise by 5% per year from its current level of R800 an ounce. Calculate the Net Present Value at a discount rate of 10%. [5 marks]