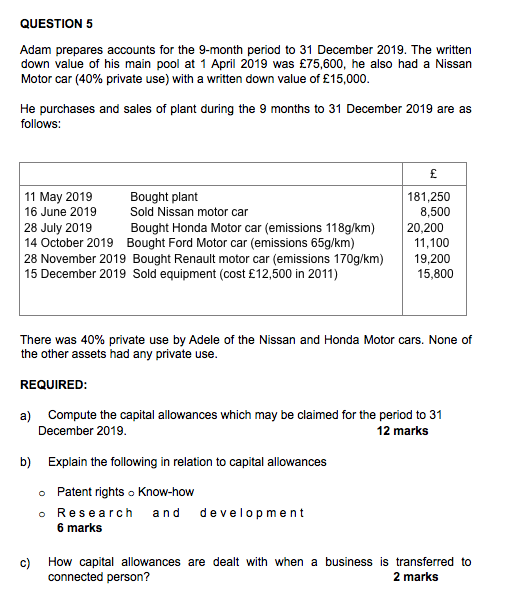

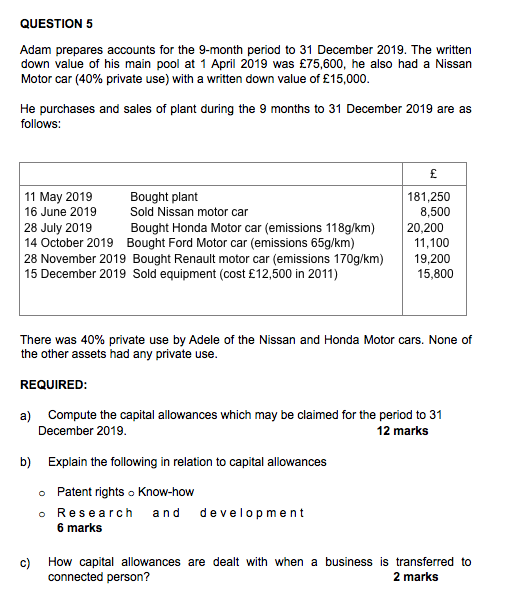

QUESTION 5 Adam prepares accounts for the 9-month period to 31 December 2019. The written down value of his main pool at 1 April 2019 was 75,600, he also had a Nissan Motor car (40% private use) with a written down value of 15,000. He purchases and sales of plant during the 9 months to 31 December 2019 are as follows: 11 May 2019 Bought plant 16 June 2019 Sold Nissan motor car 28 July 2019 Bought Honda Motor car (emissions 118g/km) 14 October 2019 Bought Ford Motor car (emissions 65g/km) 28 November 2019 Bought Renault motor car (emissions 170g/km) 15 December 2019 Sold equipment (cost 12,500 in 2011) 181,250 8,500 20,200 11,100 19,200 15,800 There was 40% private use by Adele of the Nissan and Honda Motor cars. None of the other assets had any private use. REQUIRED: a) Compute the capital allowances which may be claimed for the period to 31 December 2019. 12 marks b) Explain the following in relation to capital allowances o Patent rights o Know-how o Research and development 6 marks c) How capital allowances are dealt with when a business is transferred to connected person? 2 marks QUESTION 5 Adam prepares accounts for the 9-month period to 31 December 2019. The written down value of his main pool at 1 April 2019 was 75,600, he also had a Nissan Motor car (40% private use) with a written down value of 15,000. He purchases and sales of plant during the 9 months to 31 December 2019 are as follows: 11 May 2019 Bought plant 16 June 2019 Sold Nissan motor car 28 July 2019 Bought Honda Motor car (emissions 118g/km) 14 October 2019 Bought Ford Motor car (emissions 65g/km) 28 November 2019 Bought Renault motor car (emissions 170g/km) 15 December 2019 Sold equipment (cost 12,500 in 2011) 181,250 8,500 20,200 11,100 19,200 15,800 There was 40% private use by Adele of the Nissan and Honda Motor cars. None of the other assets had any private use. REQUIRED: a) Compute the capital allowances which may be claimed for the period to 31 December 2019. 12 marks b) Explain the following in relation to capital allowances o Patent rights o Know-how o Research and development 6 marks c) How capital allowances are dealt with when a business is transferred to connected person? 2 marks