Answered step by step

Verified Expert Solution

Question

1 Approved Answer

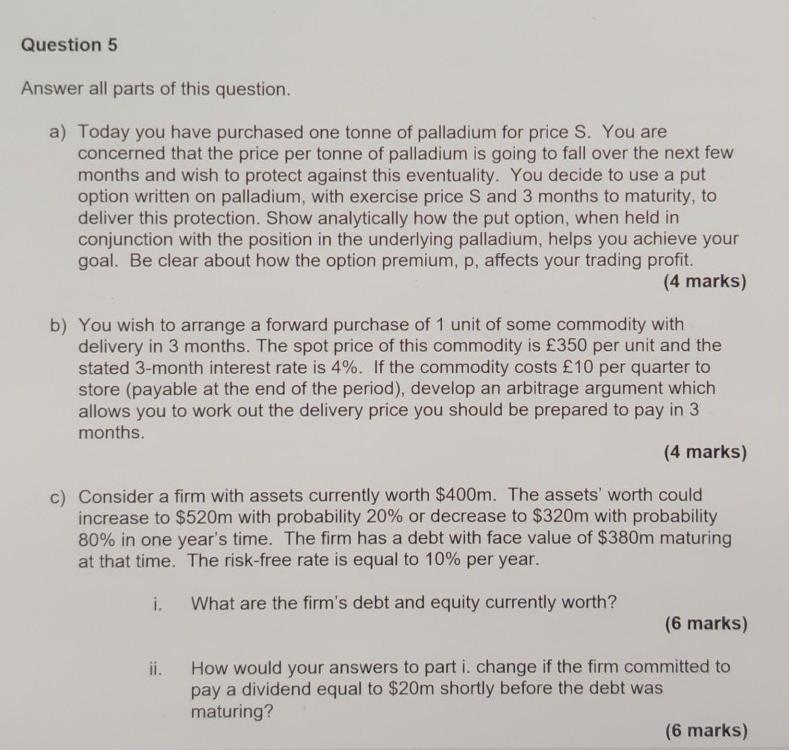

Question 5 Answer all parts of this question. a) Today you have purchased one tonne of palladium for price S. You are concerned that the

Question 5 Answer all parts of this question. a) Today you have purchased one tonne of palladium for price S. You are concerned that the price per tonne of palladium is going to fall over the next few months and wish to protect against this eventuality. You decide to use a put option written on palladium, with exercise price S and 3 months to maturity, to deliver this protection. Show analytically how the put option, when held in conjunction with the position in the underlying palladium, helps you achieve your goal. Be clear about how the option premium, p, affects your trading profit. (4 marks) b) You wish to arrange a forward purchase of 1 unit of some commodity with delivery in 3 months. The spot price of this commodity is 350 per unit and the stated 3-month interest rate is 4%. If the commodity costs 10 per quarter to store (payable at the end of the period), develop an arbitrage argument which allows you to work out the delivery price you should be prepared to pay in 3 months. (4 marks) c) Consider a firm with assets currently worth $400m. The assets' worth could increase to $520m with probability 20% or decrease to $320m with probability 80% in one year's time. The firm has a debt with face value of $380m maturing at that time. The risk-free rate is equal to 10% per year. i. What are the firm's debt and equity currently worth? (6 marks) ii. How would your answers to parti. change if the firm committed to pay a dividend equal to $20m shortly before the debt was maturing? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started