Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Answer saved Marked out of 1.00 P Flag question identifies any collateral pledged against a bond and specifies how it is to be

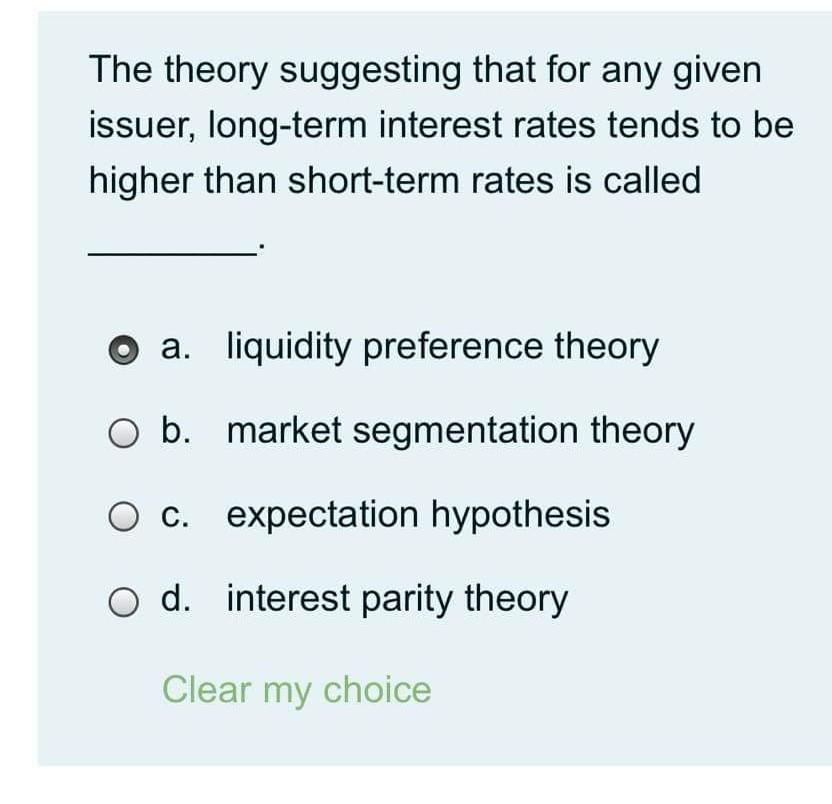

Question 5 Answer saved Marked out of 1.00 P Flag question identifies any collateral pledged against a bond and specifies how it is to be maintained. O a. standard debt provisions O b. Restrictive covenants O c. A trustee d. The bond indenture Clear my choice Which of the following is true of the risk premium? a. T-bills have a have a higher risk premium compared with Treasury bonds. b. The lower-rated corporate issues have a higher risk premium than that of the higher rated corporate issues. c. Junk bonds have a lower risk premium investment-grade bonds. O d. Government bonds have a higher risk premium compared with corporate bonds. Clear my choice Question 8 Answer saved Marked out of 1.00 P Flag question are contractual clauses in long-term debt agreements that place certain operating and financial constraints on the borrower. a. a bond indenture b. Restrictive covenants O C. A trustee O d. Standard debt provisions Clear my choice The theory suggesting that for any given issuer, long-term interest rates tends to be higher than short-term rates is called o a. liquidity preference theory O b. market segmentation theory O c. expectation hypothesis O d. interest parity theory Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started