Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Assume you own a catering firm which you founded five years ago. At the start, you invested 5,000 of your own money in

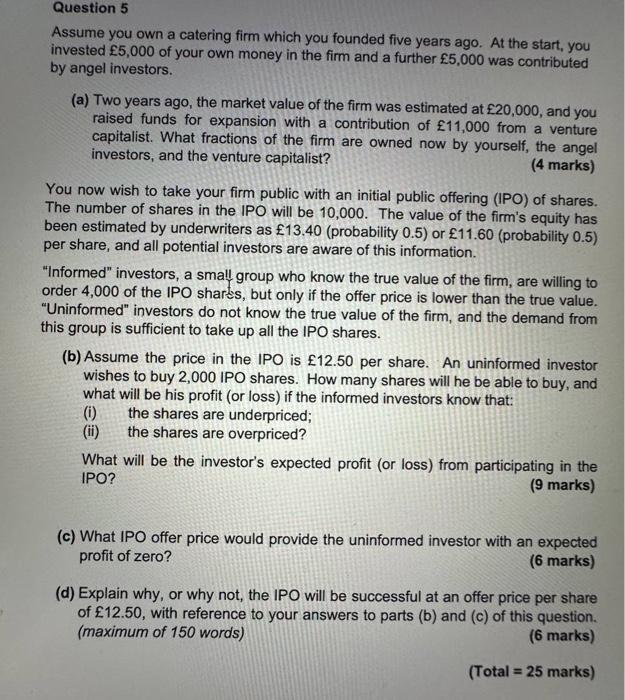

Question 5 Assume you own a catering firm which you founded five years ago. At the start, you invested 5,000 of your own money in the firm and a further 5,000 was contributed by angel investors. (a) Two years ago, the market value of the firm was estimated at 20,000, and you raised funds for expansion with a contribution of 11,000 from a venture capitalist. What fractions of the firm are owned now by yourself, the angel investors, and the venture capitalist? (4 marks) You now wish to take your firm public with an initial public offering (IPO) of shares. The number of shares in the IPO will be 10,000. The value of the firm's equity has been estimated by underwriters as 13.40 (probability 0.5) or 11.60 (probability 0.5) per share, and all potential investors are aware of this information. "Informed" investors, a small group who know the true value of the firm, are willing to order 4,000 of the IPO sharbs, but only if the offer price is lower than the true valu "Uninformed" investors do not know the true value of the firm, and the demand from this group is sufficient to take up all the IPO shares. (b) Assume the price in the IPO is 12.50 per share. An uninformed investor wishes to buy 2,000 IPO shares. How many shares will he be able to buy, and what will be his profit (or loss) if the informed investors know that: (i) the shares are underpriced; the shares are overpriced? What will be the investor's expected profit (or loss) from participating in the IPO? (9 marks) (c) What IPO offer price would provide the uninformed investor with an expected profit of zero? (6 marks) (d) Explain why, or why not, the IPO will be successful at an offer price per share of 12.50, with reference to your answers to parts (b) and (c) of this question. (maximum of 150 words) (6 marks) (Total = 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started