Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 buy (a) A call option on the stock of Jennycliff has an exercise price of $43 and time to maturity of one year.

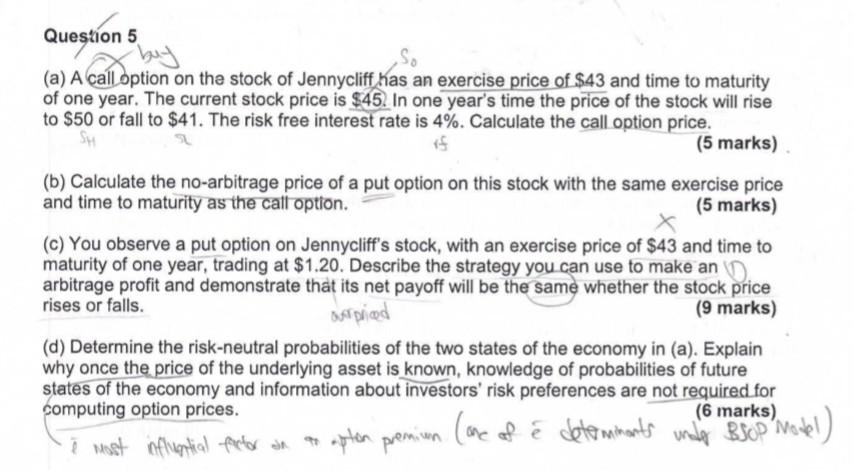

Question 5 buy (a) A call option on the stock of Jennycliff has an exercise price of $43 and time to maturity of one year. The current stock price is $45. In one year's time the price of the stock will rise to $50 or fall to $41. The risk free interest rate is 4%. Calculate the call option price. SH (5 marks) (b) Calculate the no-arbitrage price of a put option on this stock with the same exercise price and time to maturity as the call option. (5 marks) (c) You observe a put option on Jennycliff's stock, with an exercise price of $43 and time to maturity of one year, trading at $1.20. Describe the strategy you can use to make an arbitrage profit and demonstrate that its net payoff will be the same whether the stock price rises or falls. asrpriced (9 marks) (d) Determine the risk-neutral probabilities of the two states of the economy in (a). Explain why once the price of the underlying asset is known, knowledge of probabilities of future states of the economy and information about investors' risk preferences are not required for computing option prices. (6 marks) most influential factor an ao apton premium e (me of determinants unalo nobl) Brop Model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started