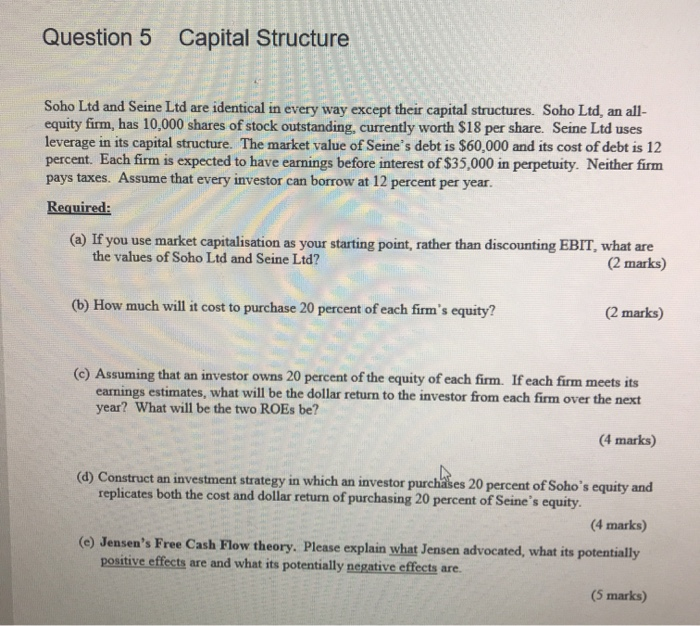

Question 5 Capital Structure Soho Ltd and Seine Ltd are identical in every way except their capital structures. Soho Ltd, an all- equity firm, has 10,000 shares of stock outstanding, currently worth $18 per share. Seine Ltd uses leverage in its capital structure. The market value of Seine's debt is $60,000 and its cost of debt is 12 percent. Each firm is expected to have earnings before interest of $35,000 in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 12 percent per year. Required: (a) If you use market capitalisation as your starting point, rather than discounting EBIT, what are the values of Soho Ltd and Seine Ltd? (2 marks) (b) How much will it cost to purchase 20 percent of each firm's equity? (2 marks) (c) Assuming that an investor owns 20 percent of the equity of each firm. If each firm meets its earnings estimates, what will be the dollar return to the investor from each firm over the next year? What will be the two ROEs be? (4 marks) (d) Construct an investment strategy in which an investor purchases 20 percent of Soho's equity and replicates both the cost and dollar return of purchasing 20 percent of Seine's equity. (4 marks) (e) Jensen's Free Cash Flow theory. Please explain what Jensen advocated, what its potentially positive effects are and what its potentially negative effects are (5 marks) Question 5 Capital Structure Soho Ltd and Seine Ltd are identical in every way except their capital structures. Soho Ltd, an all- equity firm, has 10,000 shares of stock outstanding, currently worth $18 per share. Seine Ltd uses leverage in its capital structure. The market value of Seine's debt is $60,000 and its cost of debt is 12 percent. Each firm is expected to have earnings before interest of $35,000 in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 12 percent per year. Required: (a) If you use market capitalisation as your starting point, rather than discounting EBIT, what are the values of Soho Ltd and Seine Ltd? (2 marks) (b) How much will it cost to purchase 20 percent of each firm's equity? (2 marks) (c) Assuming that an investor owns 20 percent of the equity of each firm. If each firm meets its earnings estimates, what will be the dollar return to the investor from each firm over the next year? What will be the two ROEs be? (4 marks) (d) Construct an investment strategy in which an investor purchases 20 percent of Soho's equity and replicates both the cost and dollar return of purchasing 20 percent of Seine's equity. (4 marks) (e) Jensen's Free Cash Flow theory. Please explain what Jensen advocated, what its potentially positive effects are and what its potentially negative effects are