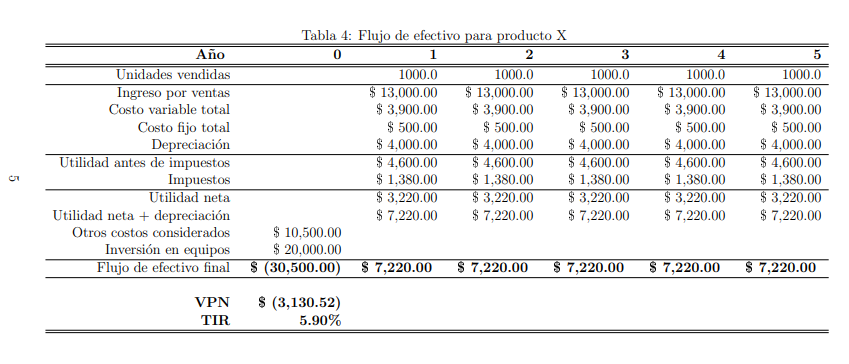

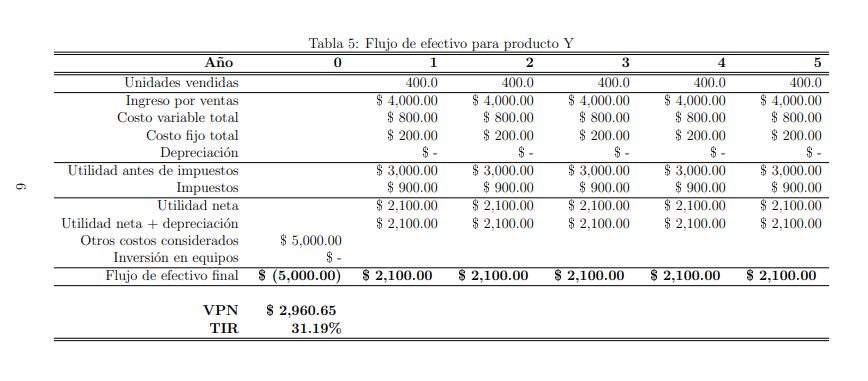

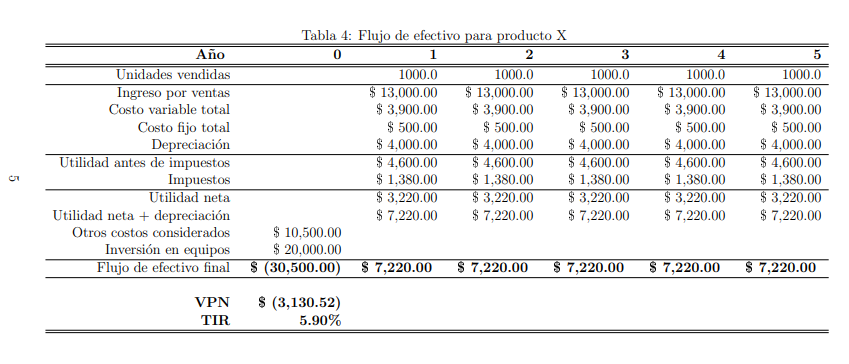

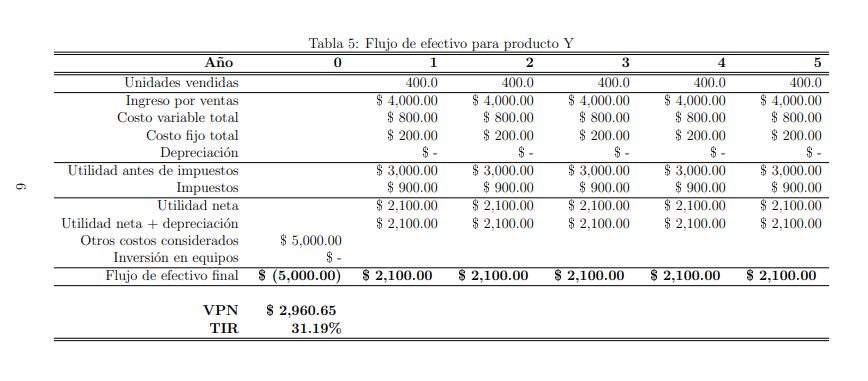

Question 5 (Cash flow from a project): Your company acquired a company several years ago machine for $ 200,000, which has been fully depreciated. The market value of

said machine is $ 15,000 before taxes. The production manager claims that he still It is possible to manufacture 2 types of products using this machine. A work team

developed the project to produce X, and another team developed the project to produce Y. Both projects were analyzed independently. In short, if you want to elaborate

X you need to purchase additional equipment that costs $ 20,000 and has no value of rescue at the end of the project's useful life. On the other hand, it is not necessary to acquire equipment to produce Y. However, to develop the Y project had to hire to a marketing consultant who conducted a market study that cost $ 5,000. Rate

company tax is 30%. Tables 4 and 5 show the project flows.

The discount rate used by the company is 10% per year, the time horizon for both projects is 5 years old and both products cannot be produced at the same time. Assume that both the demand, prices and costs of X and Y are quite precise, and after 5 years none machine (including the old one) has any salvage value.

What observations and / or corrections would you make on the cash flows presented in the Tables 4 and 5? What decision would you make with the information available?

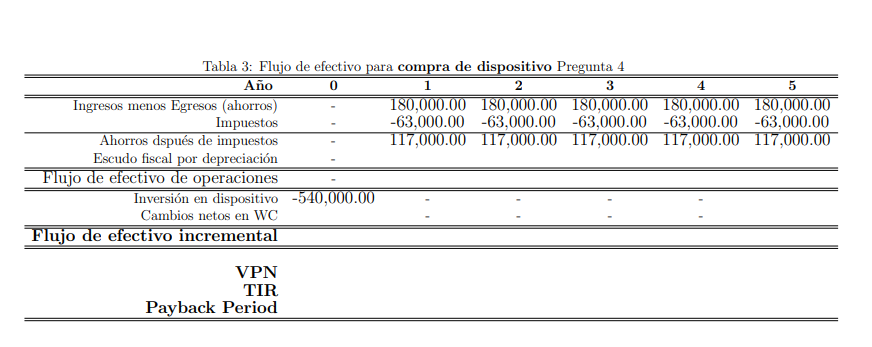

1 3 5 Tabla 3: Flujo de efectivo para compra de dispositivo Pregunta 4 Ao 0 2 4 Ingresos menos Egresos (ahorros) 180,000.00 180,000.00 180,000.00 180,000.00 180,000.00 Impuestos -63,000.00 -63,000.00 -63,000.00 -63,000.00 -63,000.00 Ahorros dspus de impuestos 117,000.00 117,000.00 117,000.00 117,000.00 117,000.00 Escudo fiscal por depreciacin Flujo de efectivo de operaciones Inversin en dispositivo -540,000.00 Cambios netos en WC Flujo de efectivo incremental VPN TIR Payback Period 4 5 Tabla 4: Flujo de efectivo para producto X Ao 0 1 2 3 Unidades vendidas 1000.0 1000.0 1000.0 Ingreso por ventas $ 13,000.00 $ 13,000.00 $ 13,000.00 Costo variable total $ 3,900.00 $ 3,900.00 $3,900.00 Costo fijo total $ 500.00 $ 500.00 $ 500.00 Depreciacin $ 4.000.00 $ 4,000.00 $ 4,000.00 Utilidad antes de impuestos $ 4,600.00 $ 4,600.00 $ 4,600.00 Impuestos $ 1,380.00 $ 1.380.00 $ 1,380.00 Utilidad neta $ 3,220.00 $ 3,220.00 $ 3.220.00 Utilidad neta + depreciacin $ 7.220.00 $ 7.220.00 $ 7,220.00 Otros costos considerados $ 10,500.00 Inversin en equipos $ 20,000.00 Flujo de efectivo final $(30,500.00) $ 7,220.00 $ 7,220.00 $ 7,220.00 1000.0 $ 13,000.00 $ 3,900.00 $ 500.00 $ 4.000.00 $ 4.600.00 $ 1.380.00 $ 3,220.00 $ 7,220.00 1000.0 $ 13,000.00 $ 3,900.00 $ 500.00 $ 4.000.00 $ 4.600.00 $ 1.380.00 $3,220.00 $ 7,220.00 $ 7,220.00 $ 7,220.00 VPN TIR $ (3,130.52) 5.90% 3 4 5 400.0 $ 4,000.00 $ 800.00 $ 200.00 400.0 $ 4,000.00 $ 800.00 $ 200.00 Tabla 5: Flujo de efectivo para producto Y Ao 0 1 2 Unidades vendidas 400.0 400.0 400.0 Ingreso por ventas $ 4,000.00 $ 4,000.00 $ 4.000.00 Costo variable total $ 800.00 $ 800.00 $ 800.00 Costo fijo total $ 200.00 $ 200.00 $ 200.00 Depreciacin $ - $ - $- Utilidad antes de impuestos $ 3.000.00 $ 3.000.00 $ 3.000.00 Impuestos $ 900.00 $ 900.00 $ 900.00 Utilidad neta $ 2,100.00 $ 2,100.00 $ 2,100.00 Utilidad neta + depreciacin $ 2,100.00 $ 2,100.00 $ 2,100.00 Otros costos considerados $ 5,000.00 Inversin en equipos Flujo de efectivo final $ (5,000.00) $2,100.00 $ 2,100.00 $ 2,100.00 $ 3,000.00 $ 900.00 $ 2,100.00 $ 2,100.00 $ 3,000.00 $ 900.00 $ 2,100.00 $ 2,100.00 $ 2,100.00 $ 2,100.00 VPN TIR $ 2,960.65 31.19% 1 3 5 Tabla 3: Flujo de efectivo para compra de dispositivo Pregunta 4 Ao 0 2 4 Ingresos menos Egresos (ahorros) 180,000.00 180,000.00 180,000.00 180,000.00 180,000.00 Impuestos -63,000.00 -63,000.00 -63,000.00 -63,000.00 -63,000.00 Ahorros dspus de impuestos 117,000.00 117,000.00 117,000.00 117,000.00 117,000.00 Escudo fiscal por depreciacin Flujo de efectivo de operaciones Inversin en dispositivo -540,000.00 Cambios netos en WC Flujo de efectivo incremental VPN TIR Payback Period 4 5 Tabla 4: Flujo de efectivo para producto X Ao 0 1 2 3 Unidades vendidas 1000.0 1000.0 1000.0 Ingreso por ventas $ 13,000.00 $ 13,000.00 $ 13,000.00 Costo variable total $ 3,900.00 $ 3,900.00 $3,900.00 Costo fijo total $ 500.00 $ 500.00 $ 500.00 Depreciacin $ 4.000.00 $ 4,000.00 $ 4,000.00 Utilidad antes de impuestos $ 4,600.00 $ 4,600.00 $ 4,600.00 Impuestos $ 1,380.00 $ 1.380.00 $ 1,380.00 Utilidad neta $ 3,220.00 $ 3,220.00 $ 3.220.00 Utilidad neta + depreciacin $ 7.220.00 $ 7.220.00 $ 7,220.00 Otros costos considerados $ 10,500.00 Inversin en equipos $ 20,000.00 Flujo de efectivo final $(30,500.00) $ 7,220.00 $ 7,220.00 $ 7,220.00 1000.0 $ 13,000.00 $ 3,900.00 $ 500.00 $ 4.000.00 $ 4.600.00 $ 1.380.00 $ 3,220.00 $ 7,220.00 1000.0 $ 13,000.00 $ 3,900.00 $ 500.00 $ 4.000.00 $ 4.600.00 $ 1.380.00 $3,220.00 $ 7,220.00 $ 7,220.00 $ 7,220.00 VPN TIR $ (3,130.52) 5.90% 3 4 5 400.0 $ 4,000.00 $ 800.00 $ 200.00 400.0 $ 4,000.00 $ 800.00 $ 200.00 Tabla 5: Flujo de efectivo para producto Y Ao 0 1 2 Unidades vendidas 400.0 400.0 400.0 Ingreso por ventas $ 4,000.00 $ 4,000.00 $ 4.000.00 Costo variable total $ 800.00 $ 800.00 $ 800.00 Costo fijo total $ 200.00 $ 200.00 $ 200.00 Depreciacin $ - $ - $- Utilidad antes de impuestos $ 3.000.00 $ 3.000.00 $ 3.000.00 Impuestos $ 900.00 $ 900.00 $ 900.00 Utilidad neta $ 2,100.00 $ 2,100.00 $ 2,100.00 Utilidad neta + depreciacin $ 2,100.00 $ 2,100.00 $ 2,100.00 Otros costos considerados $ 5,000.00 Inversin en equipos Flujo de efectivo final $ (5,000.00) $2,100.00 $ 2,100.00 $ 2,100.00 $ 3,000.00 $ 900.00 $ 2,100.00 $ 2,100.00 $ 3,000.00 $ 900.00 $ 2,100.00 $ 2,100.00 $ 2,100.00 $ 2,100.00 VPN TIR $ 2,960.65 31.19%