Question

Question 5 Consider an economy in which preferences and technology are the following: A representative household has utility function described by u(c, h) = log(c)

Question 5

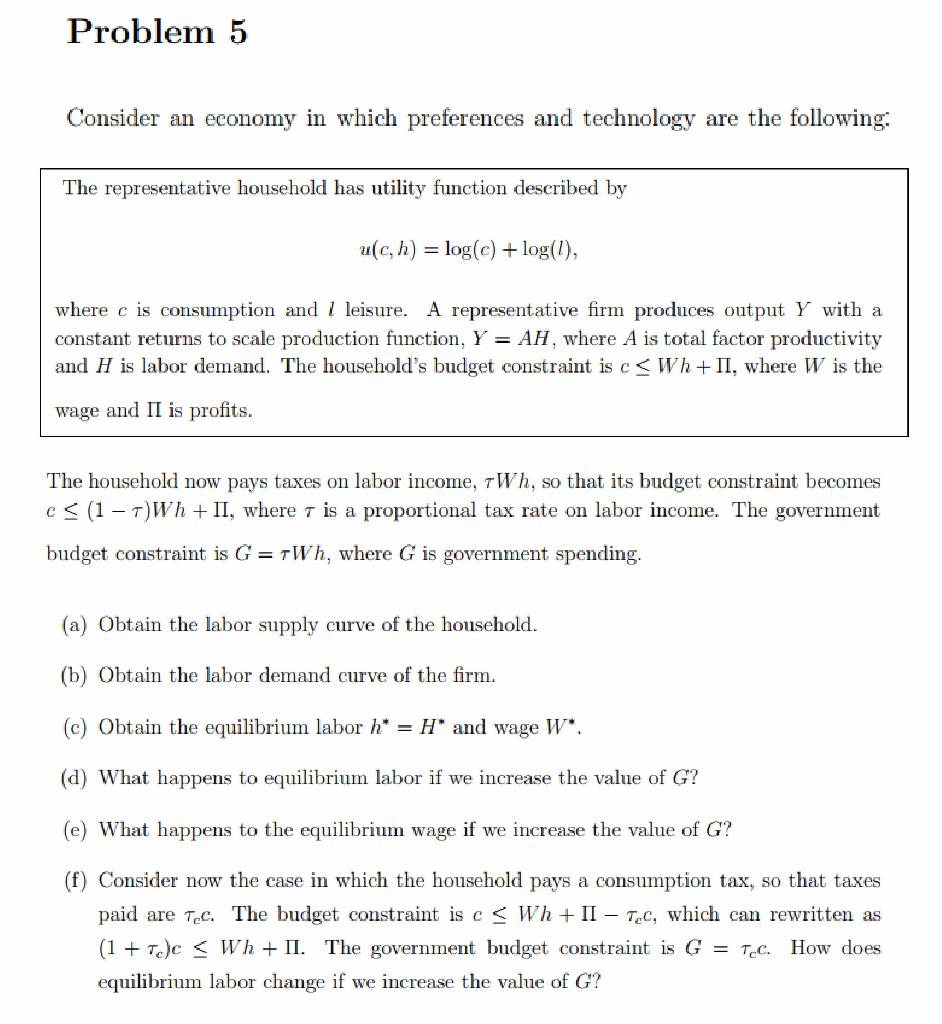

Consider an economy in which preferences and technology are the following:

A representative household has utility function described by u(c, h) = log(c) + log(l), where c is consumption and l leisure. A representative firm produces output Y with a constant returns to scale production function, Y = AH, where A is total factor productivity and H is labor demand. The households budget constraint is c W h + , where W is the wage and is profits.

The household now pays taxes on labor income, W h, so that its budget constraint becomes c (1 )W h + , where is a proportional tax rate on labor income. The government budget constraint is G = W h, where G is government spending.

(a) Obtain the labor supply curve of the household.

(b) Obtain the labor demand curve of the firm.

(c) Obtain the equilibrium labor h = H and wage W .

(d) What happens to equilibrium labor if we increase the value of G?

(e) What happens to the equilibrium wage if we increase the value of G? (f) Consider now the case in which the household pays a consumption tax, so that taxes paid are cc. The budget constraint is c W h + cc, which can rewritten as (1 + c)c W h + . The government budget constraint is G = cc. How does equilibrium labor change if we increase the value of G?

Consider an economy in which preferences and technology are the following: The representative household has utility function described by u(c,h)=log(c)+log(l), where c is consumption and l leisure. A representative firm produces output Y with a constant returns to scale production function, Y=AH, where A is total factor productivity and H is labor demand. The household's budget constraint is cWh+, where W is the wage and is profits. The household now pays taxes on labor income, Wh, so that its budget constraint becomes c(1)Wh+, where is a proportional tax rate on labor income. The government budget constraint is G=Wh, where G is government spending. (a) Obtain the labor supply curve of the household. (b) Obtain the labor demand curve of the firm. (c) Obtain the equilibrium labor h=H and wage W. (d) What happens to equilibrium labor if we increase the value of G ? (e) What happens to the equilibrium wage if we increase the value of G ? (f) Consider now the case in which the household pays a consumption tax, so that taxes paid are cc. The budget constraint is cWh+cc, which can rewritten as (1+c)cWh+. The government budget constraint is G=cc. How does equilibrium labor change if we increase the value of G ? Consider an economy in which preferences and technology are the following: The representative household has utility function described by u(c,h)=log(c)+log(l), where c is consumption and l leisure. A representative firm produces output Y with a constant returns to scale production function, Y=AH, where A is total factor productivity and H is labor demand. The household's budget constraint is cWh+, where W is the wage and is profits. The household now pays taxes on labor income, Wh, so that its budget constraint becomes c(1)Wh+, where is a proportional tax rate on labor income. The government budget constraint is G=Wh, where G is government spending. (a) Obtain the labor supply curve of the household. (b) Obtain the labor demand curve of the firm. (c) Obtain the equilibrium labor h=H and wage W. (d) What happens to equilibrium labor if we increase the value of G ? (e) What happens to the equilibrium wage if we increase the value of G ? (f) Consider now the case in which the household pays a consumption tax, so that taxes paid are cc. The budget constraint is cWh+cc, which can rewritten as (1+c)cWh+. The government budget constraint is G=cc. How does equilibrium labor change if we increase the value of GStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started