Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Consider zero-coupon Treasury bonds, i.e. bonds with zero default risk that do not pay any interest, but only promise to repay the

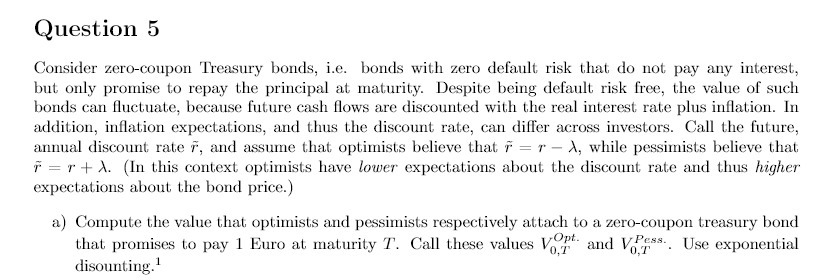

Question 5 Consider zero-coupon Treasury bonds, i.e. bonds with zero default risk that do not pay any interest, but only promise to repay the principal at maturity. Despite being default risk free, the value of such bonds can fluctuate, because future cash flows are discounted with the real interest rate plus inflation. In addition, inflation expectations, and thus the discount rate, can differ across investors. Call the future, annual discount rate , and assume that optimists believe that r, while pessimists believe that =r+A. (In this context optimists have lower expectations about the discount rate and thus higher expectations about the bond price.) a) Compute the value that optimists and pessimists respectively attach to a zero-coupon treasury bond that promises to pay 1 Euro at maturity T. Call these values Vop and Vess. Use exponential disounting. 0,7 0,T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the value that optimists and pessimists respectively attach to a zerocoupon treasu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started