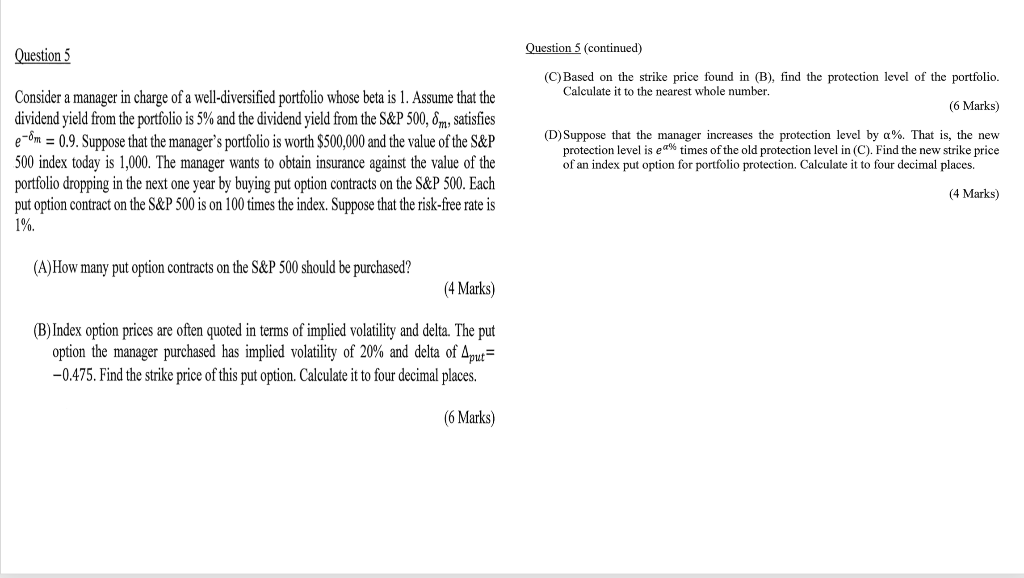

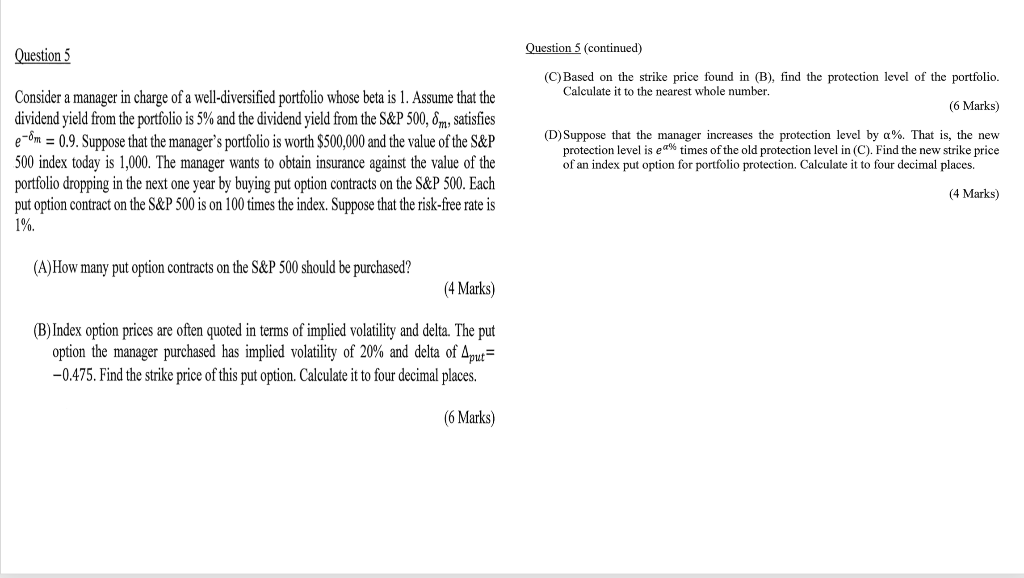

Question 5 (continued) Question 5 (C) Based on the strike price found in (B), find the protection level of the portfolio. Calculate it to the nearest whole number. (6 Marks) Consider a manager in charge of a well-diversified portfolio whose beta is 1. Assume that the dividend yield from the portfolio is 5% and the dividend yield from the S&P 500,8m, satisfies e-Om = 0.9. Suppose that the manager's portfolio is worth $500,000 and the value of the S&P 500 index today is 1,000. The manager wants to obtain insurance against the value of the portfolio dropping in the next one year by buying put option contracts on the S&P 500. Each put option contract on the S&P 500 is on 100 times the index. Suppose that the risk-free rate is 1%. (D) Suppose that the manager increases the protection level by a%. That is, the new protection level is ea% times of the old protection level in (C). Find the new strike price of an index put option for portfolio protection. Calculate it to four decimal places. (4 Marks) (A) How many put option contracts on the S&P 500 should be purchased? (4 Marks) (B) Index option prices are often quoted in terms of implied volatility and delta. The put option the manager purchased has implied volatility of 20% and delta of Aput= -0.475. Find the strike price of this put option. Calculate it to four decimal places. (6 Marks) Question 5 (continued) Question 5 (C) Based on the strike price found in (B), find the protection level of the portfolio. Calculate it to the nearest whole number. (6 Marks) Consider a manager in charge of a well-diversified portfolio whose beta is 1. Assume that the dividend yield from the portfolio is 5% and the dividend yield from the S&P 500,8m, satisfies e-Om = 0.9. Suppose that the manager's portfolio is worth $500,000 and the value of the S&P 500 index today is 1,000. The manager wants to obtain insurance against the value of the portfolio dropping in the next one year by buying put option contracts on the S&P 500. Each put option contract on the S&P 500 is on 100 times the index. Suppose that the risk-free rate is 1%. (D) Suppose that the manager increases the protection level by a%. That is, the new protection level is ea% times of the old protection level in (C). Find the new strike price of an index put option for portfolio protection. Calculate it to four decimal places. (4 Marks) (A) How many put option contracts on the S&P 500 should be purchased? (4 Marks) (B) Index option prices are often quoted in terms of implied volatility and delta. The put option the manager purchased has implied volatility of 20% and delta of Aput= -0.475. Find the strike price of this put option. Calculate it to four decimal places. (6 Marks)