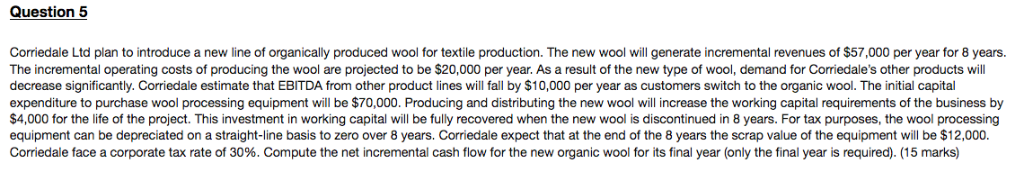

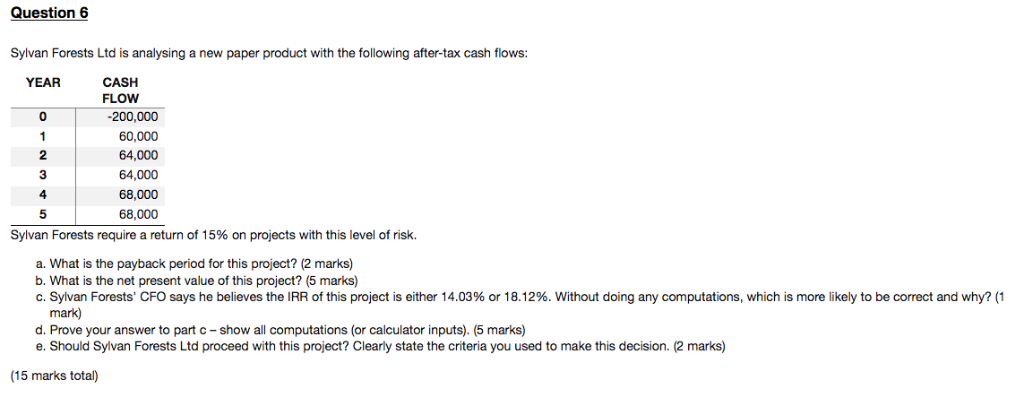

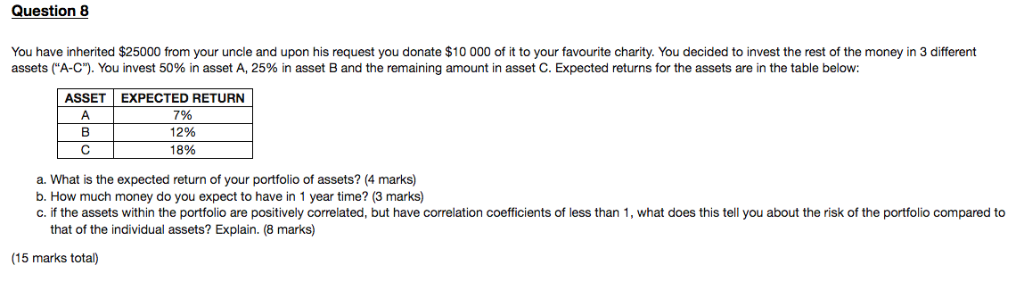

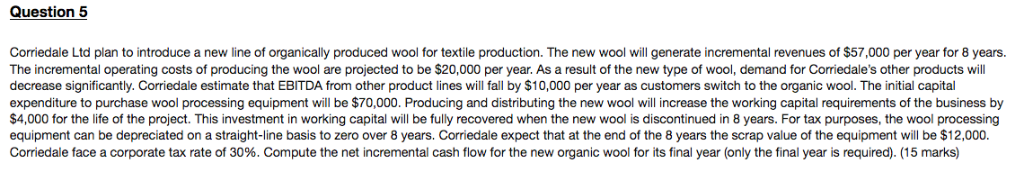

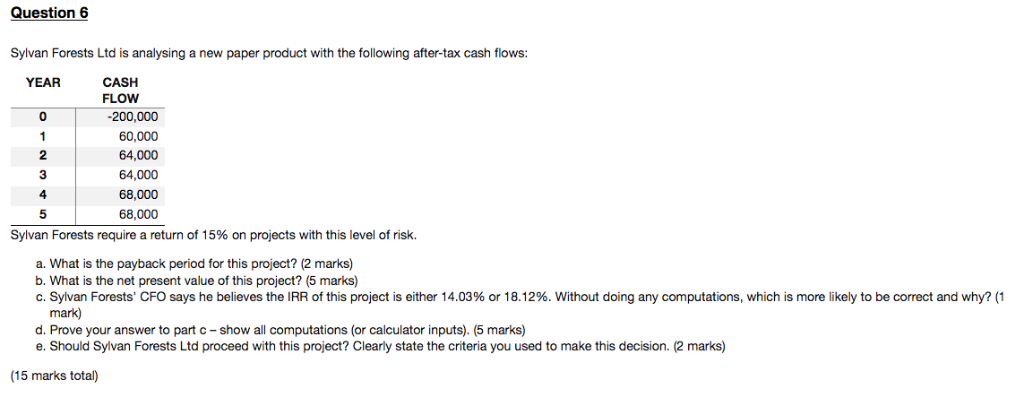

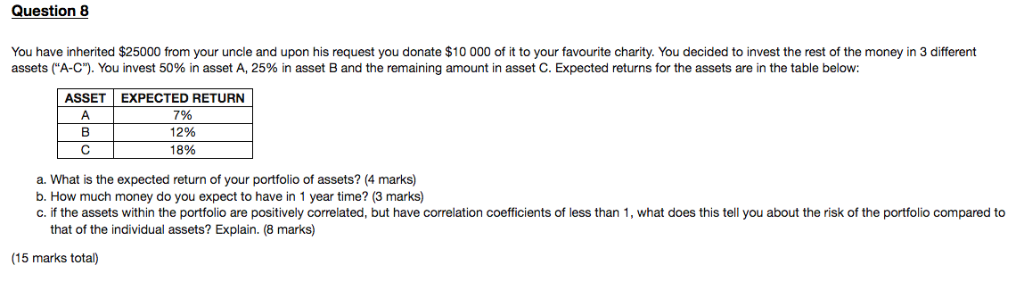

Question 5 Corriedale Ltd plan to introduce a new line of organically produced wool for textile production. The new wool will generate incremental revenues of $57,000 per year for 8 years. The incremental operating costs of producing the wool are projected to be $20,000 per year. As a result of the new type of wool, demand for Corriedale's other products will decrease significantly. Corriedale estimate that EBITDA from other product lines will fall by $10,000 per year as customers switch to the organic wool. The initial capital expenditure to purchase wool processing equipment will be $70,000. Producing and distributing the new wool will increase the working capital requirements of the business by $4,000 for the life of the project. This investment in working capital will be fully recovered when the new wool is discontinued in 8 years. For tax purposes, the wool processing equipment can be depreciated on a straight-line basis to zero over 8 years. Corriedale expect that at the end of the 8 years the scrap value of the equipment will be $12,000 Corriedale face a corporate tax rate of 30%. Compute the net incremental cash flow for the new organic wool for its final year (only the final year is required). (15 marks) Question 6 Sylvan Forests Ltd is analysing a new paper product with the following after-tax cash flows: YEAR CASH FLOW 0 200,000 0 60,000 64,000 64,000 68,000 4 68,000 5 Sylvan Forests require a return of 15% on projects with this level of risk. a. What is the payback period for this project? (2 marks) b. What is the net present value of this project? (5 marks) c. Sylvan Forests CFO says he believes the IRR of this project is either 14.03% or 8. 29 W t doing any comput to s which s more to be el me and d. Prove your answer to part c - show all computations (or calculator inputs). (5 marks) e.Should Sylvan Forests Ltd proceed with this project? Clearly state the criteria you used to make this decision. (2 marks) (15 marks total) Question 8 You have inherited $25000 from your uncle and upon his request you donate $10 000 of it to your favourite charity. You decided to invest the rest of the money in 3 different assets ("A-C"). You invest 50% in asset A, 25% in asset B and the remaining amount in asset C. Expected returns for the assets are in the table below: ASSETEXPECTED RETURN 7% 12% 1896 a. What is the expected return of your portfolio of assets? (4 marks) b. How much money do you expect to have in 1 year time? (3 marks) c. if the assets within the portfolio are positively correlated, but have correlation coefficients of less than 1, what does this tell you about the risk of the portfolio compared to that of the individual assets? Explain. (8 marks) (15 marks total) Question 5 Corriedale Ltd plan to introduce a new line of organically produced wool for textile production. The new wool will generate incremental revenues of $57,000 per year for 8 years. The incremental operating costs of producing the wool are projected to be $20,000 per year. As a result of the new type of wool, demand for Corriedale's other products will decrease significantly. Corriedale estimate that EBITDA from other product lines will fall by $10,000 per year as customers switch to the organic wool. The initial capital expenditure to purchase wool processing equipment will be $70,000. Producing and distributing the new wool will increase the working capital requirements of the business by $4,000 for the life of the project. This investment in working capital will be fully recovered when the new wool is discontinued in 8 years. For tax purposes, the wool processing equipment can be depreciated on a straight-line basis to zero over 8 years. Corriedale expect that at the end of the 8 years the scrap value of the equipment will be $12,000 Corriedale face a corporate tax rate of 30%. Compute the net incremental cash flow for the new organic wool for its final year (only the final year is required). (15 marks) Question 6 Sylvan Forests Ltd is analysing a new paper product with the following after-tax cash flows: YEAR CASH FLOW 0 200,000 0 60,000 64,000 64,000 68,000 4 68,000 5 Sylvan Forests require a return of 15% on projects with this level of risk. a. What is the payback period for this project? (2 marks) b. What is the net present value of this project? (5 marks) c. Sylvan Forests CFO says he believes the IRR of this project is either 14.03% or 8. 29 W t doing any comput to s which s more to be el me and d. Prove your answer to part c - show all computations (or calculator inputs). (5 marks) e.Should Sylvan Forests Ltd proceed with this project? Clearly state the criteria you used to make this decision. (2 marks) (15 marks total) Question 8 You have inherited $25000 from your uncle and upon his request you donate $10 000 of it to your favourite charity. You decided to invest the rest of the money in 3 different assets ("A-C"). You invest 50% in asset A, 25% in asset B and the remaining amount in asset C. Expected returns for the assets are in the table below: ASSETEXPECTED RETURN 7% 12% 1896 a. What is the expected return of your portfolio of assets? (4 marks) b. How much money do you expect to have in 1 year time? (3 marks) c. if the assets within the portfolio are positively correlated, but have correlation coefficients of less than 1, what does this tell you about the risk of the portfolio compared to that of the individual assets? Explain. (8 marks) (15 marks total)