Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 : Credit Risk Assessment You are working for an investment bank's shipping division in charge of credit assessment of clients. You are given

Question : Credit Risk Assessment

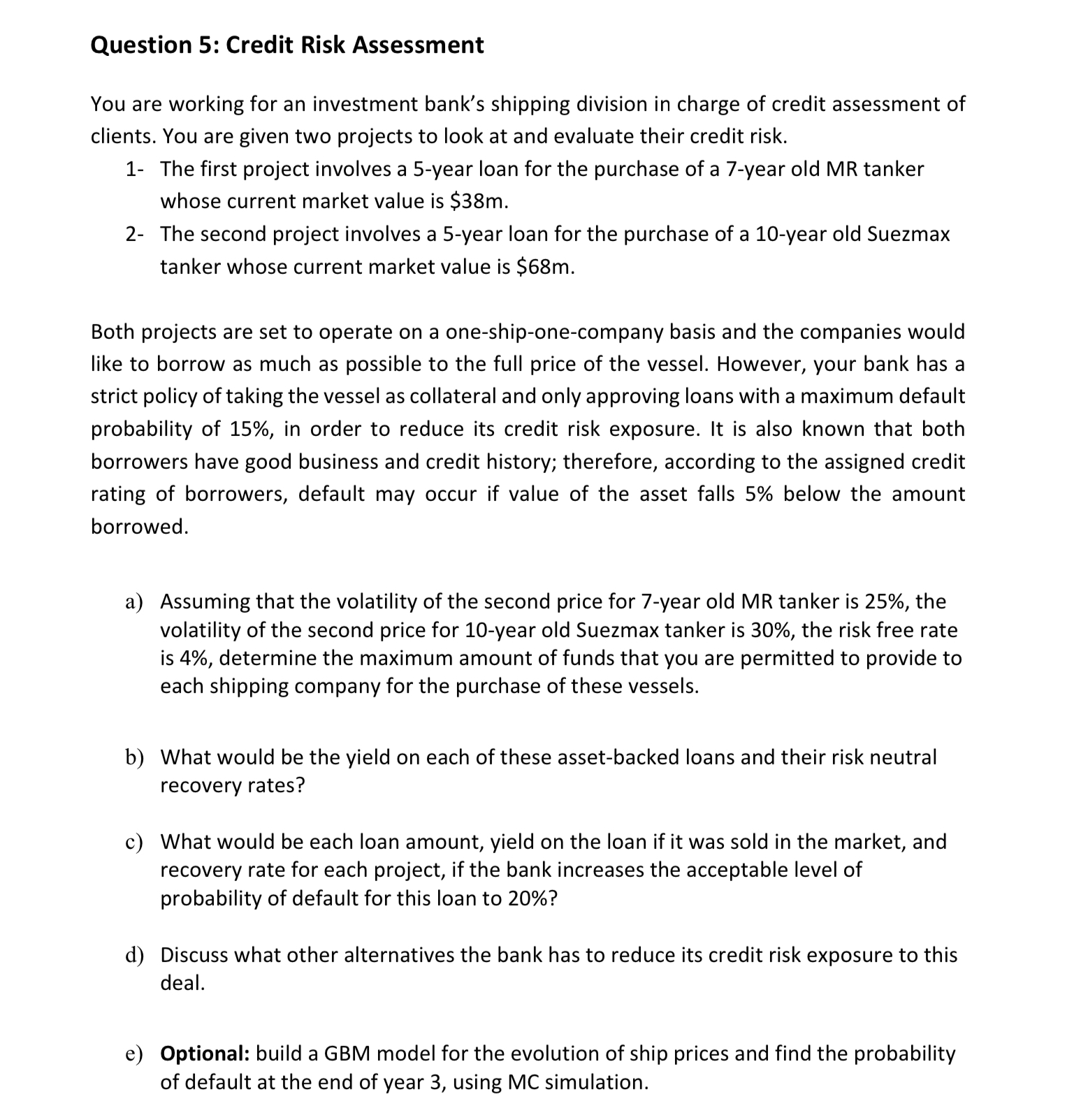

You are working for an investment bank's shipping division in charge of credit assessment of clients. You are given two projects to look at and evaluate their credit risk.

The first project involves a year loan for the purchase of a year old MR tanker whose current market value is $

The second project involves a year loan for the purchase of a year old Suezmax tanker whose current market value is $

Both projects are set to operate on a oneshiponecompany basis and the companies would like to borrow as much as possible to the full price of the vessel. However, your bank has a strict policy of taking the vessel as collateral and only approving loans with a maximum default probability of in order to reduce its credit risk exposure. It is also known that both borrowers have good business and credit history; therefore, according to the assigned credit rating of borrowers, default may occur if value of the asset falls below the amount borrowed.

a Assuming that the volatility of the second price for year old MR tanker is the volatility of the second price for year old Suezmax tanker is the risk free rate is determine the maximum amount of funds that you are permitted to provide to each shipping company for the purchase of these vessels.

b What would be the yield on each of these assetbacked loans and their risk neutral recovery rates?

c What would be each loan amount, yield on the loan if it was sold in the market, and recovery rate for each project, if the bank increases the acceptable level of probability of default for this loan to

d Discuss what other alternatives the bank has to reduce its credit risk exposure to this deal.

e Optional: build a GBM model for the evolution of ship prices and find the probability of default at the end of year using MC simulation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started