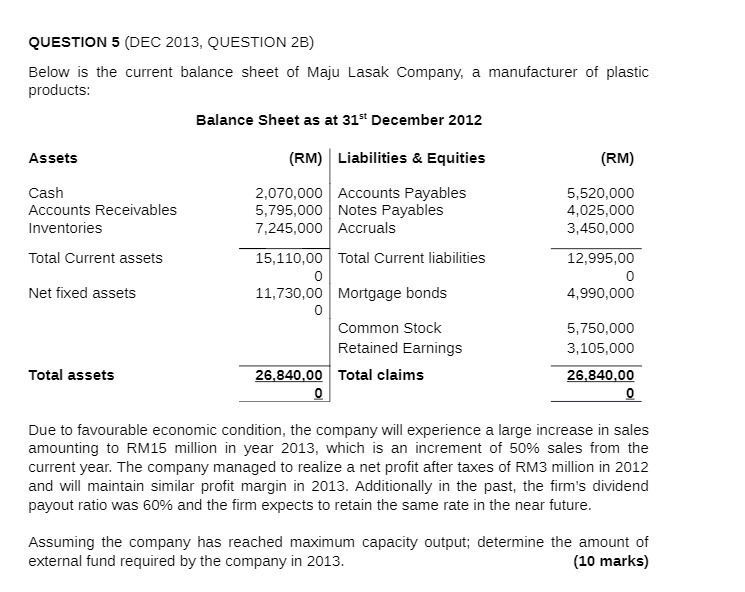

QUESTION 5 (DEC 2013, QUESTION 2B) Below is the current balance sheet of Maju Lasak Company, a manufacturer of plastic products: Balance Sheet as

QUESTION 5 (DEC 2013, QUESTION 2B) Below is the current balance sheet of Maju Lasak Company, a manufacturer of plastic products: Balance Sheet as at 31st December 2012 Assets Cash Accounts Receivables Inventories (RM) Liabilities & Equities (RM) 7,245,000 2,070,000 Accounts Payables 5,795,000 Notes Payables Accruals 5,520,000 4,025,000 3,450,000 Total Current assets 15,110,00 Total Current liabilities 12,995,00 0 0 Net fixed assets 11,730,00 Mortgage bonds 4,990,000 0 Common Stock 5,750,000 Retained Earnings 3,105,000 Total assets 26,840,00 Total claims 26,840,00 0 0 Due to favourable economic condition, the company will experience a large increase in sales amounting to RM15 million in year 2013, which is an increment of 50% sales from the current year. The company managed to realize a net profit after taxes of RM3 million in 2012 and will maintain similar profit margin in 2013. Additionally in the past, the firm's dividend payout ratio was 60% and the firm expects to retain the same rate in the near future. Assuming the company has reached maximum capacity output; determine the amount of external fund required by the company in 2013. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the external funds required by Maju Lasak Company in 2013 we need to follow these steps ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started