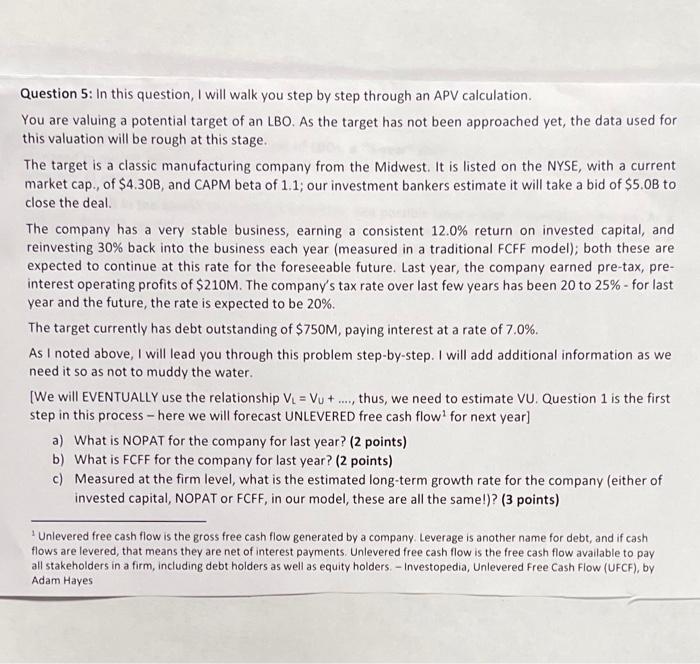

Question 5: In this question, I will walk you step by step through an APV calculation You are valuing a potential target of an LBO. As the target has not been approached yet, the data used for this valuation will be rough at this stage. The target is a classic manufacturing company from the Midwest. It is listed on the NYSE, with a current market cap., of $4.30B, and CAPM beta of 1.1; our investment bankers estimate it will take a bid of $5.00 to close the deal. The company has a very stable business, earning a consistent 12.0% return on invested capital, and reinvesting 30% back into the business each year (measured in a traditional FCFF model); both these are expected to continue at this rate for the foreseeable future. Last year, the company earned pre-tax, pre- interest operating profits of $210M. The company's tax rate over last few years has been 20 to 25%- for last year and the future, the rate is expected to be 20%. The target currently has debt outstanding of $750M, paying interest at a rate of 7.0%. As I noted above, I will lead you through this problem step-by-step. I will add additional information as we need it so as not to muddy the water. [We will EVENTUALLY use the relationship V = Vu + ..., thus, we need to estimate VU. Question 1 is the first step in this process - here we will forecast UNLEVERED free cash flow' for next year] a) What is NOPAT for the company for last year? (2 points) b) What is FCFF for the company for last year? (2 points) c) Measured at the firm level, what is the estimated long-term growth rate for the company (either of invested capital, NOPAT or FCFF, in our model, these are all the same!? (3 points) Unlevered free cash flow is the gross free cash flow generated by a company leverage is another name for debt, and if cash flows are levered, that means they are net of interest payments Unlevered free cash flow is the free cash flow available to pay all stakeholders in a firm, including debt holders as well as equity holders. - Investopedia, Unlevered Free Cash Flow (UFCF), by Adam Hayes Question 5: In this question, I will walk you step by step through an APV calculation You are valuing a potential target of an LBO. As the target has not been approached yet, the data used for this valuation will be rough at this stage. The target is a classic manufacturing company from the Midwest. It is listed on the NYSE, with a current market cap., of $4.30B, and CAPM beta of 1.1; our investment bankers estimate it will take a bid of $5.00 to close the deal. The company has a very stable business, earning a consistent 12.0% return on invested capital, and reinvesting 30% back into the business each year (measured in a traditional FCFF model); both these are expected to continue at this rate for the foreseeable future. Last year, the company earned pre-tax, pre- interest operating profits of $210M. The company's tax rate over last few years has been 20 to 25%- for last year and the future, the rate is expected to be 20%. The target currently has debt outstanding of $750M, paying interest at a rate of 7.0%. As I noted above, I will lead you through this problem step-by-step. I will add additional information as we need it so as not to muddy the water. [We will EVENTUALLY use the relationship V = Vu + ..., thus, we need to estimate VU. Question 1 is the first step in this process - here we will forecast UNLEVERED free cash flow' for next year] a) What is NOPAT for the company for last year? (2 points) b) What is FCFF for the company for last year? (2 points) c) Measured at the firm level, what is the estimated long-term growth rate for the company (either of invested capital, NOPAT or FCFF, in our model, these are all the same!? (3 points) Unlevered free cash flow is the gross free cash flow generated by a company leverage is another name for debt, and if cash flows are levered, that means they are net of interest payments Unlevered free cash flow is the free cash flow available to pay all stakeholders in a firm, including debt holders as well as equity holders. - Investopedia, Unlevered Free Cash Flow (UFCF), by Adam Hayes