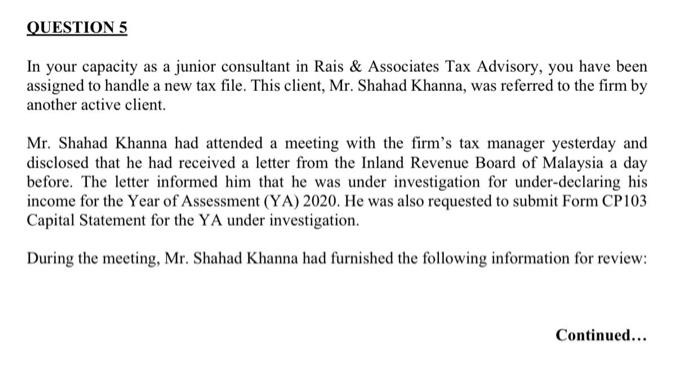

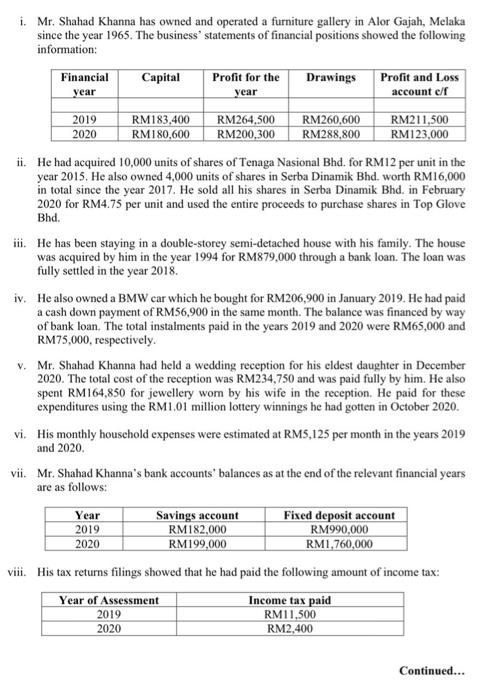

QUESTION 5 In your capacity as a junior consultant in Rais & Associates Tax Advisory, you have been assigned to handle a new tax file. This client, Mr. Shahad Khanna, was referred to the firm by another active client. Mr. Shahad Khanna had attended a meeting with the firm's tax manager yesterday and disclosed that he had received a letter from the Inland Revenue Board of Malaysia a day before. The letter informed him that he was under investigation for under-declaring his income for the Year of Assessment (YA) 2020. He was also requested to submit Form CP103 Capital Statement for the YA under investigation. During the meeting, Mr. Shahad Khanna had furnished the following information for review: Continued... i. Mr. Shahad Khanna has owned and operated a furniture gallery in Alor Gajah, Melaka since the year 1965. The business' statements of financial positions showed the following information: Financial Capital year Profit for the year Drawings Profit and Loss account c/f 2019 RM183,400 RM264,500 RM260,600 RM211,500 2020 RM180,600 RM200,300 RM288,800 RM123,000 ii. He had acquired 10,000 units of shares of Tenaga Nasional Bhd. for RM12 per unit in the year 2015. He also owned 4,000 units of shares in Serba Dinamik Bhd. worth RM16,000 in total since the year 2017. He sold all his shares in Serba Dinamik Bhd. in February 2020 for RM4.75 per unit and used the entire proceeds to purchase shares in Top Glove Bhd. iii. He has been staying in a double-storey semi-detached house with his family. The house was acquired by him in the year 1994 for RM879,000 through a bank loan. The loan was fully settled in the year 2018. iv. He also owned a BMW car which he bought for RM206,900 in January 2019. He had paid a cash down payment of RM56,900 in the same month. The balance was financed by way of bank loan. The total instalments paid in the years 2019 and 2020 were RM65,000 and RM75,000, respectively. v. Mr. Shahad Khanna had held a wedding reception for his eldest daughter in December 2020. The total cost of the reception was RM234,750 and was paid fully by him. He also spent RM164,850 for jewellery worn by his wife in the reception. He paid for these expenditures using the RM1.01 million lottery winnings he had gotten in October 2020. vi. His monthly household expenses were estimated at RM5,125 per month in the years 2019 and 2020. vii. Mr. Shahad Khanna's bank accounts' balances as at the end of the relevant financial years are as follows: Year 2019 Savings account RM182,000 RM199,000 Fixed deposit account RM990,000 RM1,760,000 2020 viii. His tax returns filings showed that he had paid the following amount of income tax: Year of Assessment 2019 Income tax paid RM11,500 RM2,400 2020 Continued... At the end of the meeting, the tax manager informed Mr. Shahad Khanna's to come again in three days to discuss the findings on his case by the firm. Required: Determine whether there is any understatement of income by way of capital accretion method for the YA under investigation to be presented to Mr. Shahad Khanna during his subsequent meeting with the tax manager. (20 marks) QUESTION 5 In your capacity as a junior consultant in Rais & Associates Tax Advisory, you have been assigned to handle a new tax file. This client, Mr. Shahad Khanna, was referred to the firm by another active client. Mr. Shahad Khanna had attended a meeting with the firm's tax manager yesterday and disclosed that he had received a letter from the Inland Revenue Board of Malaysia a day before. The letter informed him that he was under investigation for under-declaring his income for the Year of Assessment (YA) 2020. He was also requested to submit Form CP103 Capital Statement for the YA under investigation. During the meeting, Mr. Shahad Khanna had furnished the following information for review: Continued... i. Mr. Shahad Khanna has owned and operated a furniture gallery in Alor Gajah, Melaka since the year 1965. The business' statements of financial positions showed the following information: Financial Capital year Profit for the year Drawings Profit and Loss account c/f 2019 RM183,400 RM264,500 RM260,600 RM211,500 2020 RM180,600 RM200,300 RM288,800 RM123,000 ii. He had acquired 10,000 units of shares of Tenaga Nasional Bhd. for RM12 per unit in the year 2015. He also owned 4,000 units of shares in Serba Dinamik Bhd. worth RM16,000 in total since the year 2017. He sold all his shares in Serba Dinamik Bhd. in February 2020 for RM4.75 per unit and used the entire proceeds to purchase shares in Top Glove Bhd. iii. He has been staying in a double-storey semi-detached house with his family. The house was acquired by him in the year 1994 for RM879,000 through a bank loan. The loan was fully settled in the year 2018. iv. He also owned a BMW car which he bought for RM206,900 in January 2019. He had paid a cash down payment of RM56,900 in the same month. The balance was financed by way of bank loan. The total instalments paid in the years 2019 and 2020 were RM65,000 and RM75,000, respectively. v. Mr. Shahad Khanna had held a wedding reception for his eldest daughter in December 2020. The total cost of the reception was RM234,750 and was paid fully by him. He also spent RM164,850 for jewellery worn by his wife in the reception. He paid for these expenditures using the RM1.01 million lottery winnings he had gotten in October 2020. vi. His monthly household expenses were estimated at RM5,125 per month in the years 2019 and 2020. vii. Mr. Shahad Khanna's bank accounts' balances as at the end of the relevant financial years are as follows: Year 2019 Savings account RM182,000 RM199,000 Fixed deposit account RM990,000 RM1,760,000 2020 viii. His tax returns filings showed that he had paid the following amount of income tax: Year of Assessment 2019 Income tax paid RM11,500 RM2,400 2020 Continued... At the end of the meeting, the tax manager informed Mr. Shahad Khanna's to come again in three days to discuss the findings on his case by the firm. Required: Determine whether there is any understatement of income by way of capital accretion method for the YA under investigation to be presented to Mr. Shahad Khanna during his subsequent meeting with the tax manager. (20 marks)