Answered step by step

Verified Expert Solution

Question

1 Approved Answer

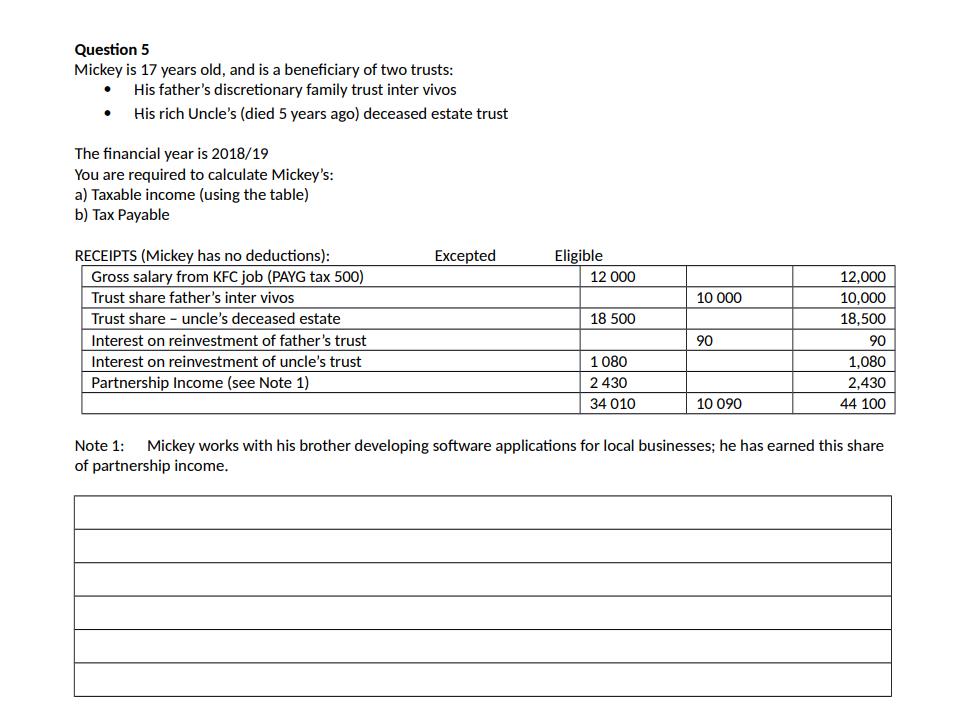

Question 5 Mickey is 17 years old, and is a beneficiary of two trusts: His father's discretionary family trust inter vivos His rich Uncle's

Question 5 Mickey is 17 years old, and is a beneficiary of two trusts: His father's discretionary family trust inter vivos His rich Uncle's (died 5 years ago) deceased estate trust The financial year is 2018/19 You are required to calculate Mickey's: a) Taxable income (using the table) b) Tax Payable RECEIPTS (Mickey has no deductions): Gross salary from KFC job (PAYG tax 500) Trust share father's inter vivos Trust share - uncle's deceased estate Interest on reinvestment of father's trust Interest on reinvestment of uncle's trust Partnership Income (see Note 1) Excepted Eligible 12 000 12,000 10 000 10,000 18 500 18,500 90 90 1080 2430 34 010 10 090 1,080 2,430 44 100 Note 1: Mickey works with his brother developing software applications for local businesses; he has earned this share of partnership income.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Mickeys taxable income and tax payable for the financial year 201819 we will consider t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started