Answered step by step

Verified Expert Solution

Question

1 Approved Answer

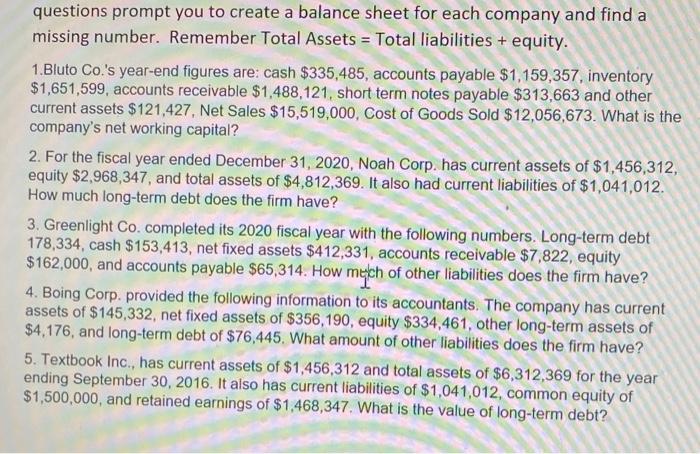

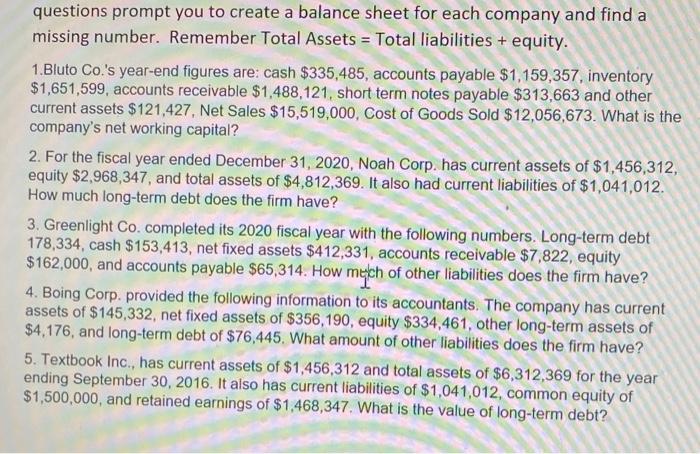

question 5 missing number. Remember Total Assets = Total liabilities + equity. 1.Bluto Co.'s year-end figures are: cash $335,485, accounts payable $1,159,357, inventory $1,651,599, accounts

question 5

missing number. Remember Total Assets = Total liabilities + equity. 1.Bluto Co.'s year-end figures are: cash $335,485, accounts payable $1,159,357, inventory $1,651,599, accounts receivable $1,488,121, short term notes payable $313,663 and other current assets $121,427, Net Sales $15,519,000, Cost of Goods Sold $12,056,673. What is the company's net working capital? 2. For the fiscal year ended December 31,2020 , Noah Corp. has current assets of $1,456,312, equity $2,968,347, and total assets of $4,812,369. It also had current liabilities of $1,041,012. How much long-term debt does the firm have? 3. Greenlight Co. completed its 2020 fiscal year with the following numbers. Long-term debt 178,334 , cash $153,413, net fixed assets $412,331, accounts receivable $7,822, equity $162,000, and accounts payable $65,314. How mejch of other liabilities does the firm have? 4. Boing Corp. provided the following information to its accountants. The company has current assets of $145,332, net fixed assets of $356,190, equity $334,461, other long-term assets of $4,176, and long-term debt of $76,445. What amount of other liabilities does the firm have? 5. Textbook Inc., has current assets of $1,456,312 and total assets of $6,312,369 for the year ending September 30,2016 . It also has current liabilities of $1,041,012, common equity of $1,500,000, and retained earnings of $1,468,347. What is the value of long-term debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started