Answered step by step

Verified Expert Solution

Question

1 Approved Answer

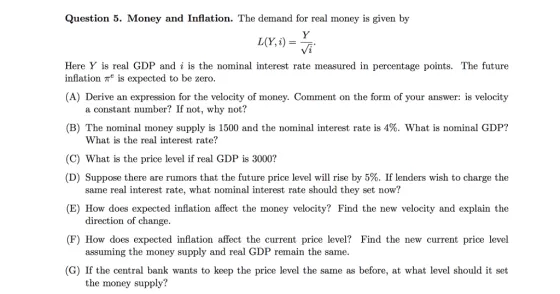

Question 5. Money and Inflation. The demand for real money is given by Y Vi L(Y,s) = Here Y is real GDP and i

Question 5. Money and Inflation. The demand for real money is given by Y Vi L(Y,s) = Here Y is real GDP and i is the nominal interest rate measured in percentage points. The future inflation is expected to be zero. (A) Derive an expression for the velocity of money. Comment on the form of your answer: is velocity a constant number? If not, why not? (B) The nominal money supply is 1500 and the nominal interest rate is 4%. What is nominal GDP? What is the real interest rate? (C) What is the price level if real GDP is 3000? (D) Suppose there are rumors that the future price level will rise by 5%. If lenders wish to charge the same real interest rate, what nominal interest rate should they set now? (E) How does expected inflation affect the money velocity? Find the new velocity and explain the direction of change. (F) How does expected inflation affect the current price level? Find the new current price level assuming the money supply and real GDP remain the same. (G) If the central bank wants to keep the price level the same as before, at what level should it set the money supply?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Money and Inflation Velocity of Money A Velocity of Money The velocity of money V is the number of times money changes hands within an economy in a given period We can derive it using the quantity equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started