Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Not yet answered Marked out of 1.00 ABC CO. Ltd is trying to determine the initial investment required to replace an old machine

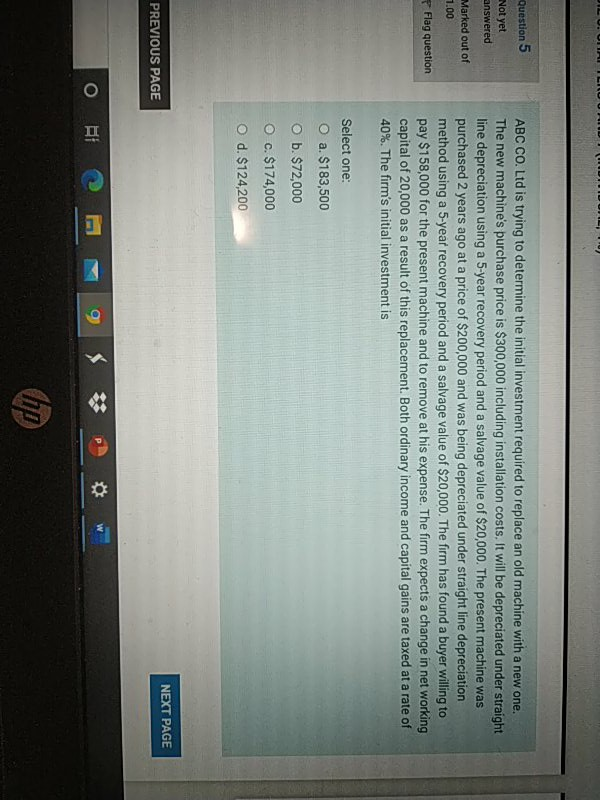

Question 5 Not yet answered Marked out of 1.00 ABC CO. Ltd is trying to determine the initial investment required to replace an old machine with a new one. The new machine's purchase price is $300,000 including installation costs. It will be depreciated under straight line depreciation using a 5-year recovery period and a salvage value of $20,000. The present machine was purchased 2 years ago at a price of $200,000 and was being depreciated under straight line depreciation method using a 5-year recovery period and a salvage value of $20,000. The firm has found a buyer willing to pay $158,000 for the present machine and to remove at his expense. The firm expects a change in net working capital of 20,000 as a result of this replacement. Both ordinary income and capital gains are taxed at a rate of 40%. The firm's initial investment is Flag question Select one: O a. $183,500 O b. $72,000 O c. $174,000 O d. $124,200 NEXT PAGE PREVIOUS PAGE & O II hp Question 5 Not yet answered Marked out of 1.00 ABC CO. Ltd is trying to determine the initial investment required to replace an old machine with a new one. The new machine's purchase price is $300,000 including installation costs. It will be depreciated under straight line depreciation using a 5-year recovery period and a salvage value of $20,000. The present machine was purchased 2 years ago at a price of $200,000 and was being depreciated under straight line depreciation method using a 5-year recovery period and a salvage value of $20,000. The firm has found a buyer willing to pay $158,000 for the present machine and to remove at his expense. The firm expects a change in net working capital of 20,000 as a result of this replacement. Both ordinary income and capital gains are taxed at a rate of 40%. The firm's initial investment is Flag question Select one: O a. $183,500 O b. $72,000 O c. $174,000 O d. $124,200 NEXT PAGE PREVIOUS PAGE & O II hp

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started