Answered step by step

Verified Expert Solution

Question

1 Approved Answer

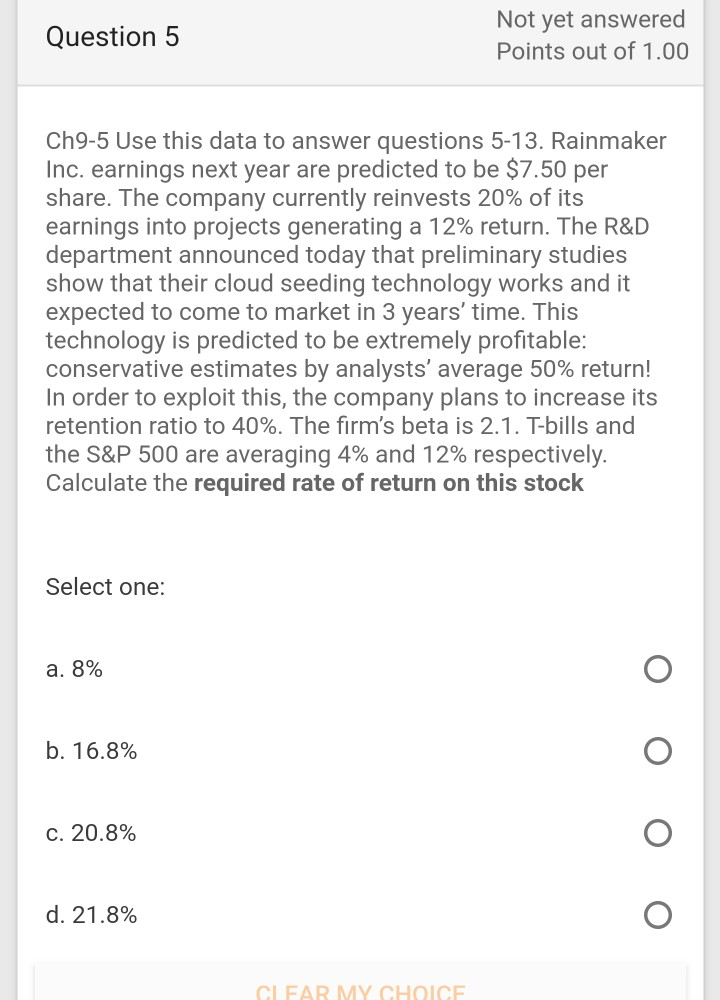

Question 5 Not yet answered Points out of 1.00 Ch9-5 Use this data to answer questions 5-13. Rainmaker Inc. earnings next year are predicted to

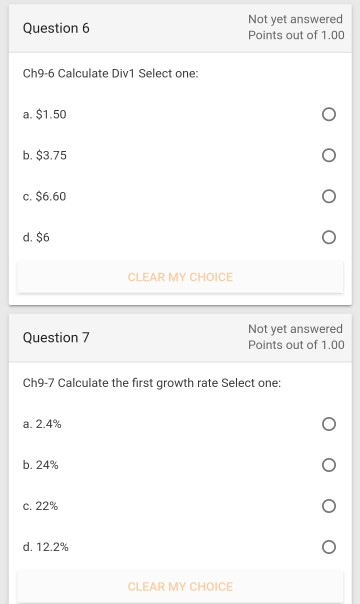

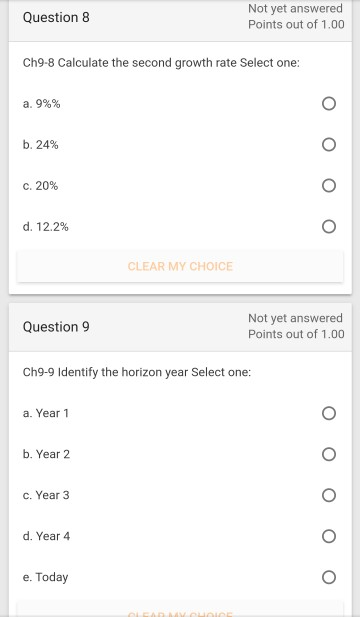

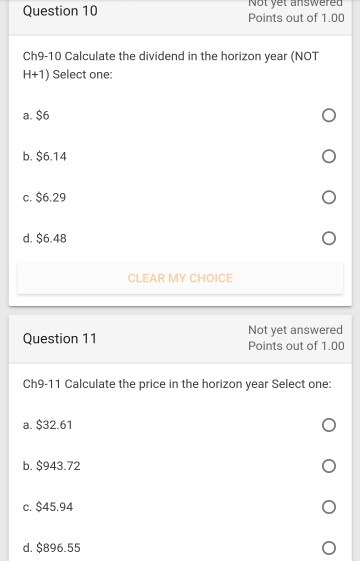

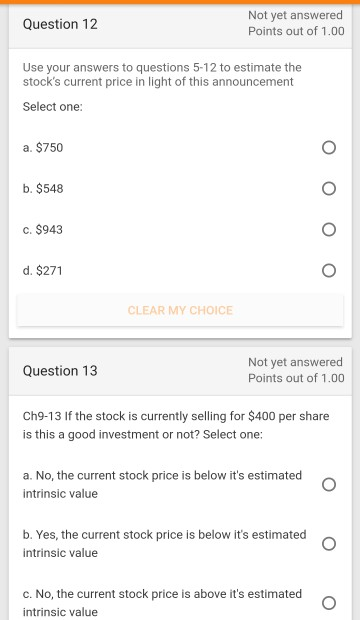

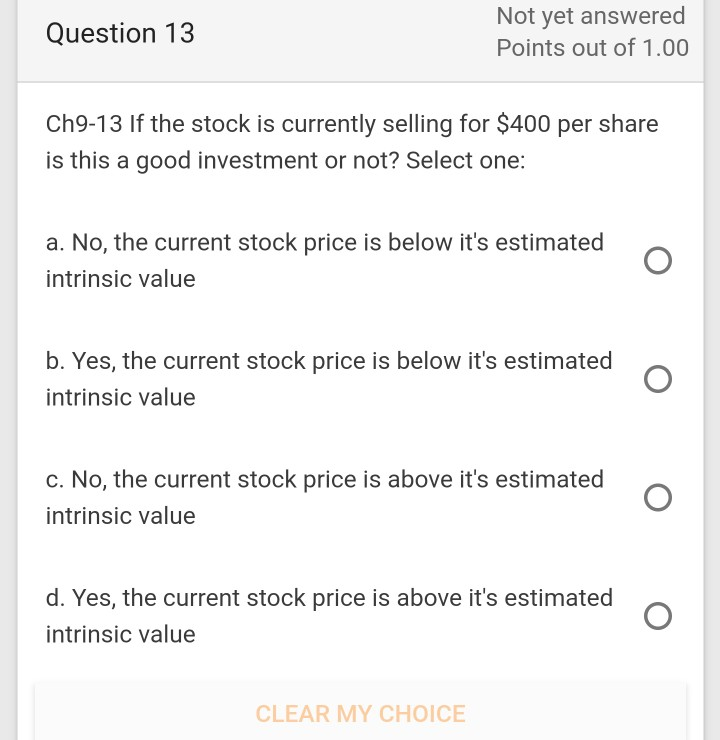

Question 5 Not yet answered Points out of 1.00 Ch9-5 Use this data to answer questions 5-13. Rainmaker Inc. earnings next year are predicted to be $7.50 per share. The company currently reinvests 20% of its earnings into projects generating a 12% return. The R&D department announced today that preliminary studies show that their cloud seeding technology works and it expected to come to market in 3 years' time. This technology is predicted to be extremely profitable: conservative estimates by analysts' average 50% return! In order to exploit this, the company plans to increase its retention ratio to 40%. The firm's beta is 2.1. T-bills and the S&P 500 are averaging 4% and 12% respectively. Calculate the required rate of return on this stock Select one: a. 8% o b. 16.8% o c. 20.8% o d. 21.8% o GLFAR MY CHOICE Question 6 Not yet answered Points out of 1.00 Ch9-6 Calculate Div1 Select one: . $1.50 o . $3.75 o . $6,60 o d. $6 o CLEAR MY CHOICE Question 7 Not yet answered Points out of 1.00 Ch9-7 Calculate the first growth rate Select one: a. 2.4% o b. 24% o . 22% o d. 12.2% o CLEAR MY CHOICE Question 8 Not yet answered Points out of 1.00 Ch9-8 Calculate the second growth rate Select one: a. 9%% o b. 24% o . 20% o d. 12.2% o CLEAR MY CHOICE Question 9 Not yet answered Points out of 1.00 Ch9-9 Identify the horizon year Select one: a. Year 1 o b. Year 2 o c. Year 3 o d. Year 4 o e. Today o Question 10 Not yet answered Points out of 1.00 Ch9-10 Calculate the dividend in the horizon year (NOT H+1) Select one: a. $6 b. $6.14 Oo oo c. $6.29 d. $6.48 CLEAR MY CHOICE Question 11 Not yet answered Points out of 1.00 Ch9-11 Calculate the price in the horizon year Select one: a. $32.61 0 b. $943.72 0 c. $45.94 0 d. $896.55 0 Question 12 Not yet answered Points out of 1.00 Use your answers to questions 5-12 to estimate the stock's current price in light of this announcement Select one: a. $750 b. $548 Oo oo c. $943 d. $271 CLEAR MY CHOICE Question 13 Not yet answered Points out of 1.00 Ch9-13 If the stock is currently selling for $400 per share is this a good investment or not? Select one: a. No, the current stock price is below it's estimated intrinsic value b. Yes, the current stock price is below it's estimated intrinsic value c. No, the current stock price is above it's estimated intrinsic value Question 13 Not yet answered Points out of 1.00 Ch9-13 If the stock is currently selling for $400 per share is this a good investment or not? Select one: a. No, the current stock price is below it's estimated intrinsic value b. Yes, the current stock price is below it's estimated intrinsic value 0 c. No, the current stock price is above it's estimated intrinsic value 0 d. Yes, the current stock price is above it's estimated intrinsic value 0 CLEAR MY CHOICE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started