Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Leilani receives a crop share from Galictica Farms, which she rents to her neighbor, Dustin. She does materially participate in the activities on Galictica

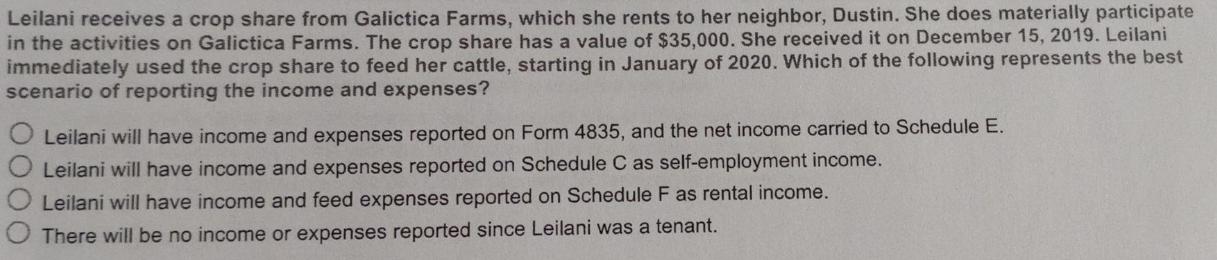

Leilani receives a crop share from Galictica Farms, which she rents to her neighbor, Dustin. She does materially participate in the activities on Galictica Farms. The crop share has a value of $35,000. She received it on December 15, 2019. Leilani immediately used the crop share to feed her cattle, starting in January of 2020. Which of the following represents the best scenario of reporting the income and expenses? Leilani will have income and expenses reported on Form 4835, and the net income carried to Schedule E. Leilani will have income and expenses reported on Schedule C as self-employment income. Leilani will have income and feed expenses reported on Schedule F as rental income. There will be no income or expenses reported since Leilani was a tenant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Leilani materially participates in the farm activities which typically means ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started