Answered step by step

Verified Expert Solution

Question

1 Approved Answer

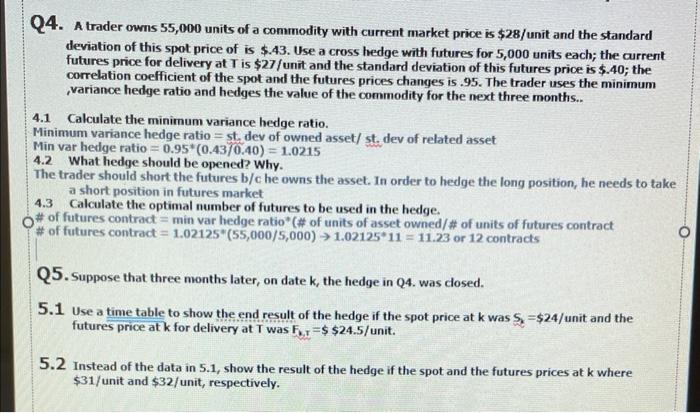

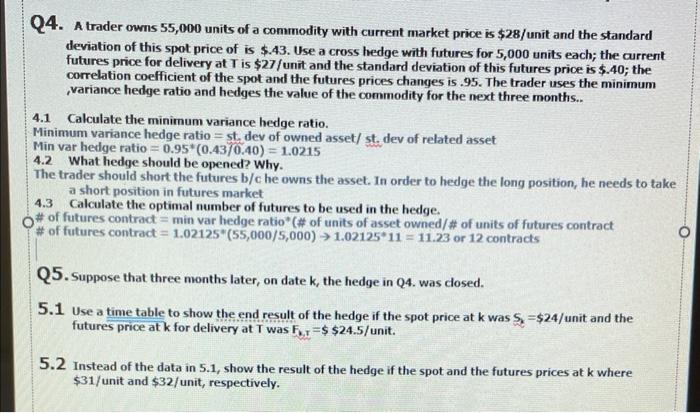

question 5 please Q4. A trader owns 55,000 units of a commodity with current market price is $28 /unit and the standard deviation of this

question 5 please

Q4. A trader owns 55,000 units of a commodity with current market price is $28 /unit and the standard deviation of this spot price of is $.43. Use a cross hedge with futures for 5,000 units each; the current futures price for delivery at T is $27 /unit and the standard deviation of this futures price is $.40; the correlation coefficient of the spot and the futures prices changes is. 95 . The trader uses the minimum ,variance hedge ratio and hedges the value of the commodity for the next three months.. 4.1 Calculate the minimum variance hedge ratio. Minimum variance hedge ratio =5t, dev of owned asset/ st. dev of related asset Min var hedge ratio =0.95(0.43/0.40)=1.0215 4.2 What hedge should be opened? Why. The trader should short the futures b/c he owns the asset. In order to hedge the long position, he needs to take a short position in futures market 4.3 Calculate the optimal number of futures to be used in the hedge. # of futures contract = min var hedge ratio (# of units of asset owned/# of units of futures contract # of futures contract =1.02125(55,000/5,000)1.0212511=11.23 or 12 contracts Q5. Suppose that three months later, on date k, the hedge in Q4. was closed. 5.1 Use a time table to show the end result of the hedge if the spot price at k was 53=$24 /unit and the futures price at k for delivery at T was F3,r=$24.5 /unit. 5.2 Instead of the data in 5.1, show the result of the hedge if the spot and the futures prices at k where $31/ unit and $32/ unit, respectively. Q4. A trader owns 55,000 units of a commodity with current market price is $28 /unit and the standard deviation of this spot price of is $.43. Use a cross hedge with futures for 5,000 units each; the current futures price for delivery at T is $27 /unit and the standard deviation of this futures price is $.40; the correlation coefficient of the spot and the futures prices changes is. 95 . The trader uses the minimum ,variance hedge ratio and hedges the value of the commodity for the next three months.. 4.1 Calculate the minimum variance hedge ratio. Minimum variance hedge ratio =5t, dev of owned asset/ st. dev of related asset Min var hedge ratio =0.95(0.43/0.40)=1.0215 4.2 What hedge should be opened? Why. The trader should short the futures b/c he owns the asset. In order to hedge the long position, he needs to take a short position in futures market 4.3 Calculate the optimal number of futures to be used in the hedge. # of futures contract = min var hedge ratio (# of units of asset owned/# of units of futures contract # of futures contract =1.02125(55,000/5,000)1.0212511=11.23 or 12 contracts Q5. Suppose that three months later, on date k, the hedge in Q4. was closed. 5.1 Use a time table to show the end result of the hedge if the spot price at k was 53=$24 /unit and the futures price at k for delivery at T was F3,r=$24.5 /unit. 5.2 Instead of the data in 5.1, show the result of the hedge if the spot and the futures prices at k where $31/ unit and $32/ unit, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started