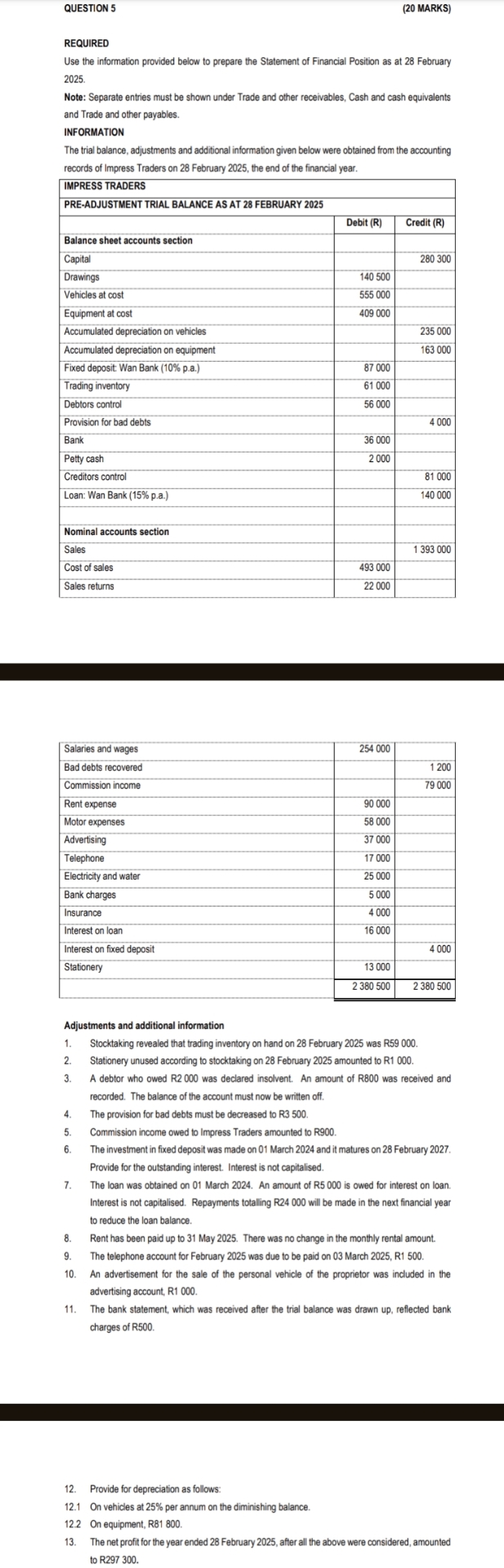

Question: QUESTION 5 REQUIREDUse the information provided below to prepare the Statement of Financial Position as at 2 8 February 2 0 2 5 . Note:

QUESTION REQUIREDUse the information provided below to prepare the Statement of Financial Position as at FebruaryNote: Separate entries must be shown under Trade and other receivables, Cash and cash equivalentsand Trade and other payables.INFORMATIONThe trial balance, adjustments and additional information given below were obtained from the accountingrecords of Imoress Traders on February the end of the financial vear.IMPRESS TRADERSPREADJUSTMENT TRIAL BALANCE AS AT FEBRUARY Balance sheet accounts sectionCapitalDrawingsVehicles at costEquipment at costAccumulated depreciation on vehiclesAccumulated depreciation on equipmentFixed deposit Wan Bank paTrading inventoryDebtors controlProvision for bad debtsBankPetty cashCreditors controlLoan: Wan Bank paNominal accounts sectionSalesCost of salesSales returnsSalaries and wagesBad debts recoveredCommission incomeRent expenseMotor expensesAdvertisingTelephoneElectricity and waterBank chargesInsuranceInterest on loanInterest on fixed depositStationeryAdjustments and additional informationThe provision for bad debts must be decreased to RCommission income owed to Impress Traders amounted to RDebit R Provide for depreciation as follows On vehides at per annum on the diminishing balance On equipment, R MARKSStocktaking revealed that trading inventory on hand on February was RStationery unused according to stocktaking on February amounted to RCredit RA debtor who owed R was declared insolvent. An amount of R was received andrecorded. The balance of the account must now be written offThe investment in fixed deposit was made on March and it matures on February Provide for the outstanding interest. Interest is not capitalised.The loan was obtained on March An amount of R is owed for interest on loan.Interest is not capitalised. Repayments totaling R will be made in the next financial yearto reduce the loan ballance.Rent has been paid up to May There was no change in the monthly rental amountThe telephone account for February was due to be paid on March RAn advertisement for the sale of the personal vehicle of the proprietor was included in theadvertising account, RThe bank statement, which was received after the trial balance was drawn up reflected bankcharges of R The net profit for the year ended February after all the above were considered, amountedto R

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock