Question

Question 5: Rula states Theoretically, the total risk of a portfolio can be reduced to zero. a) Under what circumstances is Rula's statement true.

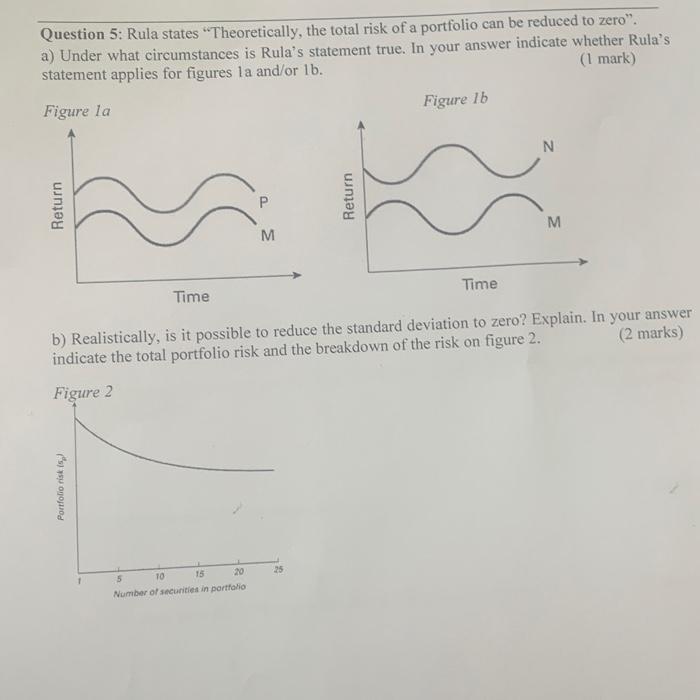

Question 5: Rula states "Theoretically, the total risk of a portfolio can be reduced to zero". a) Under what circumstances is Rula's statement true. In your answer indicate whether Rula's (1 mark) statement applies for figures la and/or lb. Figure la Return Portfolio risk (5) P M 5 10 15 20 Number of securities in portfolio Return Figure lb Time N Time b) Realistically, is it possible to reduce the standard deviation to zero? Explain. In your answer (2 marks) indicate the total portfolio risk and the breakdown of the risk on figure 2. Figure 2 M

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The question seems to be related to finance specifically to portfolio risk management Im going to answer both parts a and b based on the provided info...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Statistics

Authors: Michael Sullivan III

4th Edition

978-032184460, 032183870X, 321844602, 9780321838704, 978-0321844606

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App