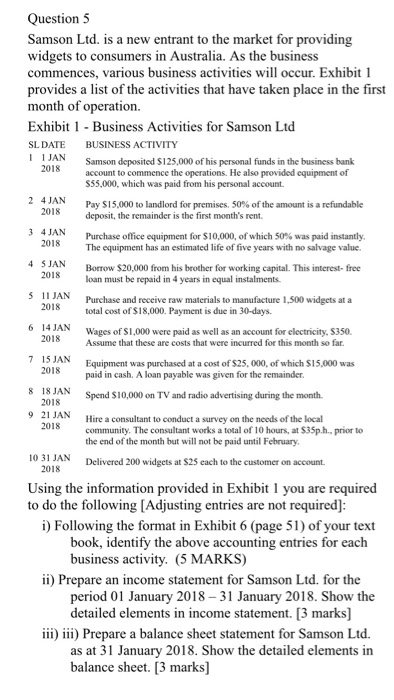

Question 5 Samson Ltd. is a new entrant to the market for providing widgets to consumers in Australia. As the business commences, various business activities will occur. Exhibit 1 provides a list of the activities that have taken place in the first month of operation. Exhibit 1 - Business Activities for Samson Ltd SL DATE BUSINESS ACTIVITY 11 JAN Samson deposited $125,000 of his personal funds in the business bank 2018 account to commence the operations. He also provided equipment of $55,000, which was paid from his personal account. 24 JAN Pay S15,000 to landlord for premises. 50% of the amount is a refundable 2018 deposit, the remainder is the first month's rent. 3 4 JAN Purchase office equipment for $10,000, of which 50% was paid instantly 2018 The equipment has an estimated life of five years with no salvage value. 4 SJAN Borrow $20,000 from his brother for working capital. This interest-free 2018 loan must be repaid in 4 years in equal instalments. 5 11 JAN Purchase and receive raw materials to manufacture 1.500 widgets at a 2018 total cost of $18,000. Payment is due in 30-days. 6 14 JAN Wages of $1.000 were paid as well as an account for clectricity, S350. 2018 Assume that these are costs that were incurred for this month so far. 7 15 JAN Equipment was purchased at a cost of $25,000, of which S15,000 was 2018 paid in cash. A loan payable was given for the remainder. 8 18 JAN Spend $10,000 on TV and radio advertising during the month. 2018 9 21 JAN Hire a consultant to conduct a survey on the needs of the local 2018 community. The consultant works a total of 10 hours, at $35p.h., prior to the end of the month but will not be paid until February. 10 31 JAN Delivered 200 widgets at $25 each to the customer on account. 2018 Using the information provided in Exhibit 1 you are required to do the following [Adjusting entries are not required): i) Following the format in Exhibit 6 (page 51) of your text book, identify the above accounting entries for each business activity. (5 MARKS) ii) Prepare an income statement for Samson Ltd. for the period 01 January 2018 - 31 January 2018. Show the detailed elements in income statement. [3 marks] iii) iii) Prepare a balance sheet statement for Samson Ltd. as at 31 January 2018. Show the detailed elements in balance sheet. [3 marks]