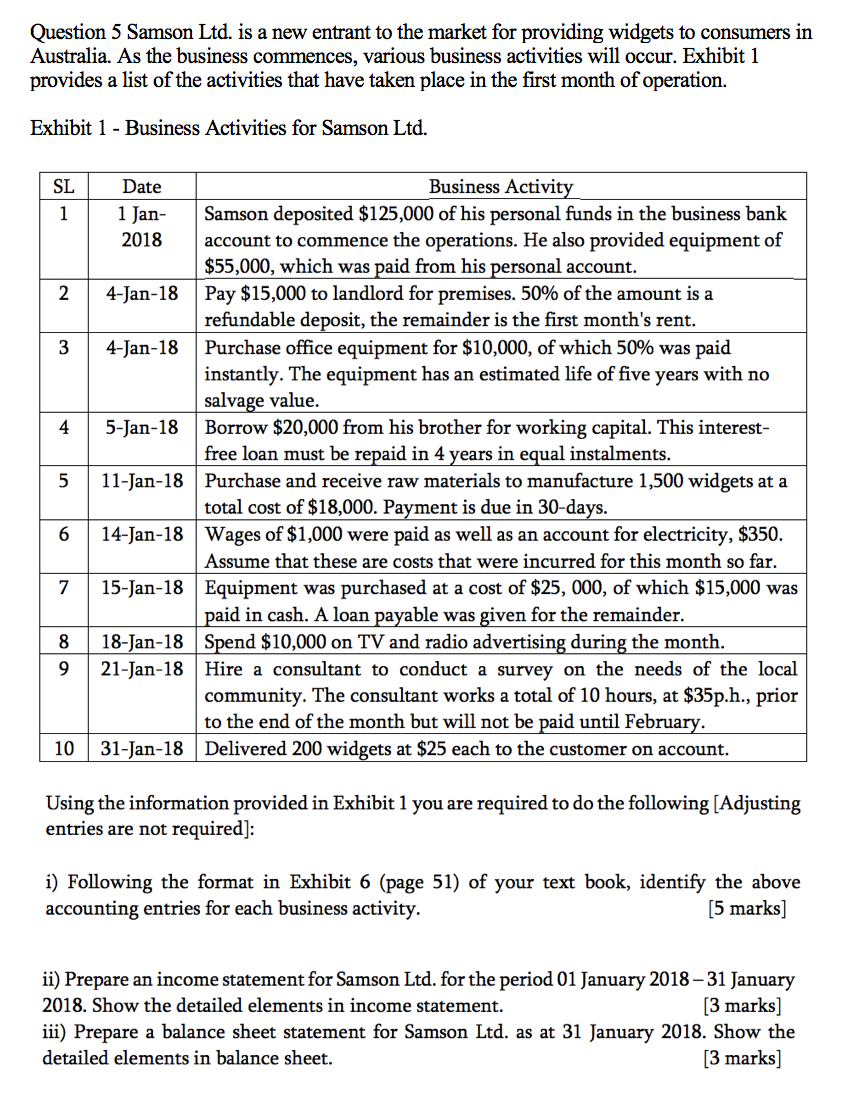

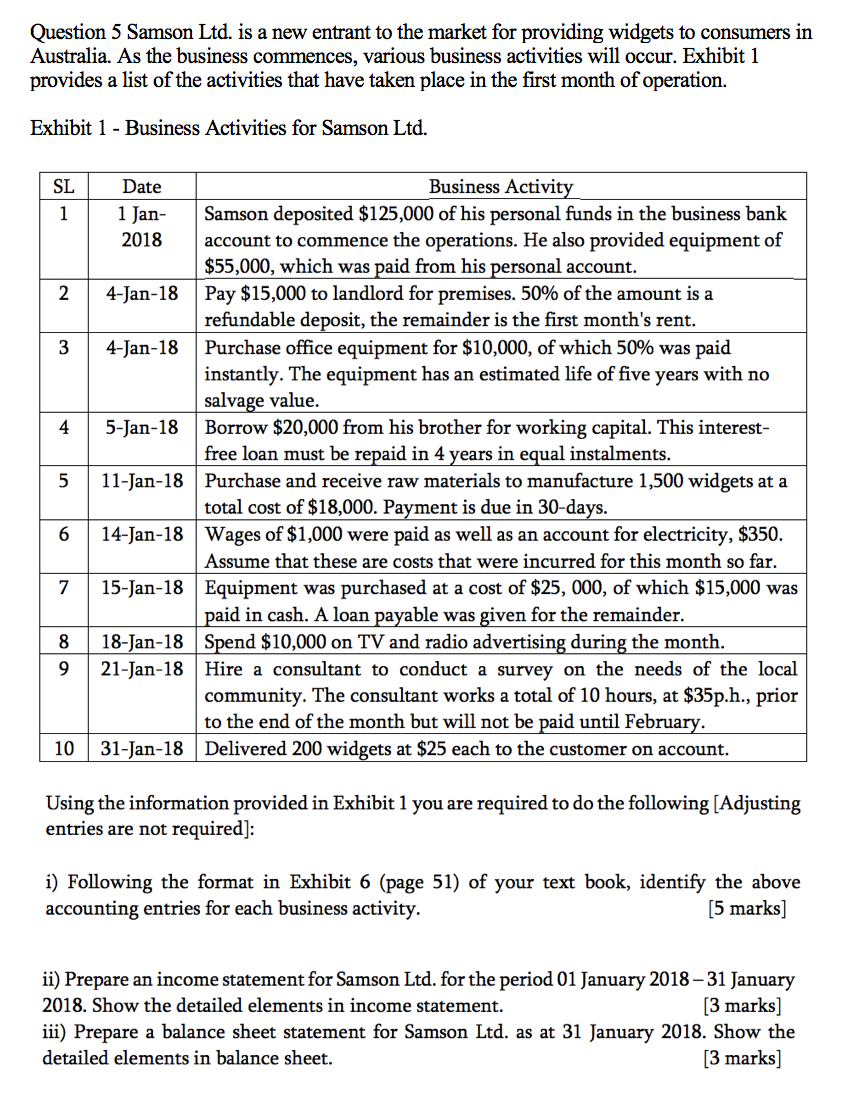

Question 5 Samson Ltd. is a new entrant to the market for providing widgets to consumers in Australia. As the business commences, various business activities will occur. Exhibit 1 provides a list of the activities that have taken place in the first month of operation. Exhibit 1 - Business Activities for Samson Ltd. SL DUS Date 1 Jan- 2018 4-Jan-18 4-Jan-18 4 5 -Jan-18 Business Activity Samson deposited $125,000 of his personal funds in the business bank account to commence the operations. He also provided equipment of $55,000, which was paid from his personal account. Pay $15,000 to landlord for premises. 50% of the amount is a refundable deposit, the remainder is the first month's rent. Purchase office equipment for $10,000, of which 50% was paid instantly. The equipment has an estimated life of five years with no salvage value. Borrow $20,000 from his brother for working capital. This interest- free loan must be repaid in 4 years in equal instalments. Purchase and receive raw materials to manufacture 1,500 widgets at a total cost of $18,000. Payment is due in 30-days. Wages of $1,000 were paid as well as an account for electricity, $350. Assume that these are costs that were incurred for this month so far. Equipment was purchased at a cost of $25, 000, of which $15,000 was paid in cash. A loan payable was given for the remainder. Spend $10,000 on TV and radio advertising during the month. Hire a consultant to conduct a survey on the needs of the local community. The consultant works a total of 10 hours, at $35p.h., prior to the end of the month but will not be paid until February. Delivered 200 widgets at $25 each to the customer on account. 11-Jan-18 6 14-Jan-18 7 15-Jan-18 8 9 18-Jan-18 21-Jan-18 10 | 31-Jan-18 Using the information provided in Exhibit 1 you are required to do the following [Adjusting entries are not required): i) Following the format in Exhibit 6 (page 51) of your text book, identify the above accounting entries for each business activity. [5 marks] ii) Prepare an income statement for Samson Ltd. for the period 01 January 2018-31 January 2018. Show the detailed elements in income statement. [3 marks] iii) Prepare a balance sheet statement for Samson Ltd. as at 31 January 2018. Show the detailed elements in balance sheet. [3 marks]