Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Seth, a UK firm, develops sites for solar and wind power. The firm's shares are owned by the founder of Seth and a

Question

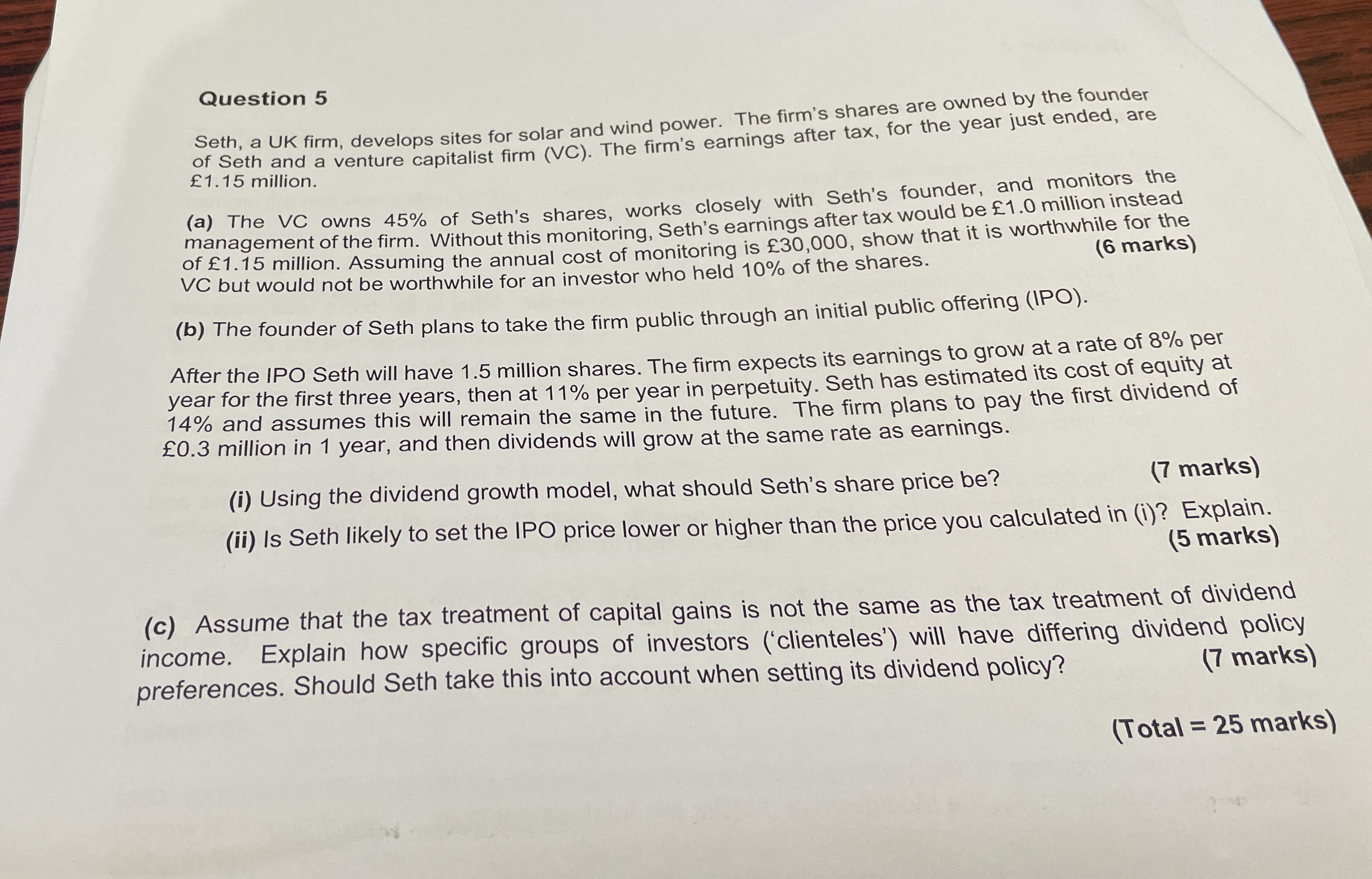

Seth, a UK firm, develops sites for solar and wind power. The firm's shares are owned by the founder

of Seth and a venture capitalist firm VC The firm's earnings after tax, for the year just ended, are

million.

a The VC owns of Seth's shares, works closely with Seth's founder, and monitors the

management of the firm. Without this monitoring, Seth's earnings after tax would be million instead

of million. Assuming the annual cost of monitoring is show that it is worthwhile for the

VC but would not be worthwhile for an investor who held of the shares.

marks

b The founder of Seth plans to take the firm public through an initial public offering IPO

After the IPO Seth will have million shares. The firm expects its earnings to grow at a rate of per

year for the first three years, then at per year in perpetuity. Seth has estimated its cost of equity at

and assumes this will remain the same in the future. The firm plans to pay the first dividend of

million in year, and then dividends will grow at the same rate as earnings.

i Using the dividend growth model, what should Seth's share price be

ii Is Seth likely to set the IPO price lower or higher than the price you calculated in i Explain.

marks

c Assume that the tax treatment of capital gains is not the same as the tax treatment of dividend

income. Explain how specific groups of investors clienteles will have differing dividend policy

preferences. Should Seth take this into account when setting its dividend policy?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started