Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Should financing costs such as the returns paid to bondholders and stockholders be a. considered in computing after tax operating cash flows? Why

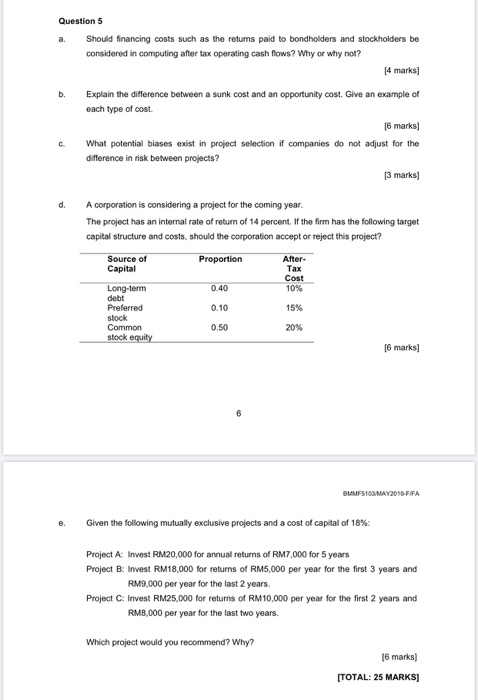

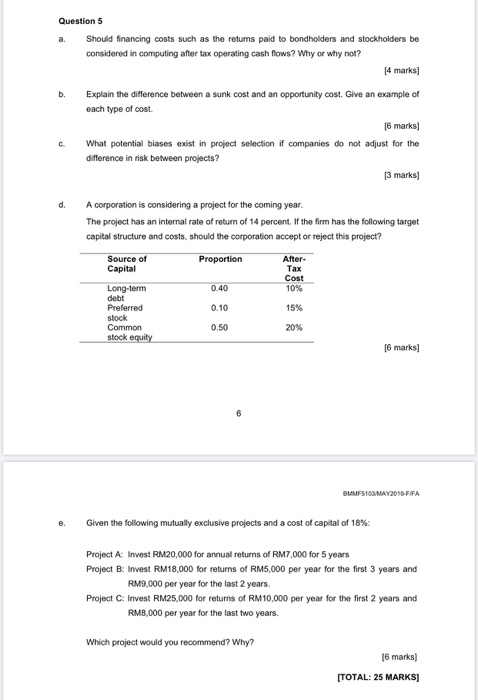

Question 5 Should financing costs such as the returns paid to bondholders and stockholders be a. considered in computing after tax operating cash flows? Why or why not? [4 marks) b. Explain the difference between a sunk cost and an opportunity cost. Give an example of each type of cost. (6 marks) C. What potential biases exist in project selection if companies do not adjust for the difference in risk between projects? [3 marks] A corporation is considering a project for the coming year. d. The project has an internal rate of return of 14 percent. If the firm has the following target capital structure and costs, should the corporation accept or reject this project? Source of Proportion After- Tax Cost 10% Capital Long-term debt Preferred 0.40 0.10 15% stock Common 20% 0.50 stock equity (6 marks) BMMFS103 MAY2010-FIFA Given the following mutually exclusive projects and a cost of capital of 18%: e. Project A: Invest RM20,000 for annual returns of RM7,000 for 5 years Project B: Invest RM18,000 for returns of RM5,000 per year for the first 3 years and RM9,000 per year for the last 2 years. Project C: Invest RM25,000 for returns of RM10,000 per year for the first 2 years and RM8,000 per year for the last two years. Which project would you recommend? Why? (6 marks) (TOTAL: 25 MARKS)

Question 5 Should financing costs such as the returns paid to bondholders and stockholders be a. considered in computing after tax operating cash flows? Why or why not? [4 marks) b. Explain the difference between a sunk cost and an opportunity cost. Give an example of each type of cost. (6 marks) C. What potential biases exist in project selection if companies do not adjust for the difference in risk between projects? [3 marks] A corporation is considering a project for the coming year. d. The project has an internal rate of return of 14 percent. If the firm has the following target capital structure and costs, should the corporation accept or reject this project? Source of Proportion After- Tax Cost 10% Capital Long-term debt Preferred 0.40 0.10 15% stock Common 20% 0.50 stock equity (6 marks) BMMFS103 MAY2010-FIFA Given the following mutually exclusive projects and a cost of capital of 18%: e. Project A: Invest RM20,000 for annual returns of RM7,000 for 5 years Project B: Invest RM18,000 for returns of RM5,000 per year for the first 3 years and RM9,000 per year for the last 2 years. Project C: Invest RM25,000 for returns of RM10,000 per year for the first 2 years and RM8,000 per year for the last two years. Which project would you recommend? Why? (6 marks) (TOTAL: 25 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started