Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5. (This question has three sub-questions: (a), (b) and (c)) (a) From the figure below, as per the proposition of Modigliani and Miller

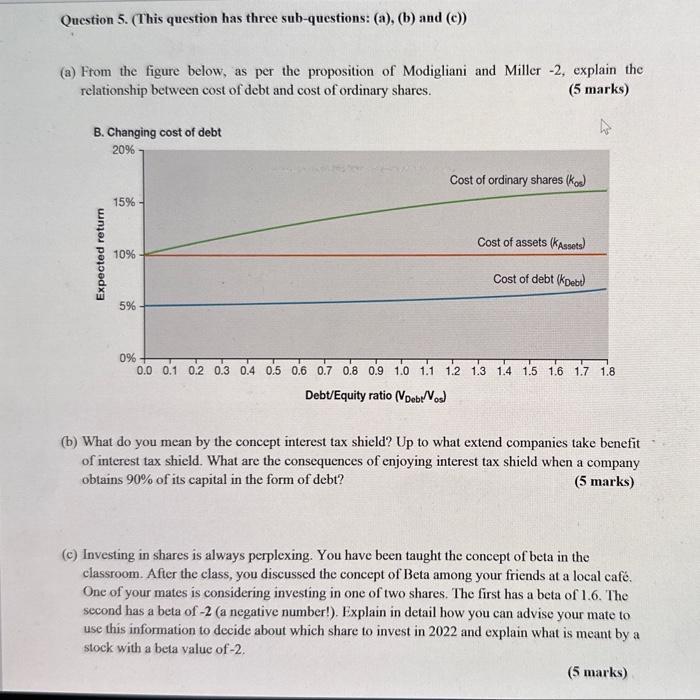

Question 5. (This question has three sub-questions: (a), (b) and (c)) (a) From the figure below, as per the proposition of Modigliani and Miller -2, explain the relationship between cost of debt and cost of ordinary shares. (5 marks) B. Changing cost of debt 20% Expected return 15% 10% 5% Cost of ordinary shares (kos) Cost of assets (KAssets) Cost of debt (KDebt) 0% 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 Debt/Equity ratio (VDebt/Vos) (b) What do you mean by the concept interest tax shield? Up to what extend companies take benefit of interest tax shield. What are the consequences of enjoying interest tax shield when a company obtains 90% of its capital in the form of debt? (5 marks) (c) Investing in shares is always perplexing. You have been taught the concept of beta in the classroom. After the class, you discussed the concept of Beta among your friends at a local caf. One of your mates is considering investing in one of two shares. The first has a beta of 1.6. The second has a beta of -2 (a negative number!). Explain in detail how you can advise your mate to use this information to decide about which share to invest in 2022 and explain what is meant by a stock with a beta value of -2. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Modigliani and Miller Proposition 2 Modigliani and Millers Proposition II with taxes states that the cost of equity increases linearly with leverage debtequity ratio This is because as a company tak...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started