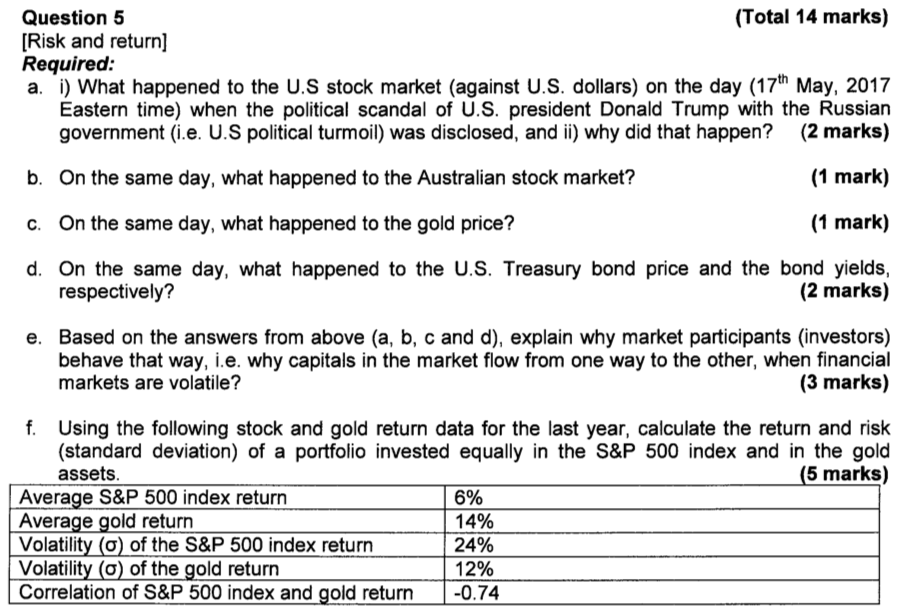

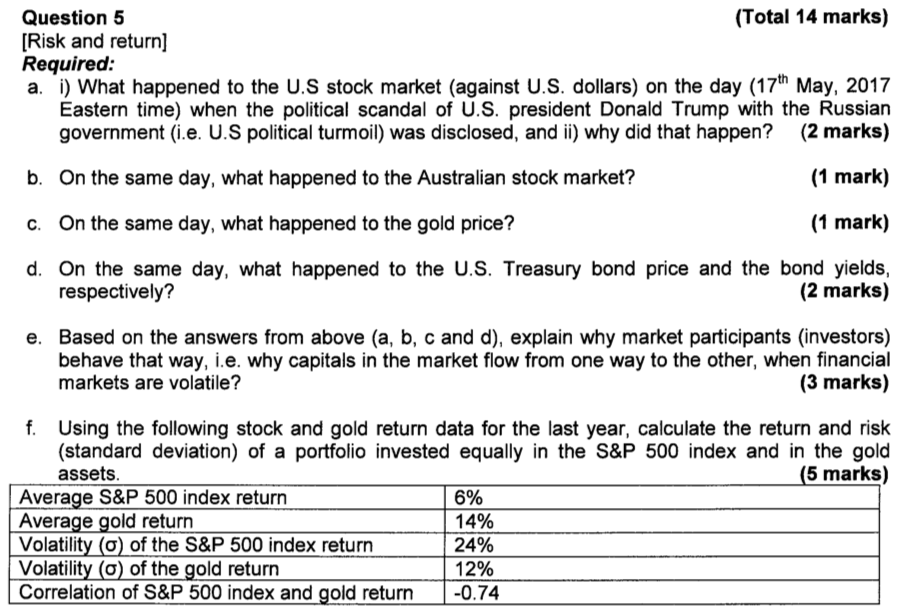

Question 5 (Total 14 marks) [Risk and return) Required: a. i) What happened to the U.S stock market (against U.S. dollars) on the day (17th May, 2017 Eastern time) when the political scandal of U.S. president Donald Trump with the Russian government (i.e. U.S political turmoil) was disclosed, and ii) why did that happen? (2 marks) b. On the same day, what happened to the Australian stock market? (1 mark) c. On the same day, what happened to the gold price? (1 mark) d. On the same day, what happened to the U.S. Treasury bond price and the bond yields, respectively? (2 marks) e. Based on the answers from above (a, b, c and d), explain why market participants (investors) behave that way, i.e. why capitals in the market flow from one way to the other, when financial markets are volatile? (3 marks) f. Using the following stock and gold return data for the last year, calculate the return and risk (standard deviation) of a portfolio invested equally in the S&P 500 index and in the gold assets. (5 marks) Average S&P 500 index return 6% Average gold return 14% Volatility (o) of the S&P 500 index return 24% Volatility (o) of the gold return 12% Correlation of S&P 500 index and gold return -0.74 Question 5 (Total 14 marks) [Risk and return) Required: a. i) What happened to the U.S stock market (against U.S. dollars) on the day (17th May, 2017 Eastern time) when the political scandal of U.S. president Donald Trump with the Russian government (i.e. U.S political turmoil) was disclosed, and ii) why did that happen? (2 marks) b. On the same day, what happened to the Australian stock market? (1 mark) c. On the same day, what happened to the gold price? (1 mark) d. On the same day, what happened to the U.S. Treasury bond price and the bond yields, respectively? (2 marks) e. Based on the answers from above (a, b, c and d), explain why market participants (investors) behave that way, i.e. why capitals in the market flow from one way to the other, when financial markets are volatile? (3 marks) f. Using the following stock and gold return data for the last year, calculate the return and risk (standard deviation) of a portfolio invested equally in the S&P 500 index and in the gold assets. (5 marks) Average S&P 500 index return 6% Average gold return 14% Volatility (o) of the S&P 500 index return 24% Volatility (o) of the gold return 12% Correlation of S&P 500 index and gold return -0.74