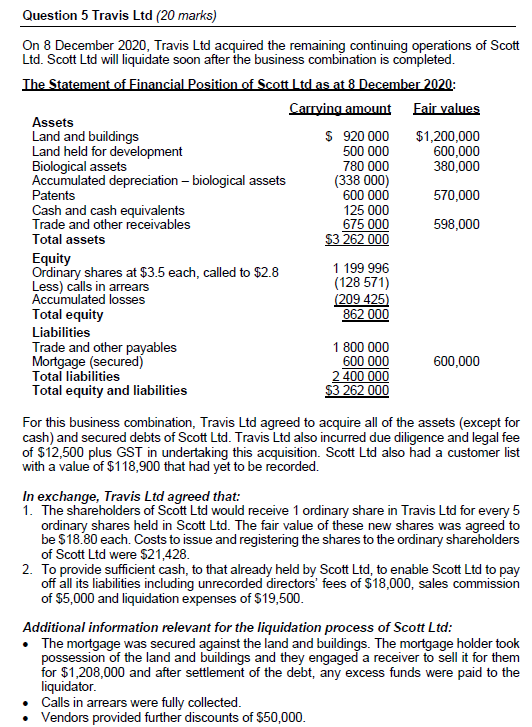

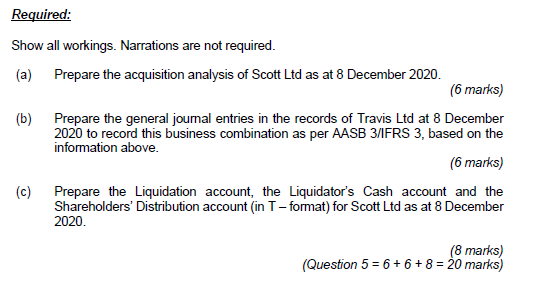

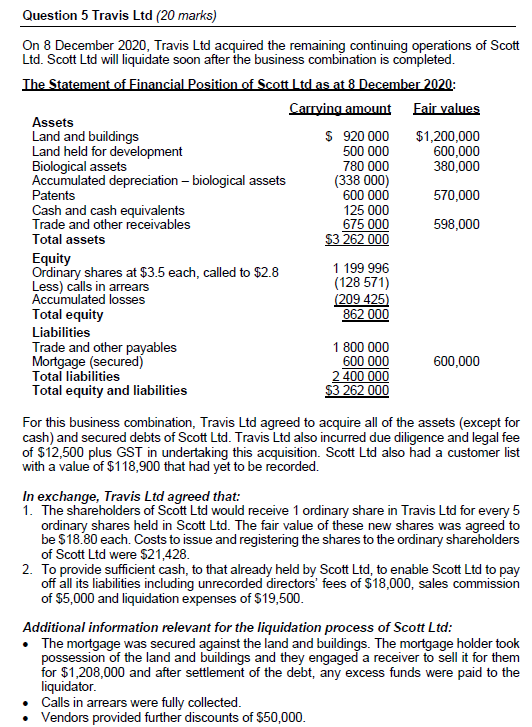

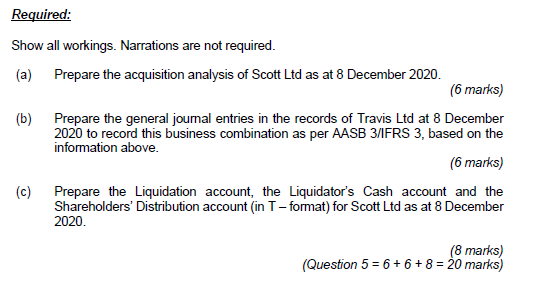

Question 5 Travis Ltd (20 marks) On 8 December 2020, Travis Ltd acquired the remaining continuing operations of Scott Ltd. Scott Ltd will liquidate soon after the business combination is completed. The Statement of Financial Position of Scott Ltd as at 8 December 2020: Carrying amount Fair values Assets Land and buildings $ 920 000 $1,200,000 Land held for development 500 000 600,000 Biological assets 780 000 380,000 Accumulated depreciation - biological assets (338 000) Patents 600 000 570,000 Cash and cash equivalents 125 000 Trade and other receivables 675 000 598,000 Total assets $3 262 000 Equity Ordinary shares at $3.5 each, called to $2.8 1 199 996 Less) calls in arrears (128 571) Accumulated losses (209 425) Total equity 862 000 Liabilities Trade and other payables 1 800 000 Mortgage (secured) 600 000 600,000 Total liabilities 2 400 000 Total equity and liabilities $3 262 000 For this business combination, Travis Ltd agreed to acquire all of the assets (except for cash) and secured debts of Scott Ltd. Travis Ltd also incurred due diligence and legal fee of $12,500 plus GST in undertaking this acquisition. Scott Ltd also had a customer list with a value of $118,900 that had yet to be recorded. In exchange, Travis Ltd agreed that: 1. The shareholders of Scott Ltd would receive 1 ordinary share in Travis Ltd for every 5 ordinary shares held in Scott Ltd. The fair value of these new shares was agreed to be $18.80 each. Costs to issue and registering the shares to the ordinary shareholders of Scott Ltd were $21,428. 2. To provide sufficient cash, to that already held by Scott Ltd, to enable Scott Ltd to pay off all its liabilities including unrecorded directors' fees of $18,000, sales commission of $5,000 and liquidation expenses of $19,500. Additional information relevant for the liquidation process of Scott Ltd: The mortgage was secured against the land and buildings. The mortgage holder took possession of the land and buildings and they engaged a receiver to sell it for them for $1,208,000 and after settlement of the debt, any excess funds were paid to the liquidator. Calls in arrears were fully collected. Vendors provided further discounts of $50,000. Required: Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Scott Ltd as at 8 December 2020. (6 marks) (b) Prepare the general journal entries in the records of Travis Ltd at 8 December 2020 to record this business combination as per AASB 3/IFRS 3, based on the information above. (6 marks) (c) Prepare the Liquidation account, the Liquidator's Cash account and the Shareholders' Distribution account (in T-format) for Scott Ltd as at 8 December 2020. (8 marks) (Question 5 = 6 + 6 + 8 = 20 marks) Question 5 Travis Ltd (20 marks) On 8 December 2020, Travis Ltd acquired the remaining continuing operations of Scott Ltd. Scott Ltd will liquidate soon after the business combination is completed. The Statement of Financial Position of Scott Ltd as at 8 December 2020: Carrying amount Fair values Assets Land and buildings $ 920 000 $1,200,000 Land held for development 500 000 600,000 Biological assets 780 000 380,000 Accumulated depreciation - biological assets (338 000) Patents 600 000 570,000 Cash and cash equivalents 125 000 Trade and other receivables 675 000 598,000 Total assets $3 262 000 Equity Ordinary shares at $3.5 each, called to $2.8 1 199 996 Less) calls in arrears (128 571) Accumulated losses (209 425) Total equity 862 000 Liabilities Trade and other payables 1 800 000 Mortgage (secured) 600 000 600,000 Total liabilities 2 400 000 Total equity and liabilities $3 262 000 For this business combination, Travis Ltd agreed to acquire all of the assets (except for cash) and secured debts of Scott Ltd. Travis Ltd also incurred due diligence and legal fee of $12,500 plus GST in undertaking this acquisition. Scott Ltd also had a customer list with a value of $118,900 that had yet to be recorded. In exchange, Travis Ltd agreed that: 1. The shareholders of Scott Ltd would receive 1 ordinary share in Travis Ltd for every 5 ordinary shares held in Scott Ltd. The fair value of these new shares was agreed to be $18.80 each. Costs to issue and registering the shares to the ordinary shareholders of Scott Ltd were $21,428. 2. To provide sufficient cash, to that already held by Scott Ltd, to enable Scott Ltd to pay off all its liabilities including unrecorded directors' fees of $18,000, sales commission of $5,000 and liquidation expenses of $19,500. Additional information relevant for the liquidation process of Scott Ltd: The mortgage was secured against the land and buildings. The mortgage holder took possession of the land and buildings and they engaged a receiver to sell it for them for $1,208,000 and after settlement of the debt, any excess funds were paid to the liquidator. Calls in arrears were fully collected. Vendors provided further discounts of $50,000. Required: Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Scott Ltd as at 8 December 2020. (6 marks) (b) Prepare the general journal entries in the records of Travis Ltd at 8 December 2020 to record this business combination as per AASB 3/IFRS 3, based on the information above. (6 marks) (c) Prepare the Liquidation account, the Liquidator's Cash account and the Shareholders' Distribution account (in T-format) for Scott Ltd as at 8 December 2020. (8 marks) (Question 5 = 6 + 6 + 8 = 20 marks)