Question 52 please the top one, I don't have the information requested in the below comment....i posted whatever was available in the textbook

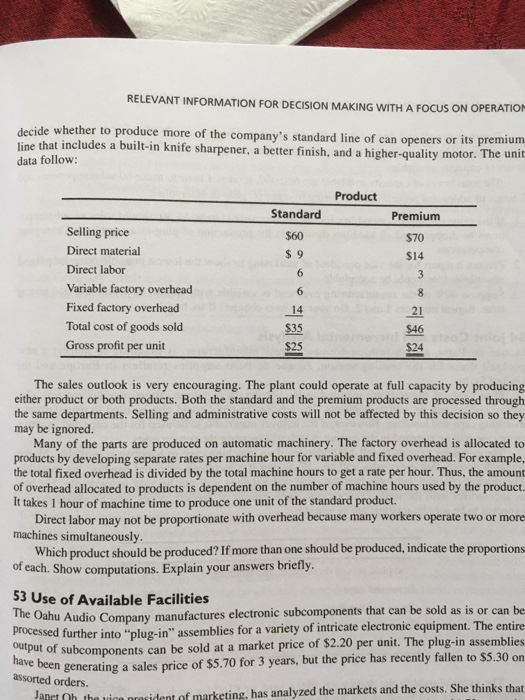

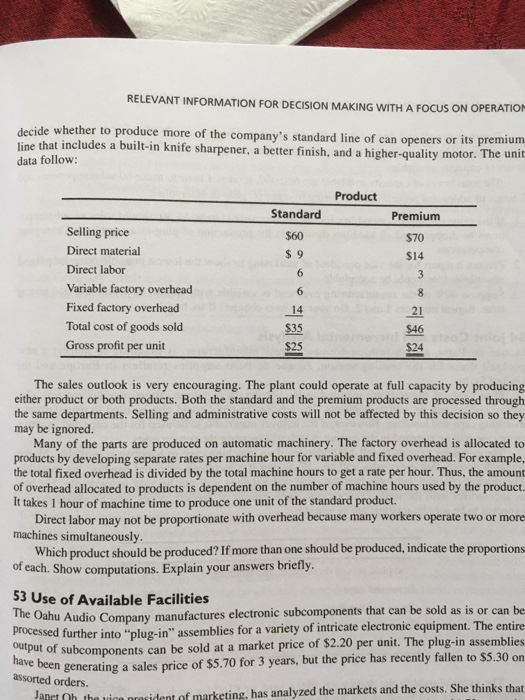

Decide whether to produce more of the company's standard line of can openers or its premium line that includes a built-in knife sharpener, a better finish, and a higher - quality motor. The unit data follow: The sales outlook is very encouraging. The plant could operate at full capacity by producing either product or both products. Both the standard and the premium products are processed through the same departments. Selling and administrative costs will not be affected by this decision so they may be ignored. Many of the parts are produced on automatic machinery. The factory overhead is allocated to products by developing separate rates per machine hour for variable and fixed overhead. For example, the total fixed overhead is divided by the total machine hours to get a rate per hour. Thus, the amount of overhead allocated to products is dependent on the number of machine hours used by the product. It takes 1 hour of machine time to produce one unit of the standard product. Direct labor may not be proportionate with overhead because many workers operate two or more machines simultaneously. Which product should be produced? If more than one should be produced, indicate the proportions of each. Show computations. Explain your answers briefly. The Oahu Audio Company manufactures electronic subcomponents that can be sold as is or can be Processed further into "plug-in" assemblies for a variety of intricate electronic equipment. The entire output of subcomponents can be sold a. a market price of $2.20 per unit. The plug-in assemblies have been generating a sales price of $5.70 for 3 years, but the price has recently fallen to $5.30 on assorted orders . Decide whether to produce more of the company's standard line of can openers or its premium line that includes a built-in knife sharpener, a better finish, and a higher - quality motor. The unit data follow: The sales outlook is very encouraging. The plant could operate at full capacity by producing either product or both products. Both the standard and the premium products are processed through the same departments. Selling and administrative costs will not be affected by this decision so they may be ignored. Many of the parts are produced on automatic machinery. The factory overhead is allocated to products by developing separate rates per machine hour for variable and fixed overhead. For example, the total fixed overhead is divided by the total machine hours to get a rate per hour. Thus, the amount of overhead allocated to products is dependent on the number of machine hours used by the product. It takes 1 hour of machine time to produce one unit of the standard product. Direct labor may not be proportionate with overhead because many workers operate two or more machines simultaneously. Which product should be produced? If more than one should be produced, indicate the proportions of each. Show computations. Explain your answers briefly. The Oahu Audio Company manufactures electronic subcomponents that can be sold as is or can be Processed further into "plug-in" assemblies for a variety of intricate electronic equipment. The entire output of subcomponents can be sold a. a market price of $2.20 per unit. The plug-in assemblies have been generating a sales price of $5.70 for 3 years, but the price has recently fallen to $5.30 on assorted orders