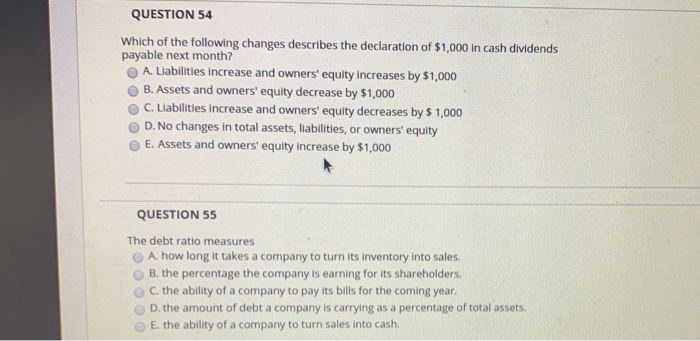

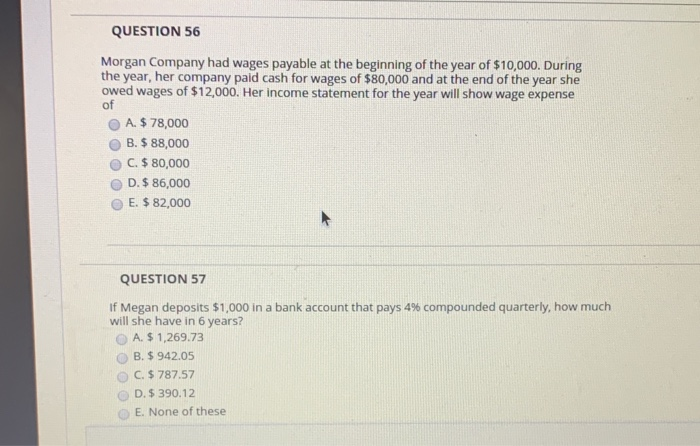

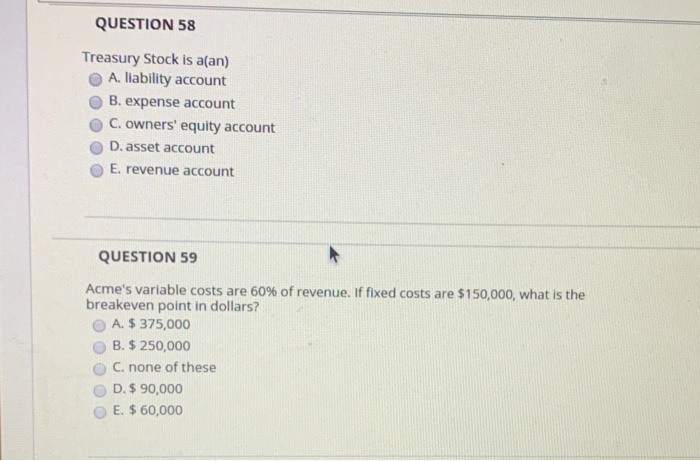

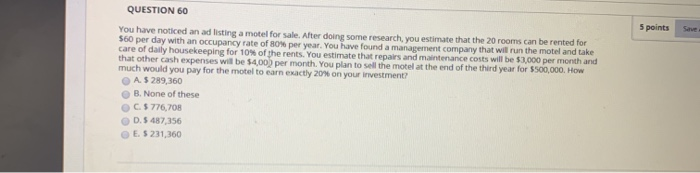

QUESTION 54 Which of the following changes describes the declaration of $1,000 in cash dividends payable next month? A. Liabilities increase and owners' equity increases by $1,000 B. Assets and owners' equity decrease by $1,000 C. Liabilities increase and owners' equity decreases by $1,000 D. No changes in total assets, liabilities, or owners' equity E. Assets and owners' equity increase by $1,000 QUESTION 55 The debt ratio measures A. how long it takes a company to turn its inventory into sales. OB. the percentage the company is earning for its shareholders. C. the ability of a company to pay its bills for the coming year. D. the amount of debt a company is carrying as a percentage of total assets. E. the ability of a company to turn sales into cash. QUESTION 56 Morgan Company had wages payable at the beginning of the year of $10,000. During the year, her company paid cash for wages of $80,000 and at the end of the year she owed wages of $12,000. Her income statement for the year will show wage expense of A. $ 78,000 B. $ 88,000 C. $ 80,000 D. $ 86,000 E. $ 82,000 QUESTION 57 if Megan deposits $1,000 in a bank account that pays 4% compounded quarterly, how much will she have in 6 years? A. $ 1,269.73 B. $ 942.05 C. $ 787.57 D. $ 390.12 E. None of these QUESTION 58 Treasury Stock is aan) A. liability account B. expense account C. owners' equity account D. asset account E. revenue account QUESTION 59 Acme's variable costs are 60% of revenue. If fixed costs are $150,000, what is the breakeven point in dollars? A. $375,000 B. $ 250,000 C. none of these D. $ 90,000 E. $ 60,000 QUESTION 60 5 points You have noticed an addistinga motel for sale. After doing some research, you estimate that the 20 rooms can be rented for $60 per day with an occupancy rate of 80 per year. You have found a management company that will run the motel and take care of daily housekeeping for 10% of the rents. You estimate that repairs and maintenance costs will be $1.000 per month and that other cash expenses will be $400) per month. You plan to all the more at the end of the third year for $500,000. How much would you pay for the motel to earn exactly 20% on your investment A 5 289,360 B. None of these C5776,708 D. 5 487,356 E 5231,360