Answered step by step

Verified Expert Solution

Question

1 Approved Answer

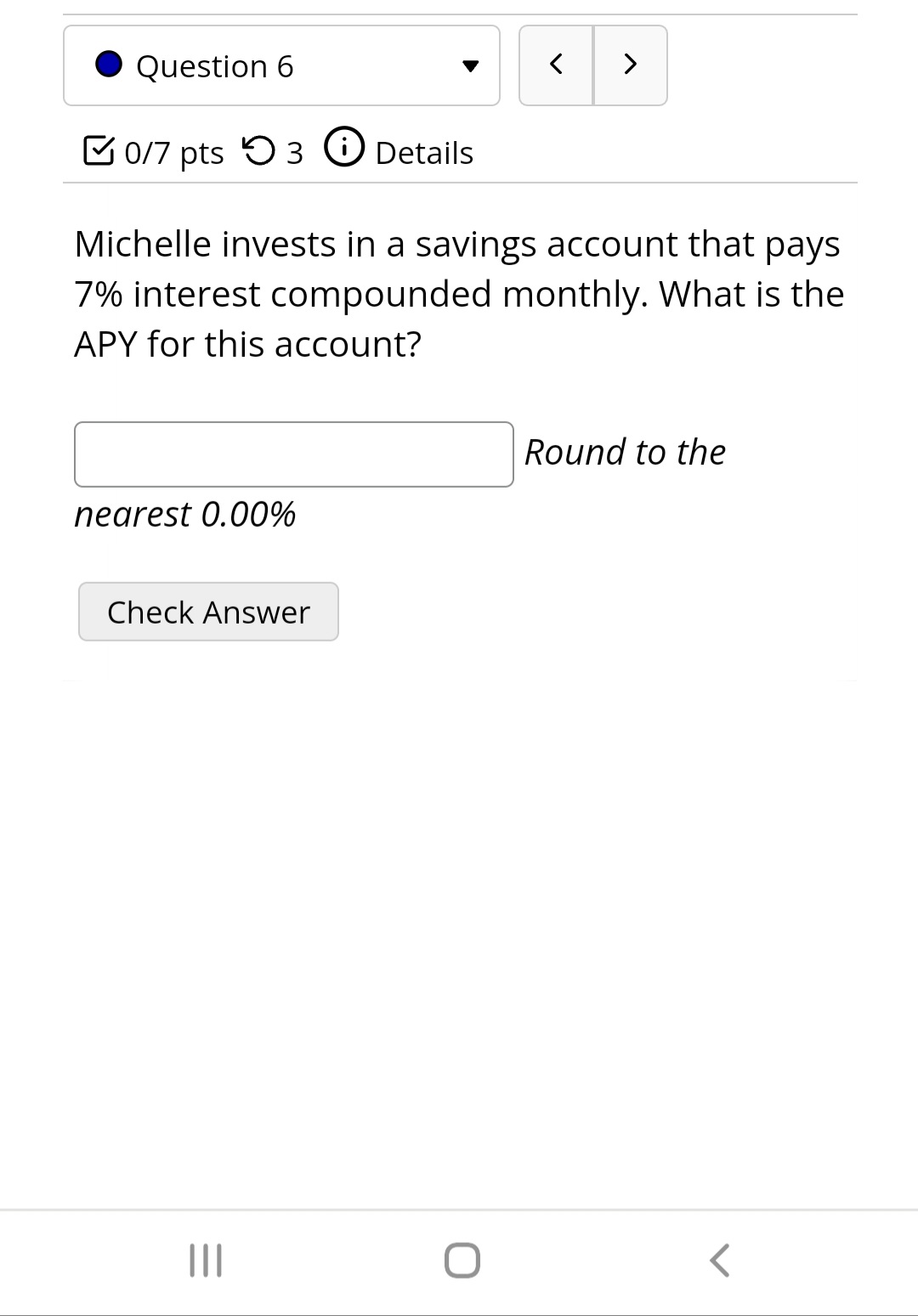

Question 6 0/7 pts 3 Details > Michelle invests in a savings account that pays 7% interest compounded monthly. What is the APY for

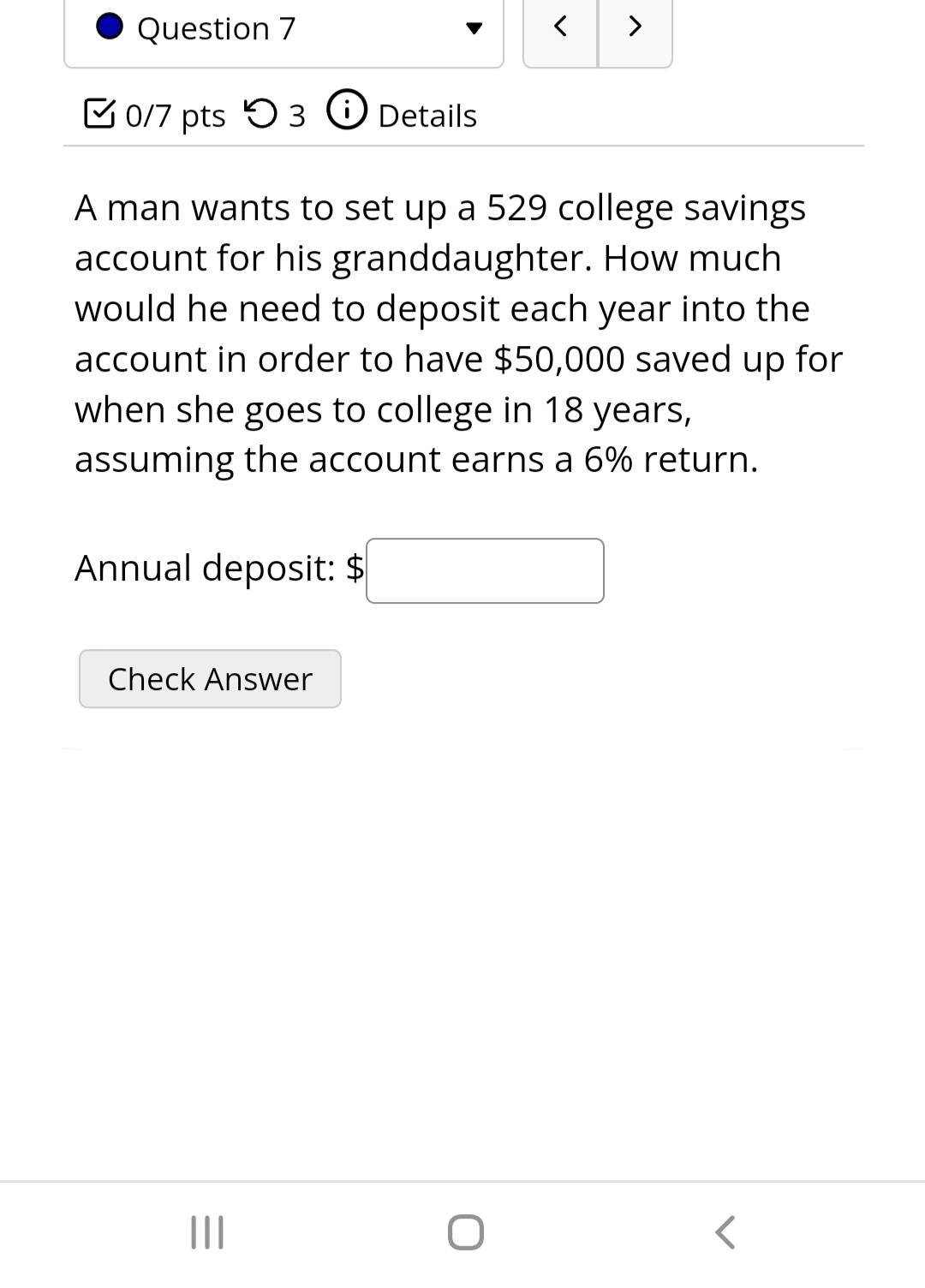

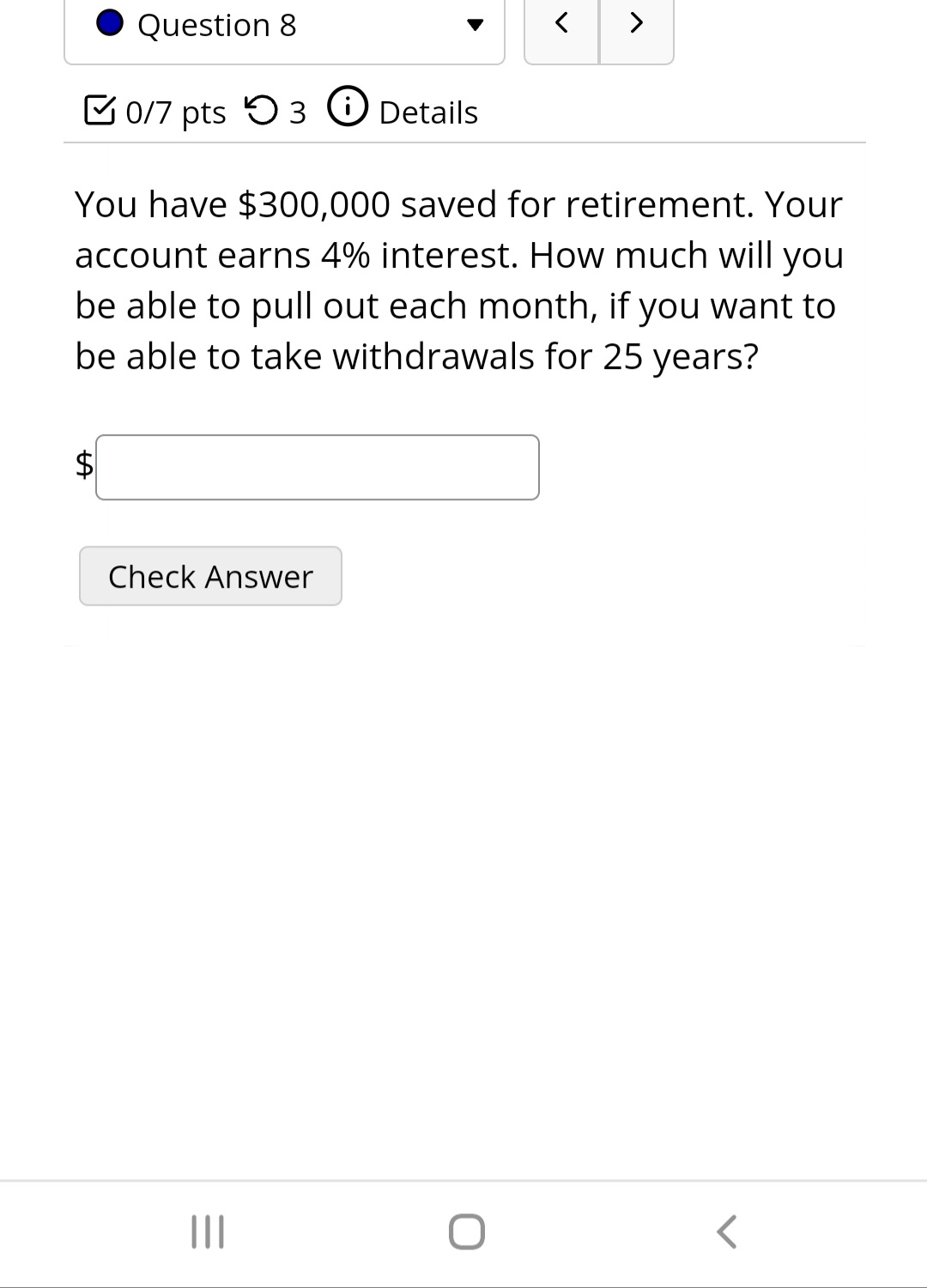

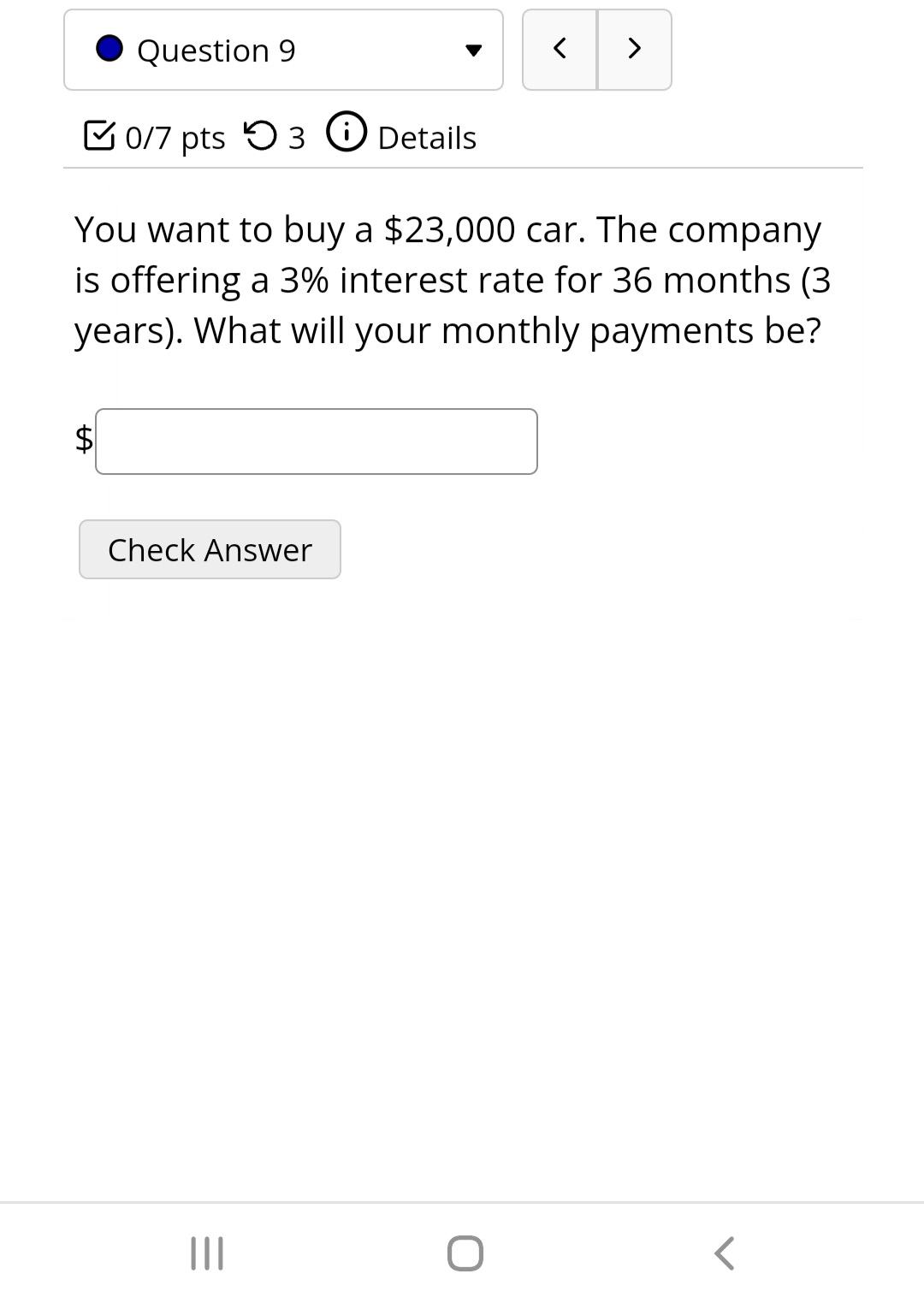

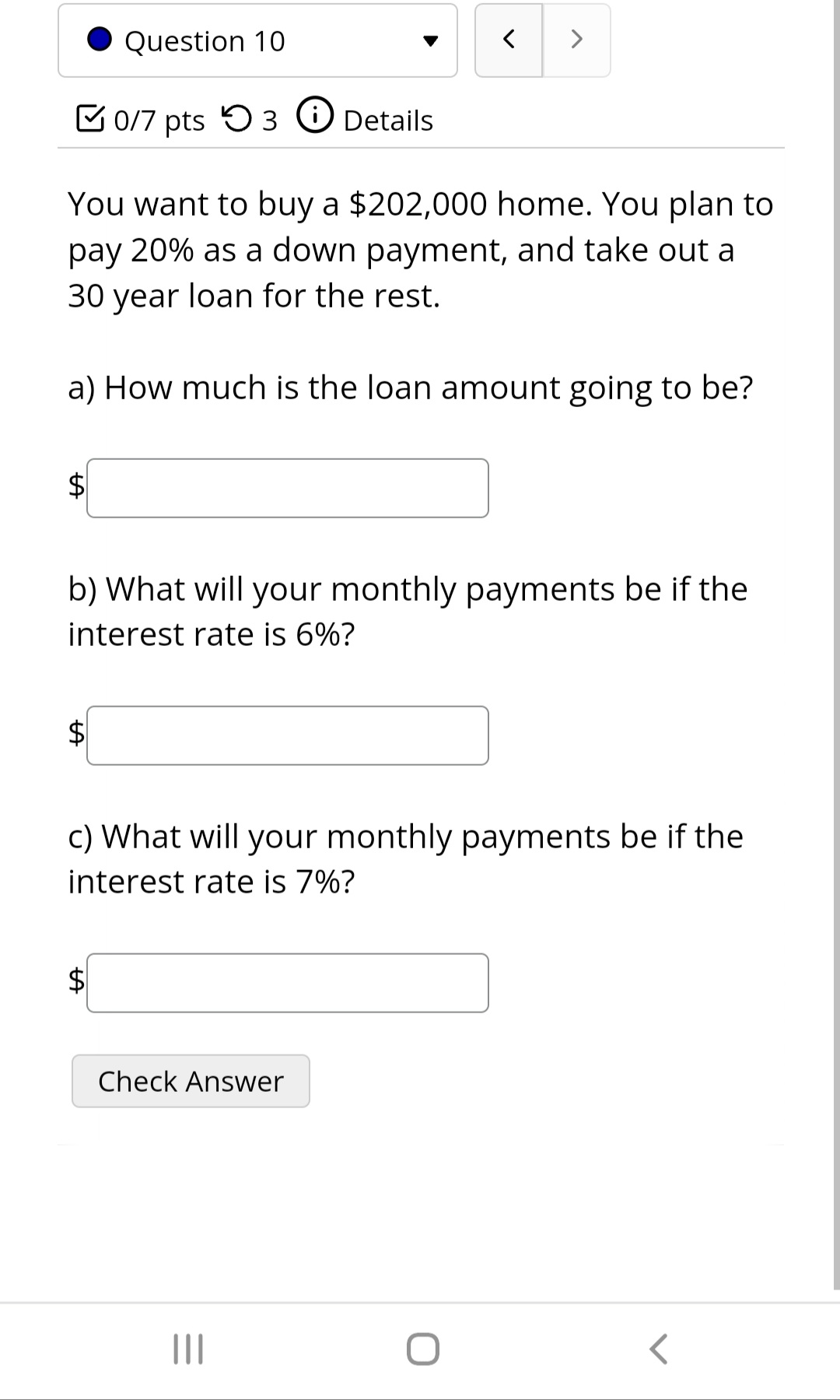

Question 6 0/7 pts 3 Details > Michelle invests in a savings account that pays 7% interest compounded monthly. What is the APY for this account? nearest 0.00% Check Answer Round to the ||| Question 7 0/7 pts 3 Details > > A man wants to set up a 529 college savings account for his granddaughter. How much would he need to deposit each year into the account in order to have $50,000 saved up for when she goes to college in 18 years, assuming the account earns a 6% return. Annual deposit: $ Check Answer Question 8 0/7 pts 3 Details You have $300,000 saved for retirement. Your account earns 4% interest. How much will you be able to pull out each month, if you want to be able to take withdrawals for 25 years? +A Check Answer III Question 9 0/7 pts 3 Details > > You want to buy a $23,000 car. The company is offering a 3% interest rate for 36 months (3. years). What will your monthly payments be? Check Answer ||| Question 10 0/7 pts 3 Details You want to buy a $202,000 home. You plan to pay 20% as a down payment, and take out a 30 year loan for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be if the interest rate is 6%? c) What will your monthly payments be if the interest rate is 7%? Check Answer |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started