Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 (1) Suppose the bid/ask spread for a share of a particular stock is $0.25. An investor buys 1000 shares and then immediately sells

Question 6

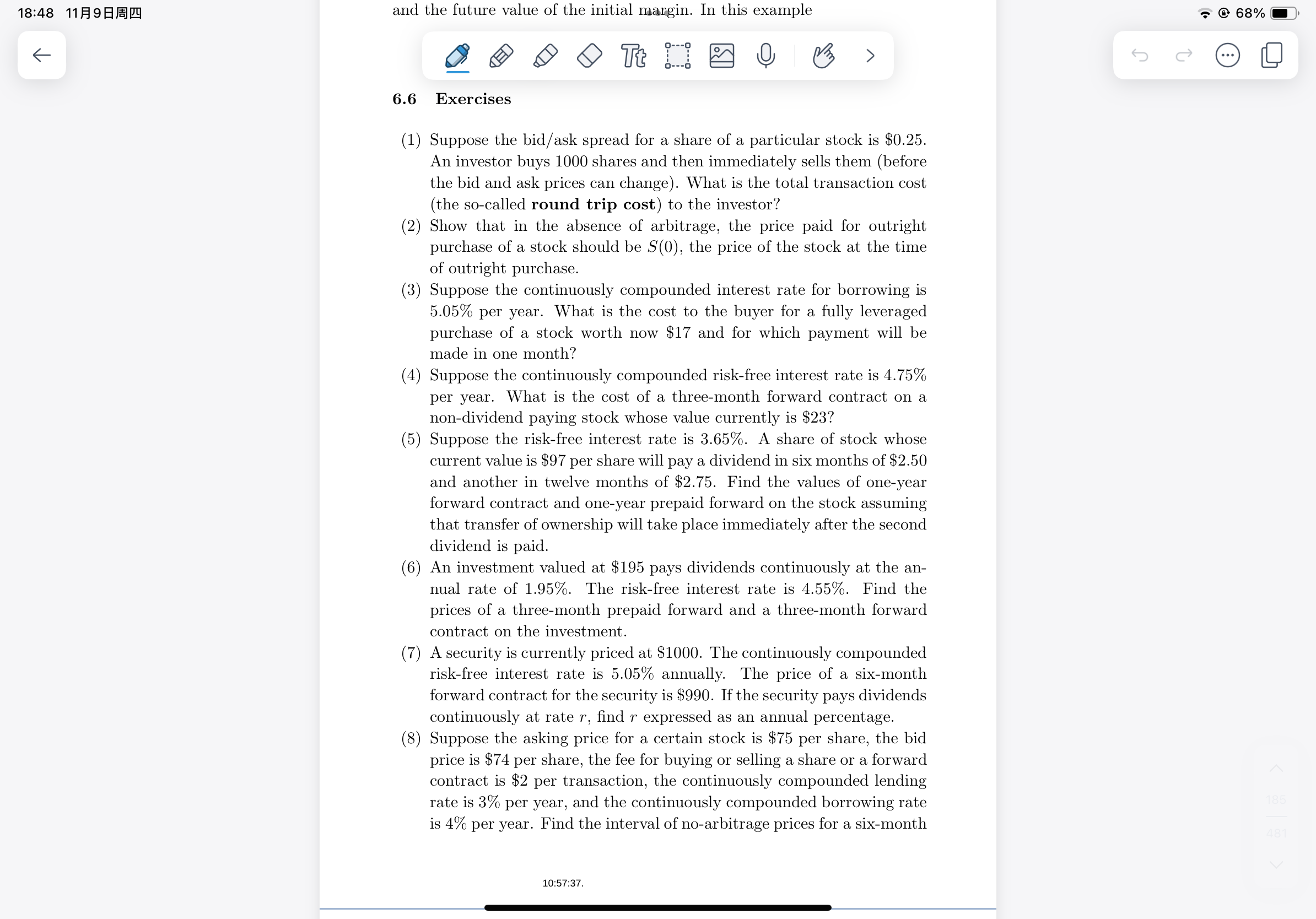

(1) Suppose the bid/ask spread for a share of a particular stock is $0.25. An investor buys 1000 shares and then immediately sells them (before the bid and ask prices can change). What is the total transaction cost (the so-called round trip cost) to the investor? (2) Show that in the absence of arbitrage, the price paid for outright purchase of a stock should be S(0), the price of the stock at the time of outright purchase. (3) Suppose the continuously compounded interest rate for borrowing is 5.05% per year. What is the cost to the buyer for a fully leveraged purchase of a stock worth now $17 and for which payment will be made in one month? (4) Suppose the continuously compounded risk-free interest rate is 4.75% per year. What is the cost of a three-month forward contract on a non-dividend paying stock whose value currently is $23 ? (5) Suppose the risk-free interest rate is 3.65%. A share of stock whose current value is $97 per share will pay a dividend in six months of $2.50 and another in twelve months of $2.75. Find the values of one-year forward contract and one-year prepaid forward on the stock assuming that transfer of ownership will take place immediately after the second dividend is paid. (6) An investment valued at $195 pays dividends continuously at the annual rate of 1.95%. The risk-free interest rate is 4.55%. Find the prices of a three-month prepaid forward and a three-month forward contract on the investment. (7) A security is currently priced at $1000. The continuously compounded risk-free interest rate is 5.05% annually. The price of a six-month forward contract for the security is $990. If the security pays dividends continuously at rate r, find r expressed as an annual percentage. (8) Suppose the asking price for a certain stock is $75 per share, the bid price is $74 per share, the fee for buying or selling a share or a forward contract is $2 per transaction, the continuously compounded lending rate is 3% per year, and the continuously compounded borrowing rate is 4% per year. Find the interval of no-arbitrage prices for a six-monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started