Answered step by step

Verified Expert Solution

Question

1 Approved Answer

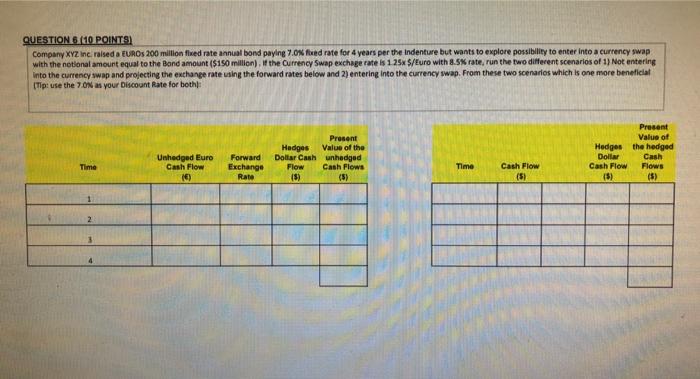

QUESTION 6 (10 POINTS) Company XYZ Inc. raised a EUROS 200 million fixed rate annual bond paying 7.0% fixed rate for 4 years per

QUESTION 6 (10 POINTS) Company XYZ Inc. raised a EUROS 200 million fixed rate annual bond paying 7.0% fixed rate for 4 years per the indenture but wants to explore possibility to enter into a currency swap with the notional amount equal to the Bond amount ($150 million). If the Currency Swap exchage rate is 1.25x 5/Euro with 8.5% rate, run the two different scenarios of 1) Not entering into the currency swap and projecting the exchange rate using the forward rates below and 2) entering into the currency swap. From these two scenarios which is one more beneficial (Tip: use the 7.0% as your Discount Rate for both): Present Time Unhedged Euro Cash Flow (E) Forward Exchange Rate Hedges Dollar Cash Flow Present Value of the unhedged Cash Flows Hedges Dollar Value of the hedged Cash Time Cash Flow (5) (5) (5) Cash Flow (5) Flows (5) 1 2 3 4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the two scenarios for Company XYZ Incs bond and currency swap well compare the unhedged ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started