Answered step by step

Verified Expert Solution

Question

1 Approved Answer

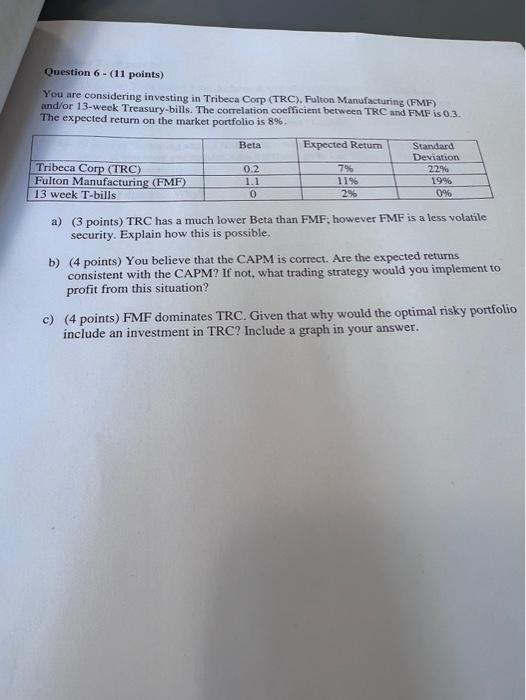

Question 6 - (11 points) You are considering investing in Tribeca Corp (TRC), Fulton Manufacturing (FMF) and/or 13-week Treasury-bills. The correlation coefficient between TRC and

Question 6 - (11 points) You are considering investing in Tribeca Corp (TRC), Fulton Manufacturing (FMF) and/or 13-week Treasury-bills. The correlation coefficient between TRC and FMF is 0.3. The expected return on the market portfolio is 8%. Tribeca Corp (TRC) Fulton Manufacturing (FMF) 13 week T-bills Beta 0.2 1.1 0 Expected Return 7% 11% 2% Standard Deviation 22% 19% 0% a) (3 points) TRC has a much lower Beta than FMF; however FMF is a less volatile security. Explain how this is possible. b) (4 points) You believe that the CAPM is correct. Are the expected returns consistent with the CAPM? If not, what trading strategy would you implement to profit from this situation? c) (4 points) FMF dominates TRC. Given that why would the optimal risky portfolio include an investment in TRC? Include a graph in your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started