Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 [15 points] Today is January 1, 2024. You are helping Enrico make 10-year cash flow projections for an IT project. The cost

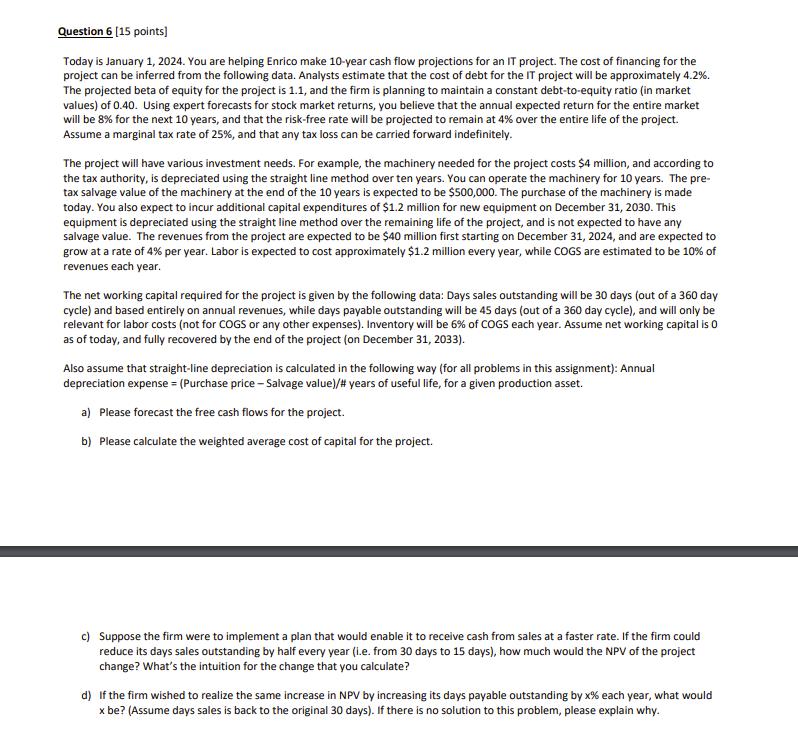

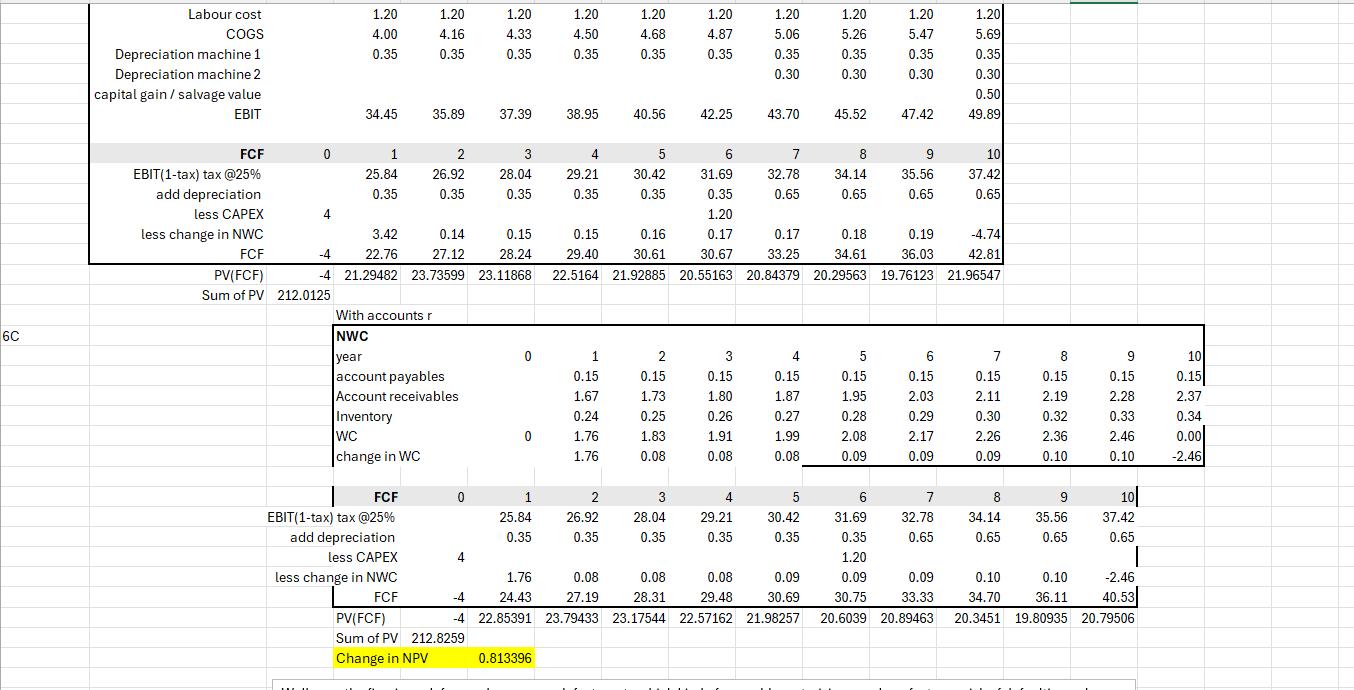

Question 6 [15 points] Today is January 1, 2024. You are helping Enrico make 10-year cash flow projections for an IT project. The cost of financing for the project can be inferred from the following data. Analysts estimate that the cost of debt for the IT project will be approximately 4.2%. The projected beta of equity for the project is 1.1, and the firm is planning to maintain a constant debt-to-equity ratio (in market values) of 0.40. Using expert forecasts for stock market returns, you believe that the annual expected return for the entire market will be 8% for the next 10 years, and that the risk-free rate will be projected to remain at 4% over the entire life of the project. Assume a marginal tax rate of 25%, and that any tax loss can be carried forward indefinitely. The project will have various investment needs. For example, the machinery needed for the project costs $4 million, and according to the tax authority, is depreciated using the straight line method over ten years. You can operate the machinery for 10 years. The pre- tax salvage value of the machinery at the end of the 10 years is expected to be $500,000. The purchase of the machinery is made today. You also expect to incur additional capital expenditures of $1.2 million for new equipment on December 31, 2030. This equipment is depreciated using the straight line method over the remaining life of the project, and is not expected to have any salvage value. The revenues from the project are expected to be $40 million first starting on December 31, 2024, and are expected to grow at a rate of 4% per year. Labor is expected to cost approximately $1.2 million every year, while COGS are estimated to be 10% of revenues each year. The net working capital required for the project is given by the following data: Days sales outstanding will be 30 days (out of a 360 day cycle) and based entirely on annual revenues, while days payable outstanding will be 45 days (out of a 360 day cycle), and will only be relevant for labor costs (not for COGS or any other expenses). Inventory will be 6% of COGS each year. Assume net working capital is 0 as of today, and fully recovered by the end of the project (on December 31, 2033). Also assume that straight-line depreciation is calculated in the following way (for all problems in this assignment): Annual depreciation expense = (Purchase price-Salvage value)/# years of useful life, for a given production asset. a) Please forecast the free cash flows for the project. b) Please calculate the weighted average cost of capital for the project. c) Suppose the firm were to implement a plan that would enable it to receive cash from sales at a faster rate. If the firm could reduce its days sales outstanding by half every year (i.e. from 30 days to 15 days), how much would the NPV of the project change? What's the intuition for the change that you calculate? d) If the firm wished to realize the same increase in NPV by increasing its days payable outstanding by x% each year, what would x be? (Assume days sales is back to the original 30 days). If there is no solution to this problem, please explain why. 6C Labour cost 1.20 1.20 1.20 1.20 1.20 1.20 1.20 1.20 1.20 1.20 COGS 4.00 4.16 4.33 4.50 4.68 4.87 5.06 5.26 5.47 5.69 Depreciation machine 1 Depreciation machine 2 0.35 0.35 0.35 0.35 0.35 0.35 0.35 0.35 0.35 0.35 0.30 0.30 0.30 0.30 capital gain/salvage value 0.50 EBIT 34.45 35.89 37.39 38.95 40.56 42.25 43.70 45.52 47.42 49.89 FCF 0 1 2 3 4 5 6 7 8 9 10 EBIT(1-tax) tax @25% 25.84 26.92 28.04 29.21 30.42 31.69 32.78 34.14 35.56 37.42 add depreciation 0.35 0.35 0.35 0.35 0.35 0.35 0.65 0.65 0.65 0.65 less CAPEX 4 1.20 less change in NWC 3.42 0.14 0.15 0.15 0.16 0.17 0.17 0.18 0.19 -4.74 FCF -4 22.76 27.12 28.24 29.40 30.61 30.67 33.25 34.61 36.03 42.81 PV(FCF) -4 21.29482 23.73599 23.11868 22.5164 21.92885 20.55163 20.84379 20.29563 19.76123 21.96547 Sum of PV 212.0125 With accounts r NWC year 1 2 3 4 5 6 7 8 9 10 account payables 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 Account receivables 1.67 1.73 1.80 1.87 1.95 2.03 2.11 2.19 2.28 2.37 Inventory 0.24 0.25 0.26 0.27 0.28 0.29 0.30 0.32 0.33 0.34 WC 0 1.76 1.83 1.91 1.99 2.08 2.17 2.26 2.36 2.46 0.00 change in WC 1.76 0.08 0.08 0.08 0.09 0.09 0.09 0.10 0.10 -2.46 FCF 2 3 4 5 6 7 8 10 EBIT(1-tax) tax @25% 25.84 26.92 28.04 29.21 30.42 31.69 32.78 34.14 35.56 37.42 add depreciation less CAPEX 0.35 0.35 0.35 0.35 0.35 0.35 0.65 0.65 0.65 0.65 1.20 less change in NWC 1.76 0.08 0.08 0.08 0.09 0.09 0.09 0.10 0.10 -2.46 FCF PV(FCF) Sum of PV Change in NPV -4 -4 212.8259 24.43 27.19 28.31 29.48 30.69 30.75 33.33 34.70 36.11 40.53 22.85391 23.79433 23.17544 22.57162 21.98257 20.6039 20.89463 20.3451 19.80935 20.79506 0.813396

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started