Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 [20] Janet is a colleague of yours. She is considering investing in shares in the technology industry. Having researched some of the leading

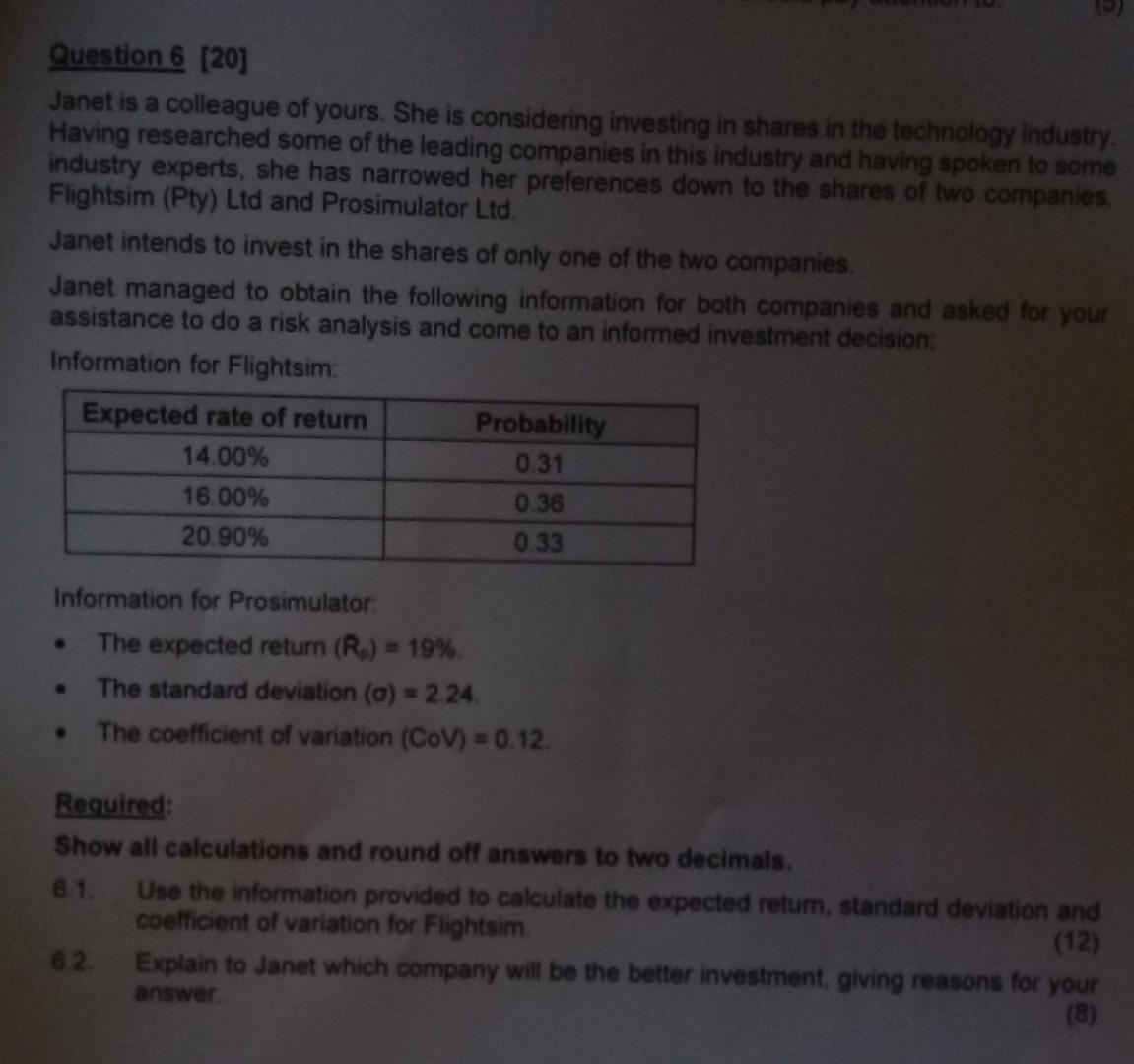

Question 6 [20] Janet is a colleague of yours. She is considering investing in shares in the technology industry. Having researched some of the leading companies in this industry and having spoken to some industry experts, she has narrowed her preferences down to the shares of two companies, Flightsim (Pty) Ltd and Prosimulator Ltd. Janet intends to invest in the shares of only one of the two companies. Janet managed to obtain the following information for both companies and asked for your assistance to do a risk analysis and come to an informed investment decision: Information for Flightsim. Expected rate of return Probability 14.00% 0.31 16.00% 0.36 20.90% 0.33 Information for Prosimulator The expected return (Rp) = 19%. The standard deviation (a) = 2.24 The coefficient of variation (CoV) = 0.12. Required: Show all calculations and round off answers to two decimals. 6.1. Use the information provided to calculate the expected return, standard deviation and coefficient of variation for Flightsim. (12) 6.2. Explain to Janet which company will be the better investment, giving reasons for your (8)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started